Form 1099 Instructions 2025

Are you feeling overwhelmed by tax season approaching? Don’t worry, we’ve got you covered with some helpful tips on navigating Form 1099 Instructions 2025. Understanding tax forms can be confusing, but we’re here to break it down for you.

Form 1099 is used to report various types of income you may have received throughout the year, such as freelance work, rental income, or interest. It’s essential to fill out this form accurately to avoid any potential issues with the IRS. Let’s dive into some key instructions for the 2025 version.

Form 1099 Instructions 2025

Form 1099 Instructions 2025

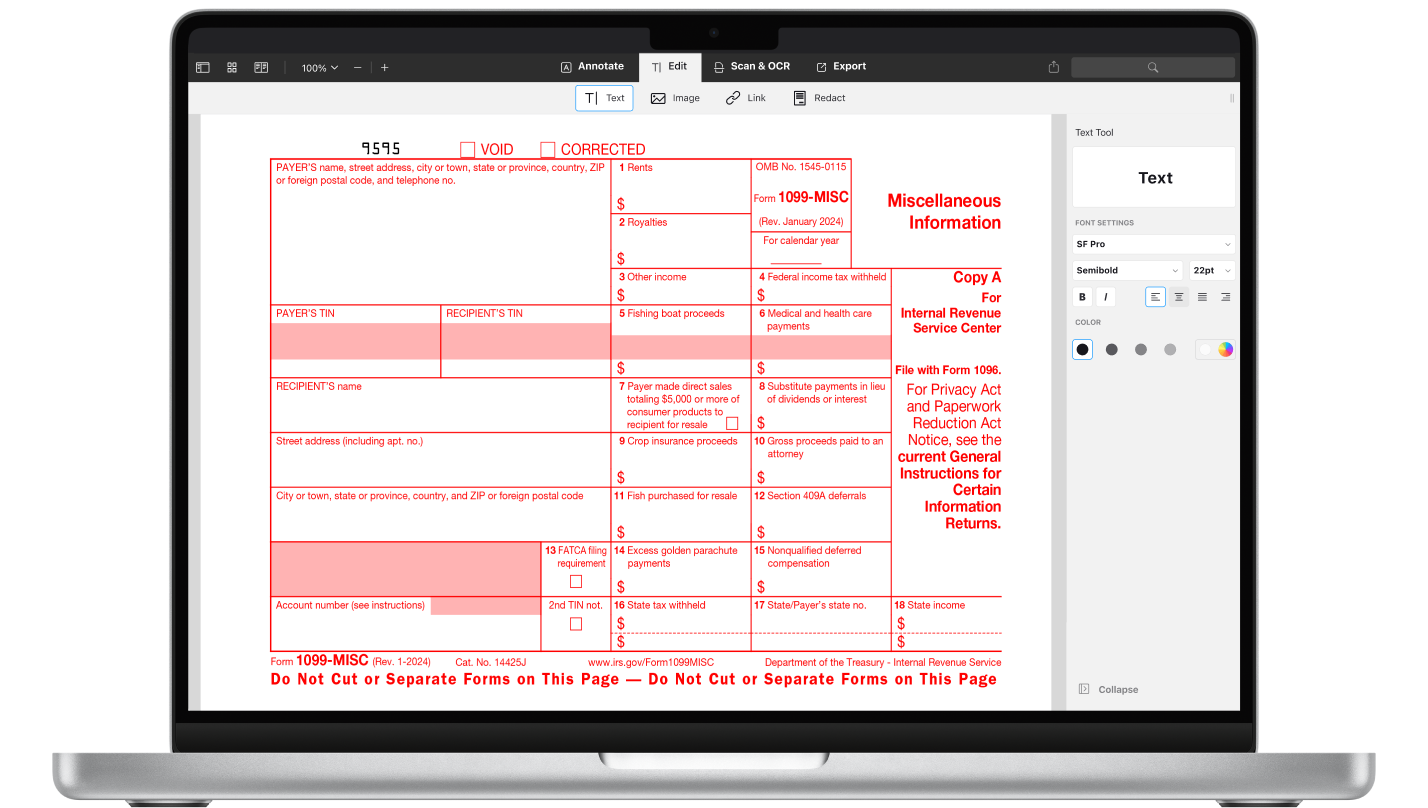

When completing Form 1099, make sure to provide accurate information about the income you received. Double-check all figures and ensure they match your records. Any discrepancies could lead to delays or penalties, so accuracy is key.

