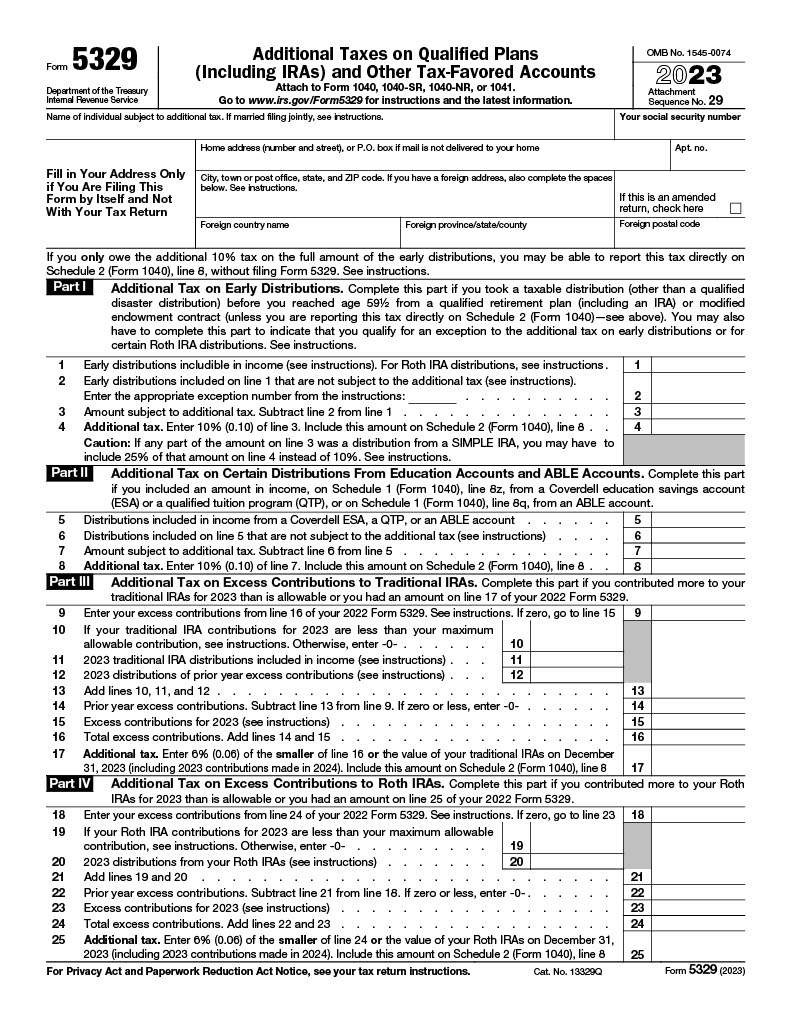

Form 5329: Additional Taxes on Retirement Plans and Other Tax-Favored Accounts

Form 5329 is used to report additional taxes related to retirement plans, IRAs, and other tax-favored accounts. This form is essential for taxpayers who may need to report early distributions that don’t qualify for an exception or if they didn’t take the required minimum distributions (RMDs). Properly completing Form 5329 helps ensure compliance with IRS regulations and avoid potential penalties.

If you need to report excise taxes for issues like excess contributions or early withdrawals, filing Form 5329 is crucial. Understanding when and how to use this form can prevent costly mistakes and keep your tax records accurate. Access and download the Form 5329 PDF below to accurately file and manage your retirement-related tax obligations.