Form 1099 Due Date 2025

Ready or not, tax season is upon us once again. It’s that time of year when everyone’s scrambling to gather their financial documents and get everything in order for filing. One important document to keep in mind is Form 1099.

Form 1099 is used to report various types of income you may have received throughout the year, such as freelance earnings, interest, dividends, and more. It’s crucial to ensure you have all the necessary forms and information ready to accurately report your income.

Form 1099 Due Date 2025

Form 1099 Due Date 2025

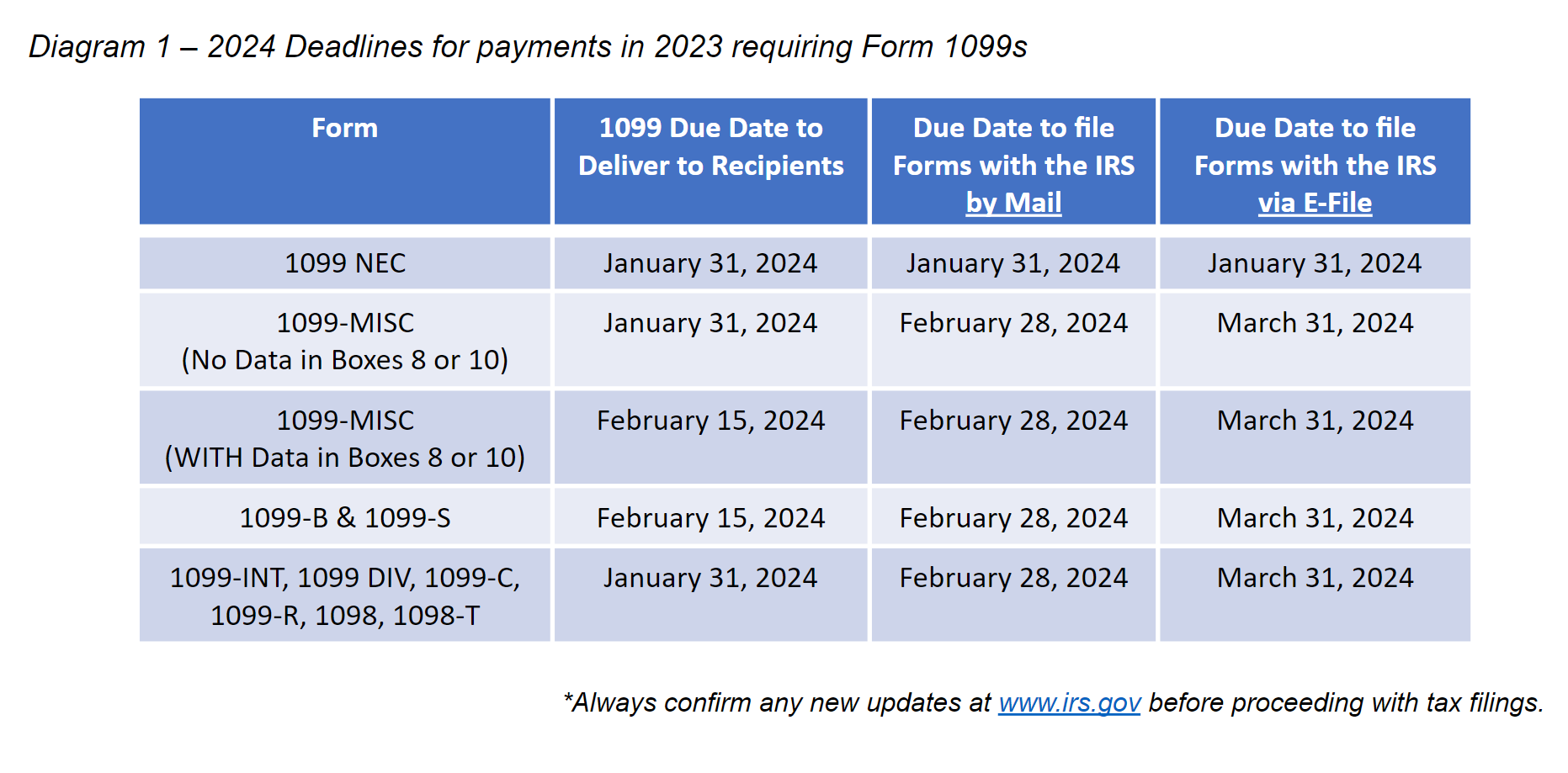

The Form 1099 due date for 2025 is typically January 31st. This means that businesses and individuals who have paid you income during the previous tax year must send you a copy of your Form 1099 by this date. Make sure to keep an eye out for these forms in your mailbox or inbox.

If you haven’t received your Form 1099 by the due date, it’s essential to reach out to the issuer promptly. You’ll need this information to accurately report your income on your tax return. Failing to report income could result in penalties from the IRS, so it’s crucial to stay on top of your tax documents.