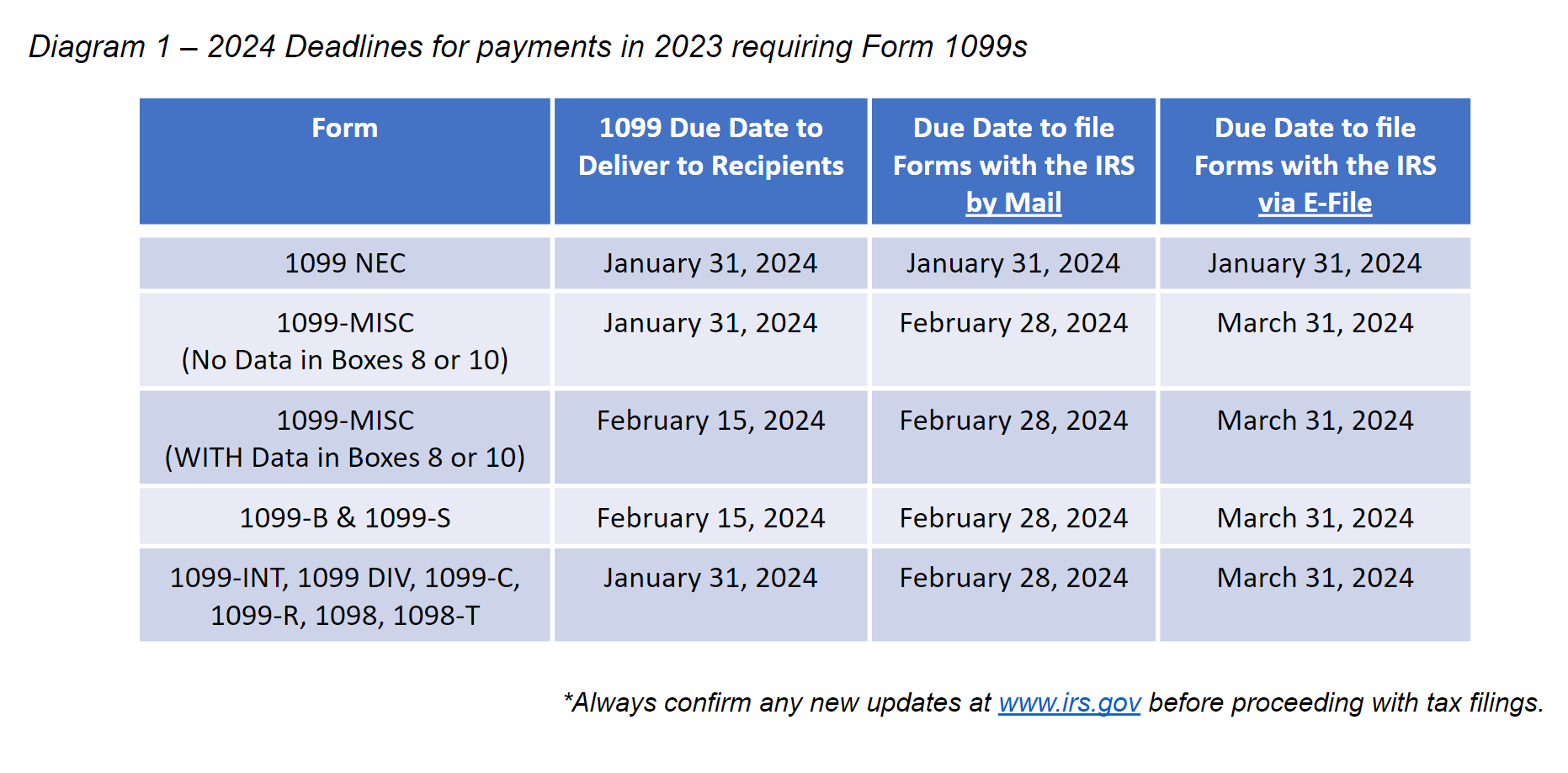

Additionally, be aware of any changes or updates to the form’s instructions for the 2025 tax year. The IRS regularly updates tax forms to reflect new laws or regulations, so staying informed is crucial. Keep an eye out for any updates to avoid any potential errors.

