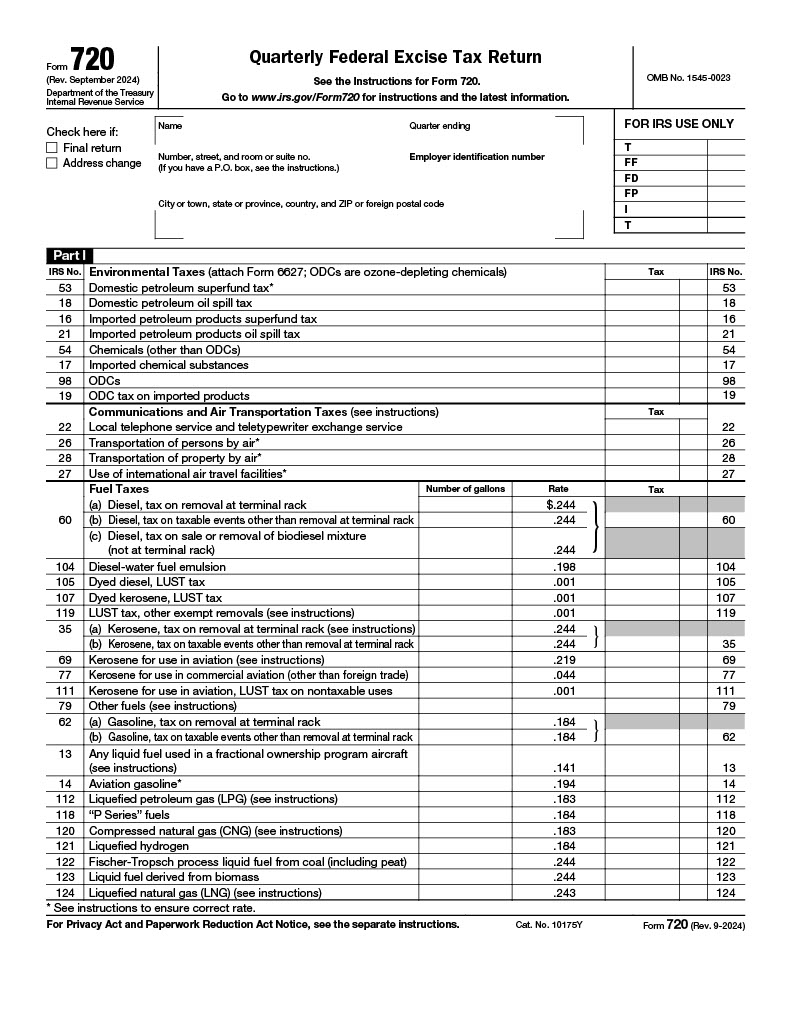

Form 720: Federal Excise Tax Return Explained

Form 720, known as the Quarterly Federal Excise Tax Return, is used by businesses to report and pay excise taxes to the IRS. This form is crucial for businesses involved in specific goods and services subject to excise taxes, such as fuel, air transportation, and certain manufacturers’ taxes. Accurately filing Form 720 ensures compliance with federal regulations and helps businesses avoid penalties associated with late or incorrect reporting.

Form 720 must be submitted quarterly, covering all excise tax liabilities within the reporting period. Our downloadable PDF of Form 720 makes it easier for businesses to access and complete the form on time. Whether you’re managing transportation services, environmental taxes, or other excise tax obligations, having this form readily available helps streamline your reporting process. Download the form below and stay compliant with your quarterly excise tax requirements.