Remember, accuracy is key when it comes to filing your taxes. Double-check all your forms and information to ensure everything is correct before submitting your return. If you have any questions or concerns about Form 1099 or any other tax-related matters, don’t hesitate to consult with a tax professional for guidance.

So, as you embark on your tax-filing journey this year, don’t forget about Form 1099 and its importance in accurately reporting your income. Stay organized, stay informed, and don’t hesitate to seek help if needed. Here’s to a smooth and stress-free tax season!

Key Deadlines For 2025 1099 Forms

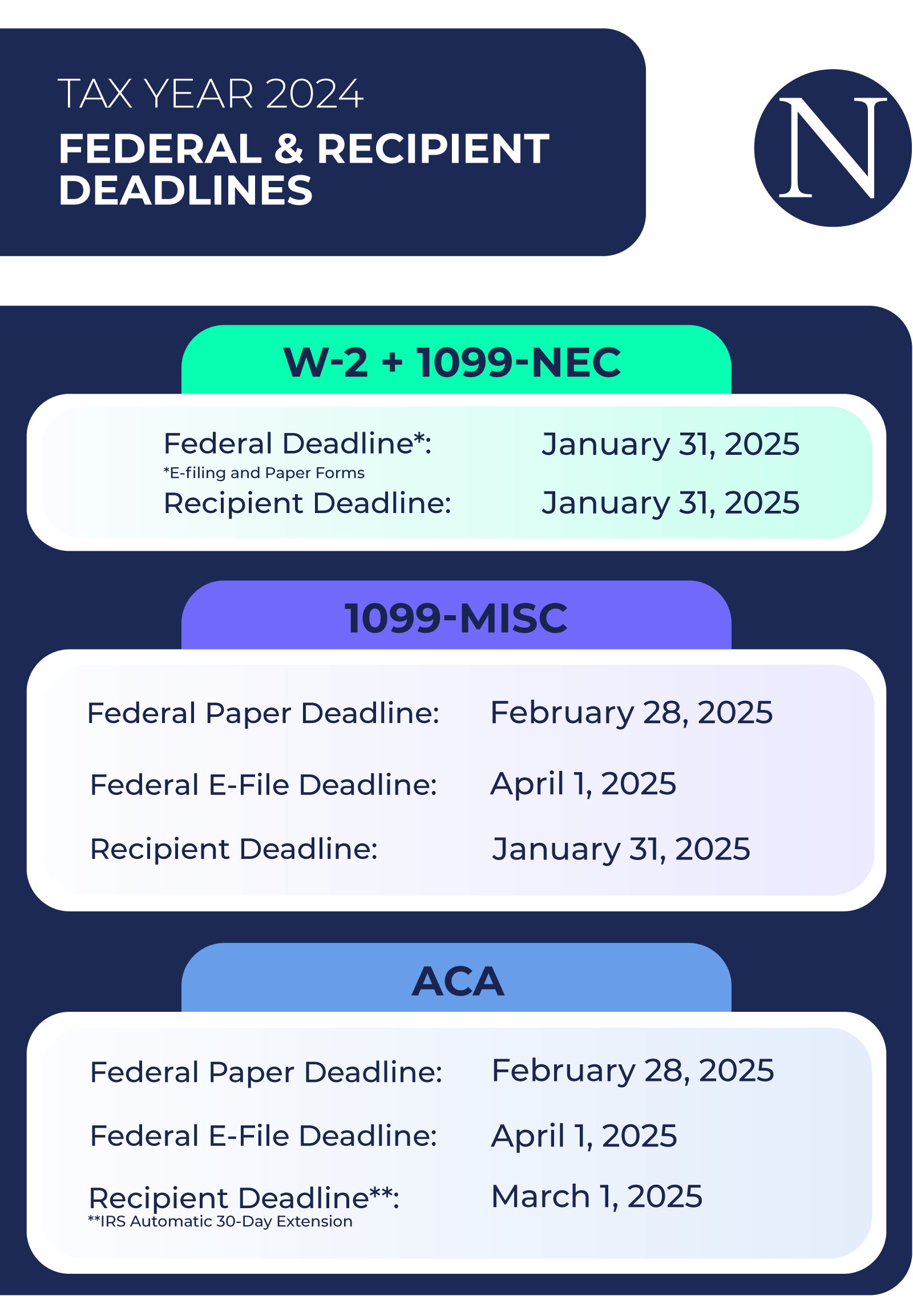

Essential Tax Deadlines For Your Business In 2024 NelcoSolutions

IRS Form 1099 NEC Due Date 2024 Tax1099 Blog

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

1099 Requirements For Business Owners In 2025 Mark J Kohler