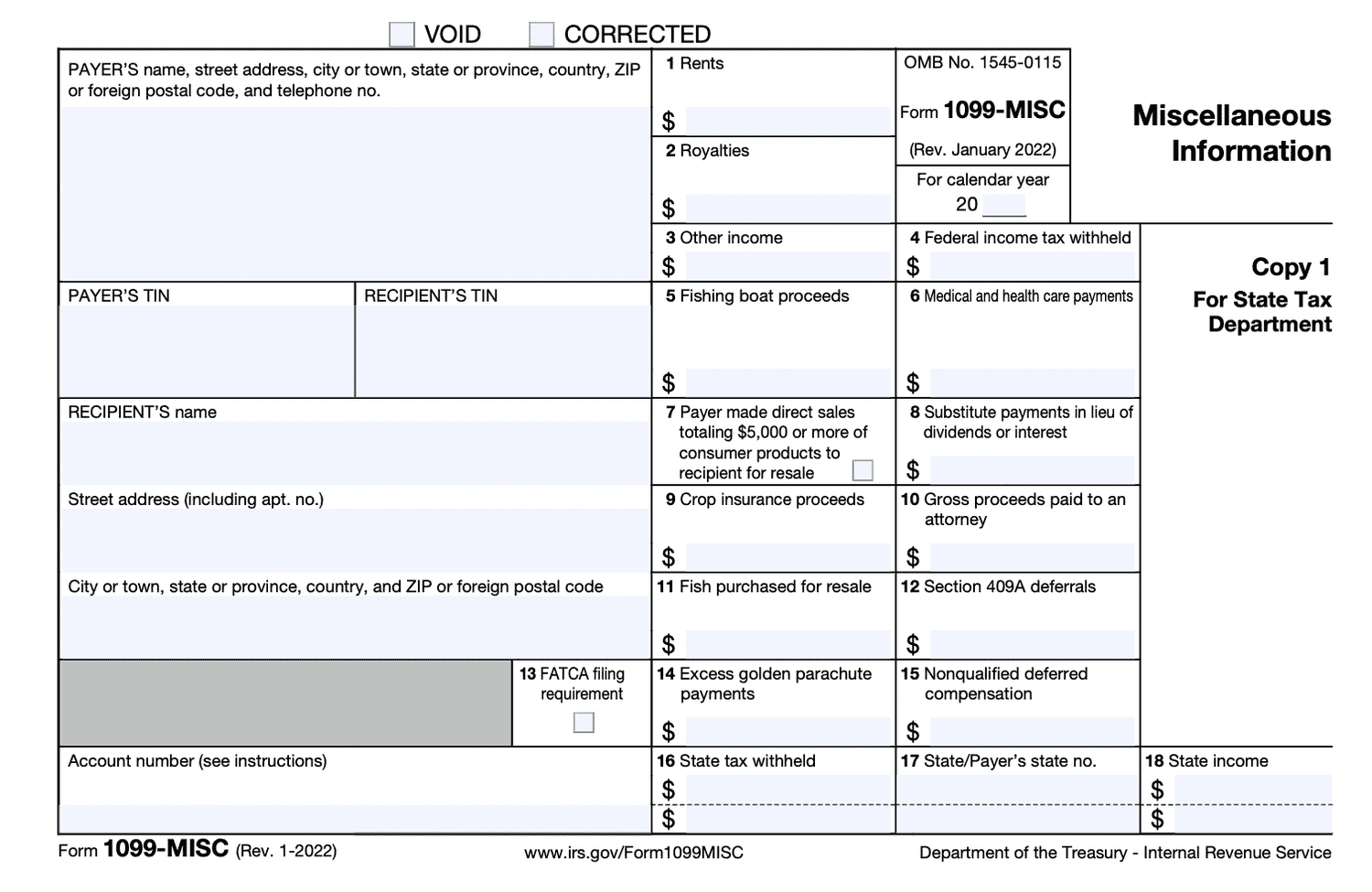

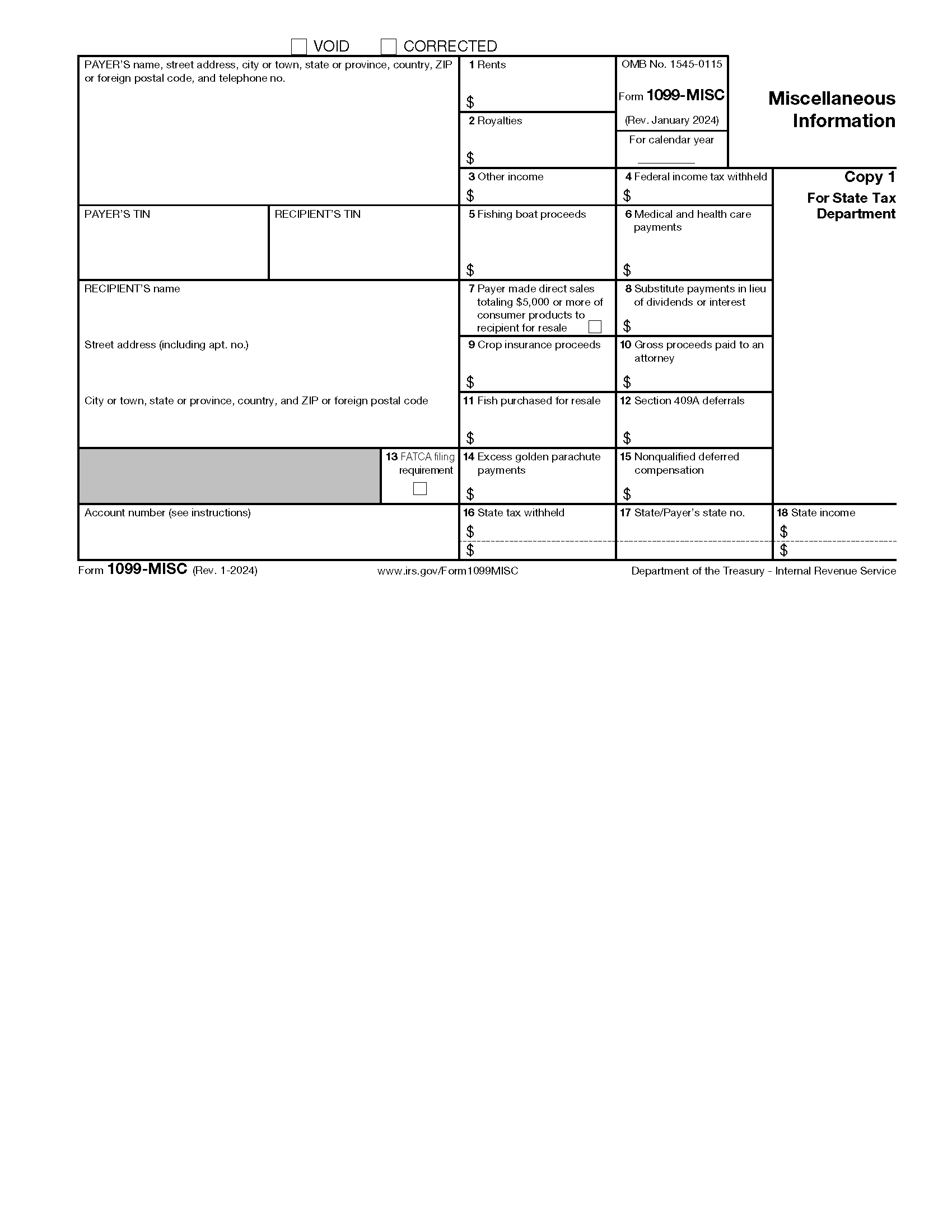

Form 1099 2025

If you’re a freelancer or independent contractor, you’re probably familiar with Form 1099. This form is used to report income received from clients or companies.

Whether you’re a seasoned pro or new to the game, it’s important to stay up-to-date on the latest tax requirements. Form 1099 2025 is the latest version of this essential tax document.

Form 1099 2025

Understanding Form 1099 2025

Form 1099 2025 will include updated guidelines and regulations for reporting income. Make sure you familiarize yourself with the changes to ensure compliance with the IRS.

