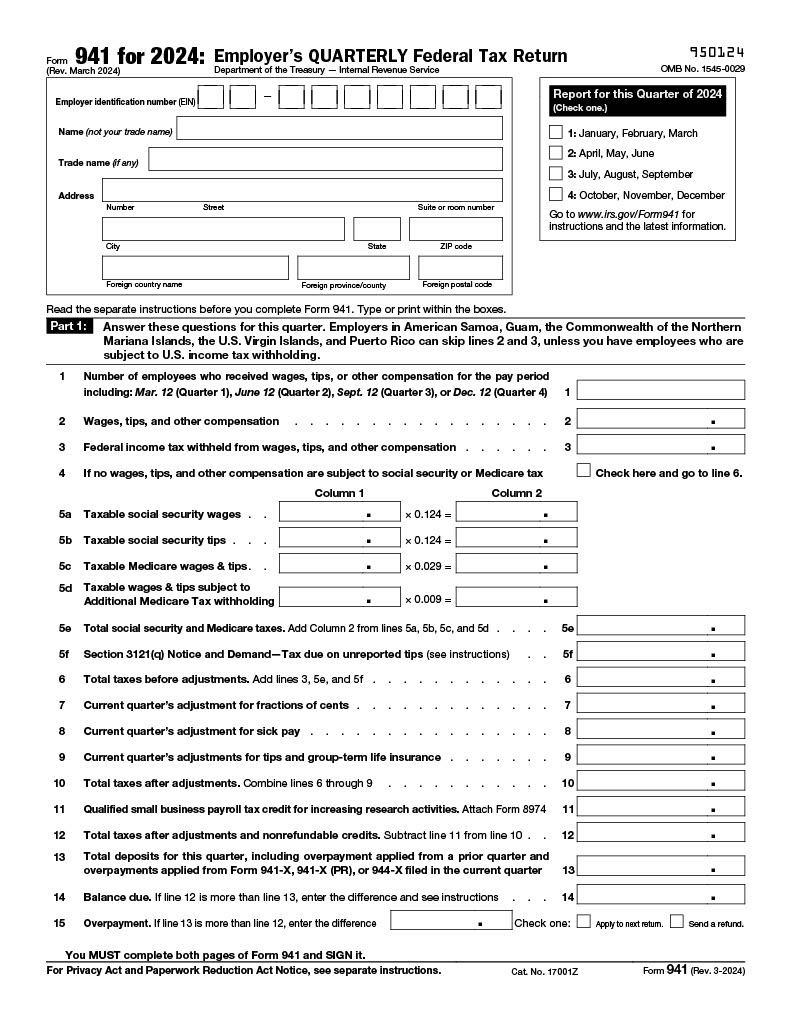

Form 941: Essential for Reporting Employer Payroll Taxes

Form 941, officially known as the Employer’s Quarterly Federal Tax Return, is crucial for businesses that withhold income taxes, Social Security, and Medicare taxes from employees’ paychecks. Employers must file this form to report wages paid and taxes withheld, ensuring compliance with IRS payroll tax regulations. Filing Form 941 on time helps businesses avoid penalties and maintain smooth financial operations.

This form must be submitted quarterly, covering four reporting periods each year. Staying up-to-date with Form 941 submissions is essential to accurately report payroll expenses and keep tax records in good standing. To help you stay organized, we provide a convenient, downloadable PDF of Form 941, making it easier for employers to meet their tax obligations. Download the form below to streamline your quarterly tax reporting process.