If you’re unsure about how to fill out Form 1099, don’t hesitate to seek professional help. A tax advisor or accountant can provide guidance and ensure that your forms are completed correctly. It’s better to be safe than sorry when it comes to taxes.

In conclusion, understanding Form 1099 Instructions 2025 is essential for proper tax reporting. By following these tips and staying informed about any updates, you can navigate tax season with confidence. Remember, accuracy is key, so take your time and double-check your forms before submitting them.

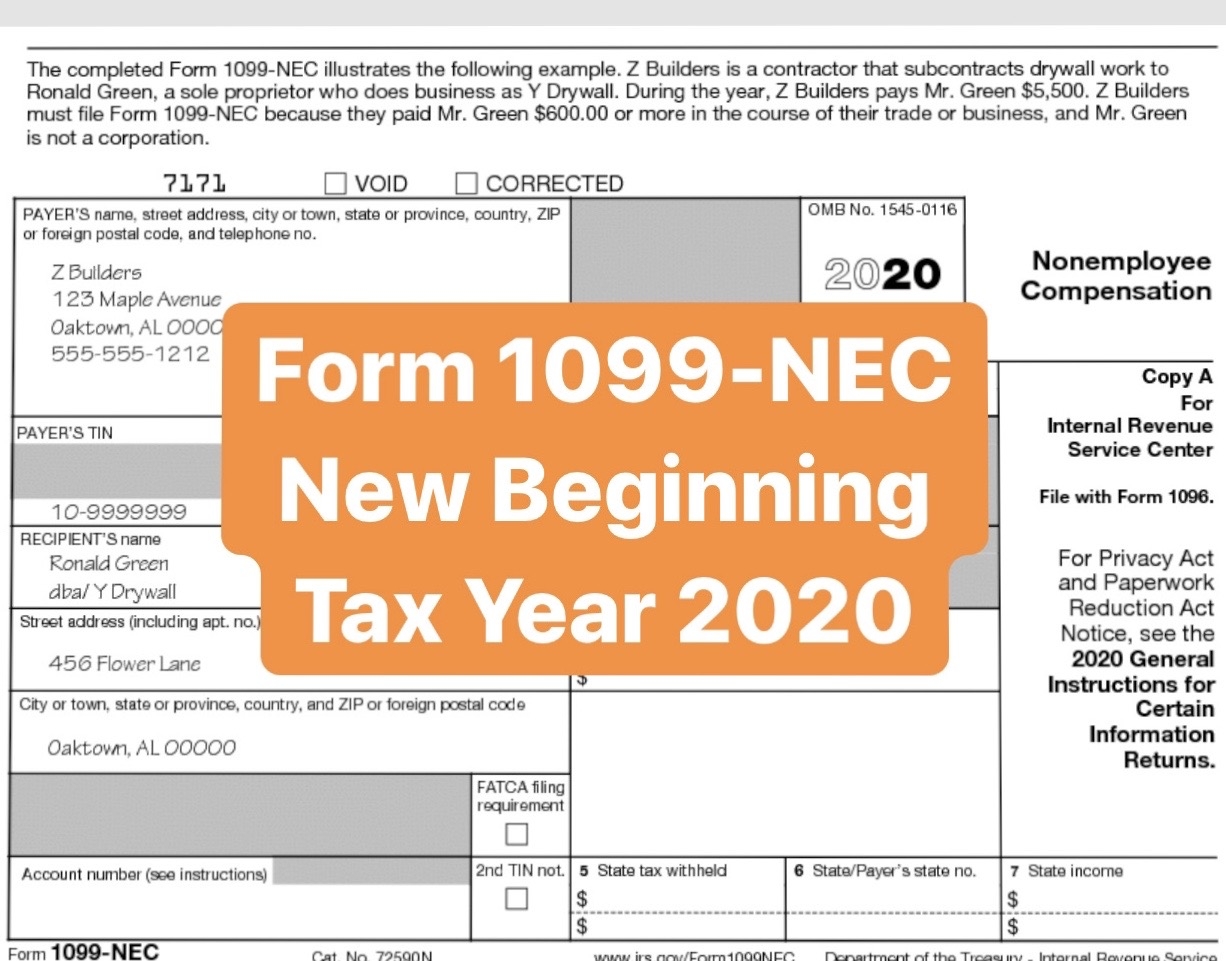