As a freelancer, keeping accurate records and understanding your tax obligations is crucial. Form 1099 2025 will outline the necessary information you need to provide to the IRS.

By staying informed about Form 1099 2025, you can avoid potential penalties and ensure a smooth tax filing process. Don’t wait until the last minute to get organized and prepared.

Remember, tax laws can change, so it’s essential to stay informed and seek professional advice if needed. Stay proactive and informed about Form 1099 2025 to avoid any surprises come tax time.

As tax season approaches, take the time to review the latest updates to Form 1099 2025. Being proactive and informed will help you navigate the tax filing process with confidence.

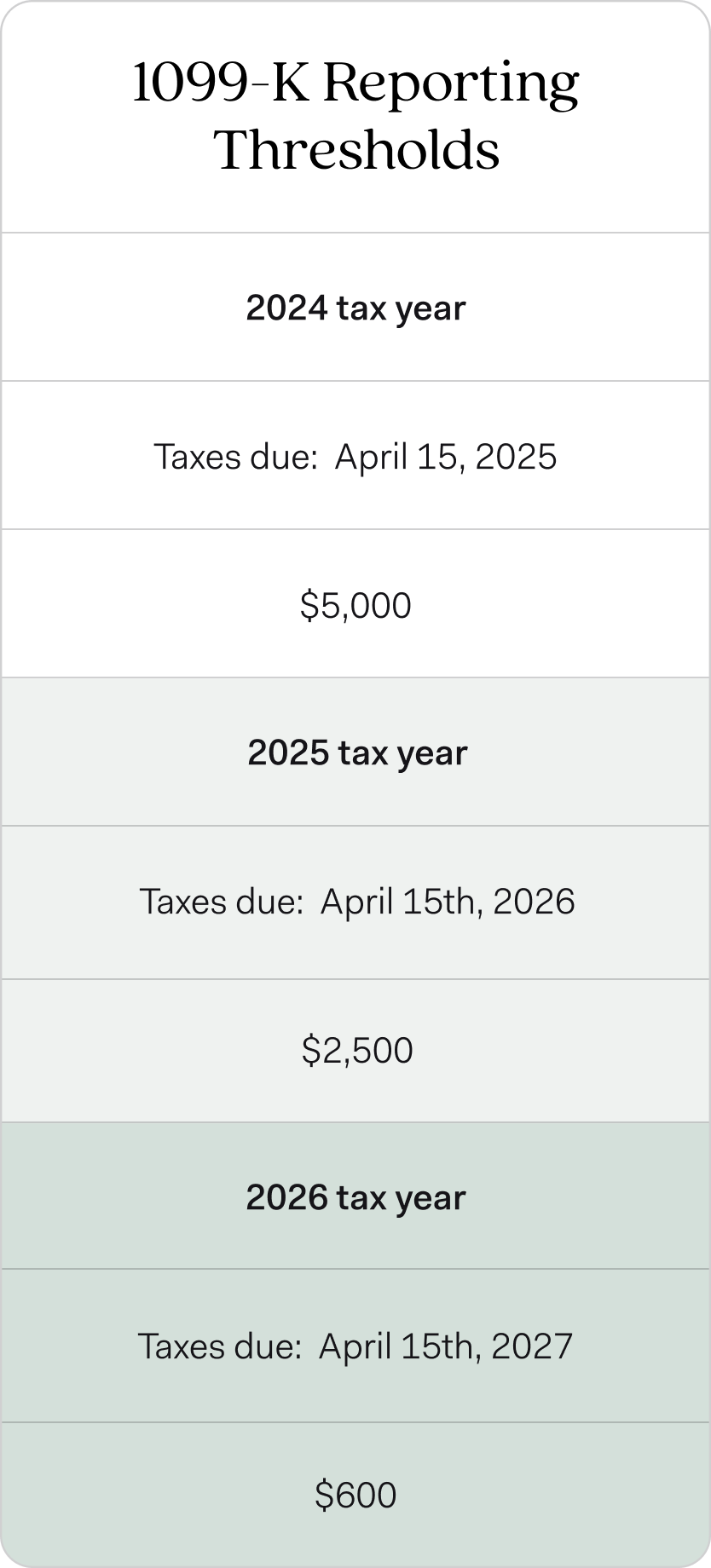

Form 1099 K A Guide For The Self Employed

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

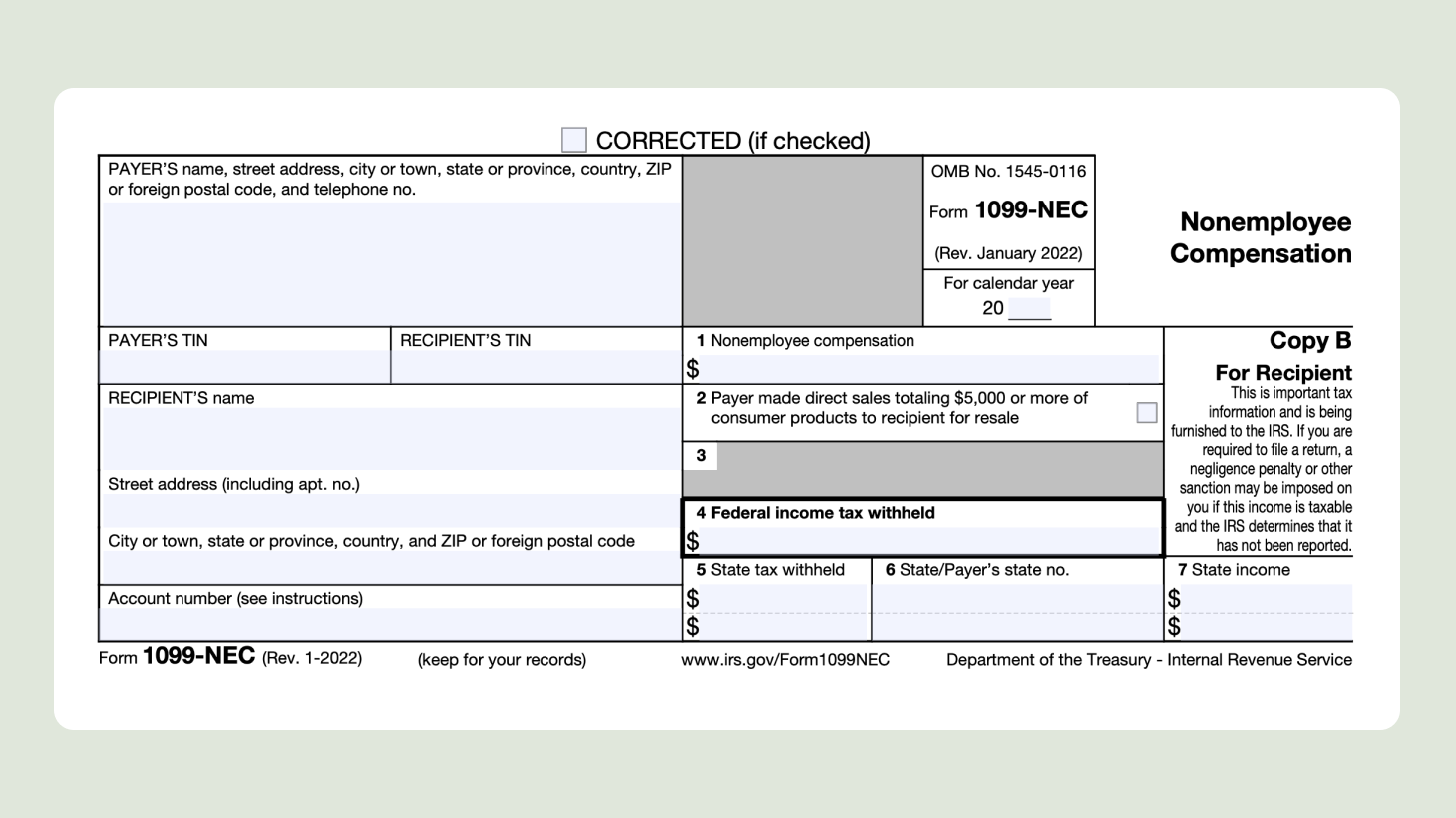

An Overview Of The 1099 NEC Form

Form 1099 Reporting Non Employment Income

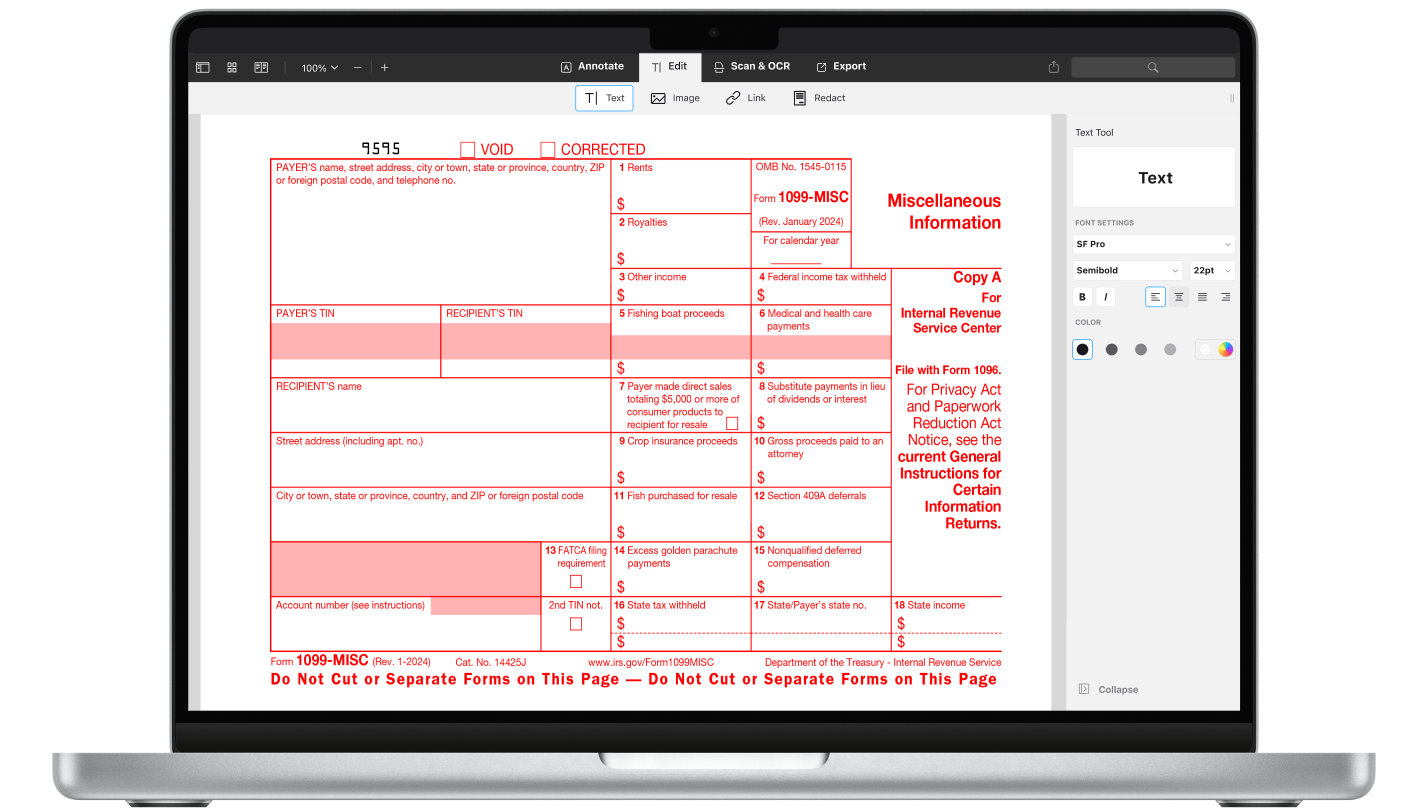

Free IRS Form 1099 MISC PDF EForms