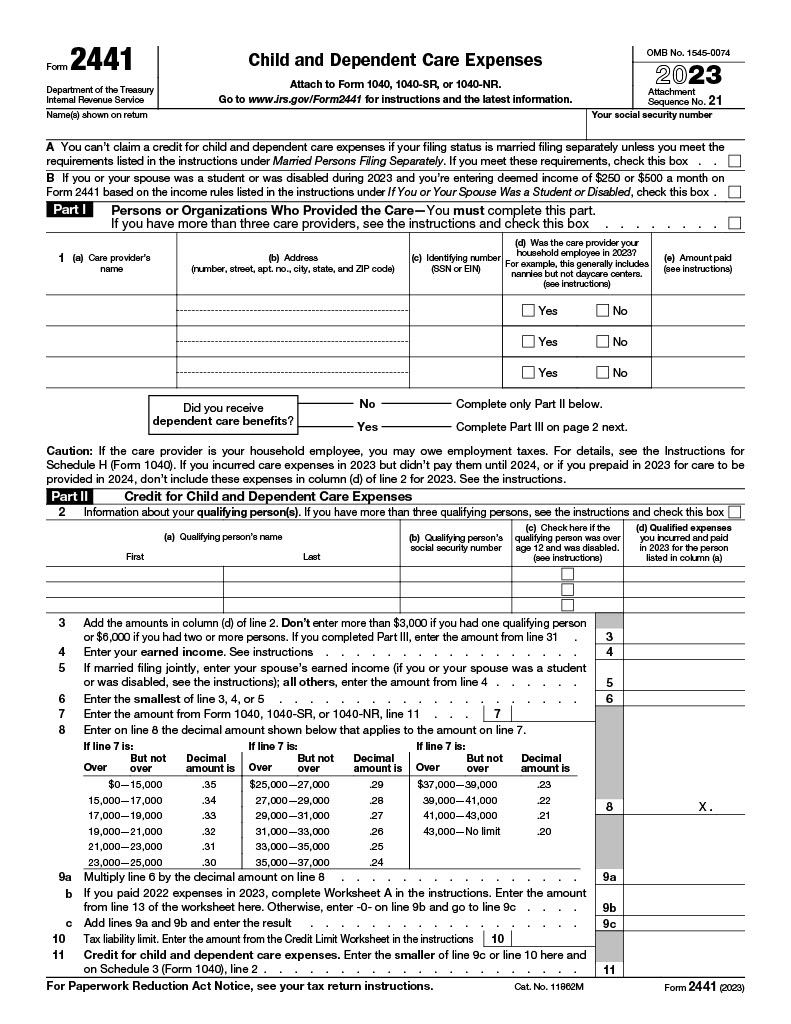

Form 2441: Claiming the Child and Dependent Care Credit

Form 2441, also known as the Child and Dependent Care Expenses form, is vital for taxpayers who wish to claim a credit for child or dependent care costs. This form helps reduce tax liability by allowing you to report expenses related to the care of qualifying individuals, enabling you or your spouse to work or look for work. Filing Form 2441 accurately can lead to significant tax savings.

To qualify, you must provide detailed information about your care provider and document eligible expenses. Completing Form 2441 ensures that you take full advantage of this valuable tax credit and meet IRS requirements. Download the Form 2441 PDF below and review the instructions to claim your child or dependent care expenses correctly and maximize your potential tax benefits.