Form 8862: Restoring Eligibility for Earned Income Credit

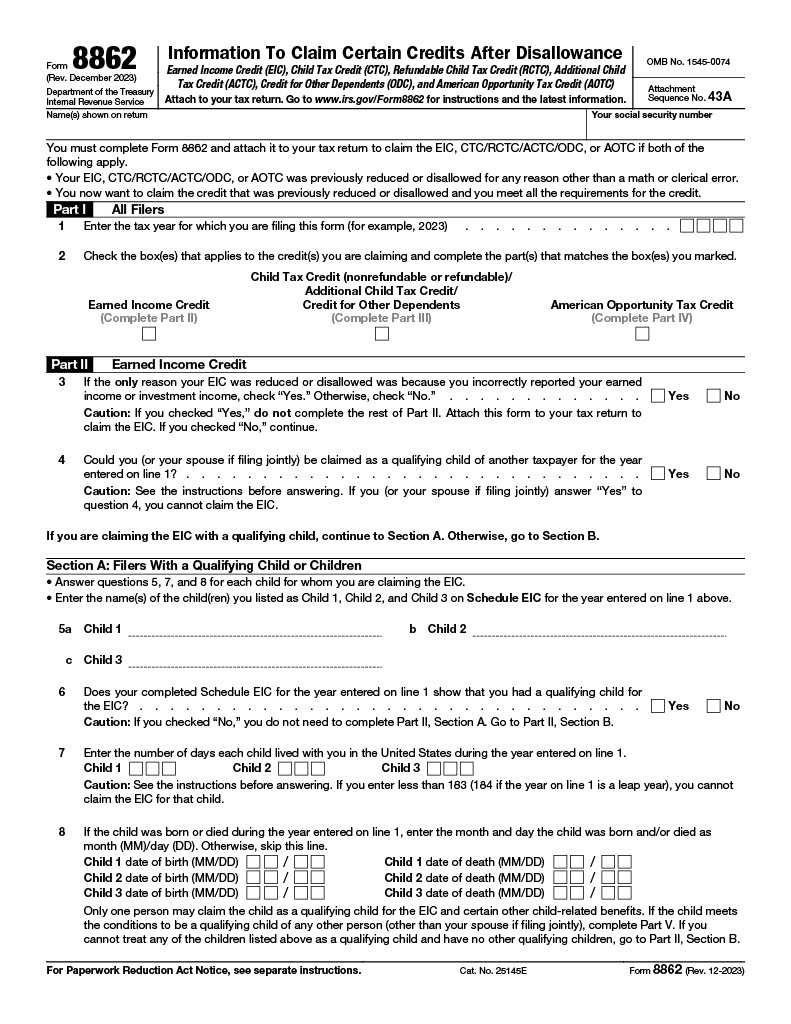

Form 8862, also known as Information to Claim Certain Credits After Disallowance, is crucial for taxpayers who want to reclaim eligibility for specific tax credits, such as the Earned Income Credit (EIC), after being denied in a previous year. Filing this form ensures the IRS can review your information to determine if you now meet the qualifications for these credits.

Completing Form 8862 accurately is essential to avoid delays in processing and to ensure the potential benefits are reinstated without issues. If you’ve had your credit denied or reduced in the past, this form is a critical step toward restoring eligibility. Access and download the Form 8862 PDF below to ensure your claim is filed correctly and efficiently.