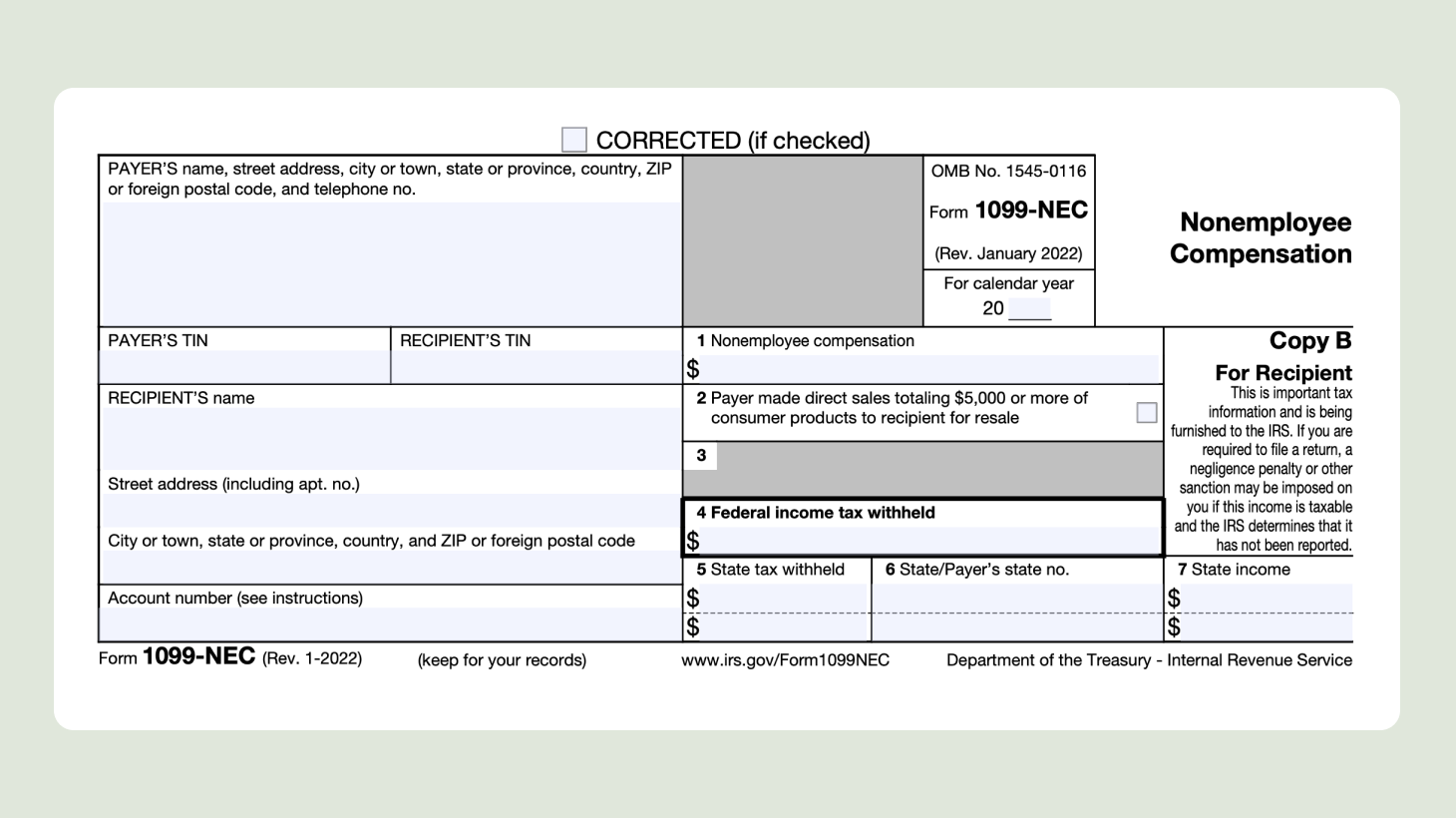

What Is Form 1099 NEC For Nonemployee Compensation

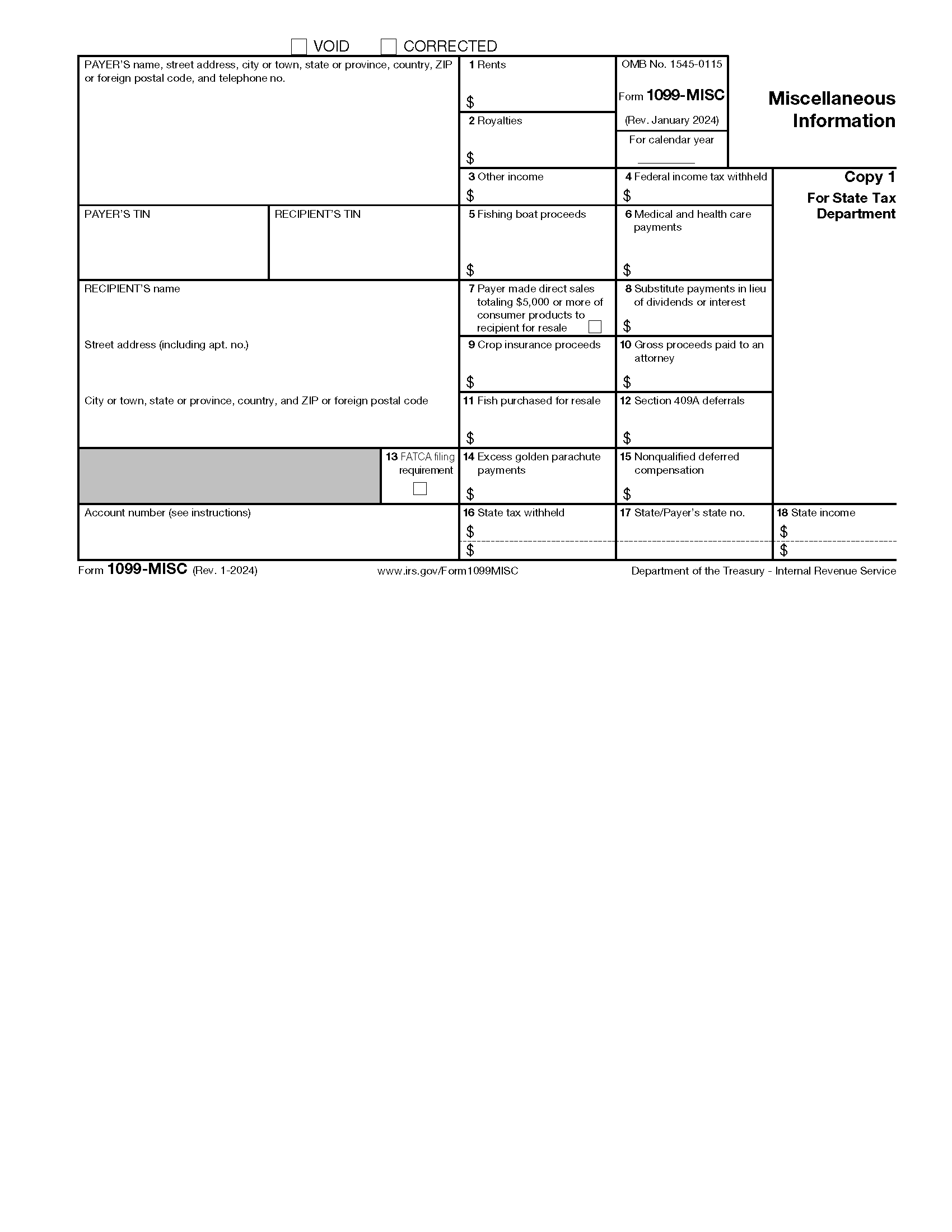

Free IRS Form 1099 MISC PDF EForms

An Overview Of The 1099 NEC Form

1099 Requirements For Business Owners In 2025 Mark J Kohler

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert