IRS 1040 Form 2025

Are you ready for tax season? Filing your taxes can be overwhelming, but understanding the IRS 1040 Form 2025 is essential. Whether you’re a seasoned taxpayer or a newbie, this form is crucial to report your income, deductions, and tax credits.

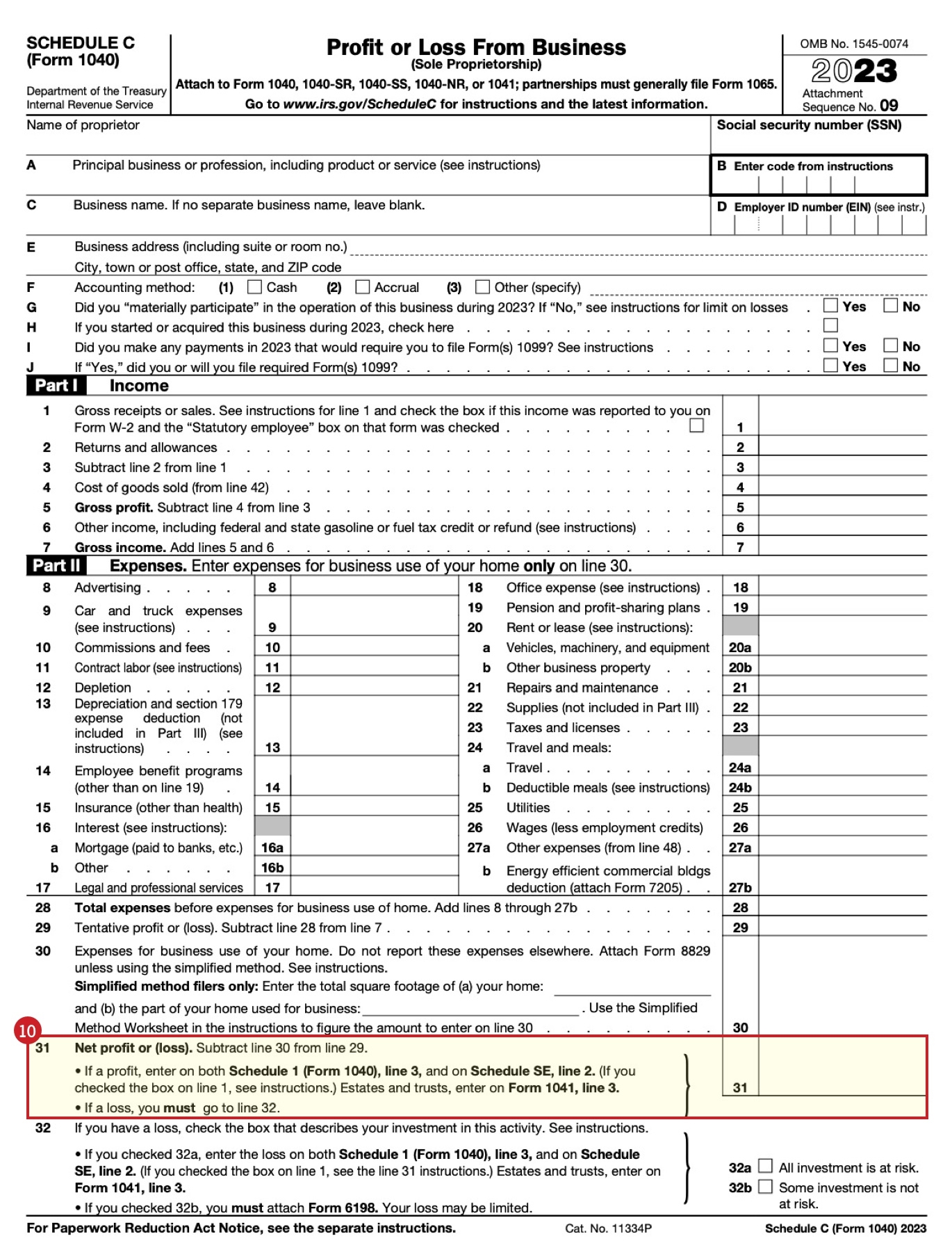

The IRS 1040 Form 2025 is the standard tax form used by individuals to file their annual income tax returns. It’s a comprehensive document that allows you to report various sources of income, claim deductions, and calculate your tax liability for the year.

IRS 1040 Form 2025

Demystifying the IRS 1040 Form 2025

When filling out the IRS 1040 Form 2025, make sure to provide accurate information about your income, expenses, and credits. Double-check your math to avoid errors that could delay your refund or trigger an audit. Remember, honesty is key when dealing with the IRS.

Don’t forget to include all relevant documentation, such as W-2 forms, 1099s, and receipts for deductible expenses. Keep track of any changes in your financial situation throughout the year to ensure your tax return is complete and accurate.

If you’re feeling overwhelmed, consider seeking help from a tax professional or using tax software to guide you through the process. Remember, it’s better to ask for assistance than to make costly mistakes on your tax return.

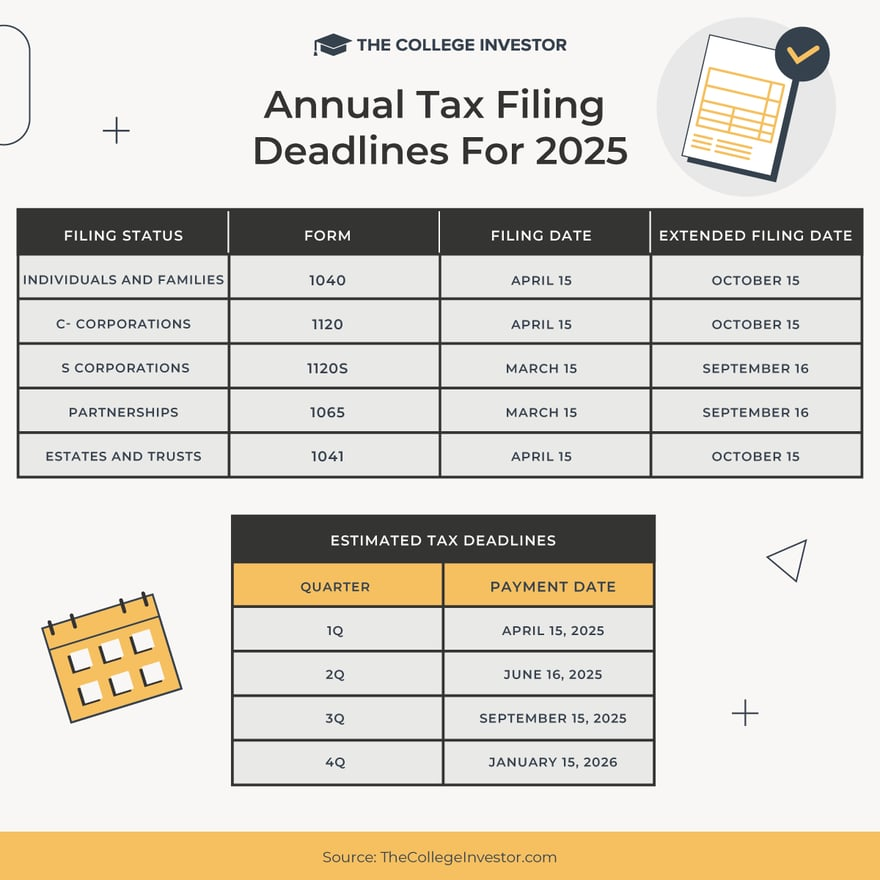

In conclusion, understanding the IRS 1040 Form 2025 is crucial for successfully filing your taxes. By providing accurate information, double-checking your work, and seeking help when needed, you can navigate the tax filing process with confidence. Remember, the deadline for filing your taxes is fast approaching, so don’t procrastinate!

Tax Season 2025 Changes What Are The Modifications To Consider Before Filing Your Return Marca

Form 1040 U S Individual Tax Return Definition Types And Use

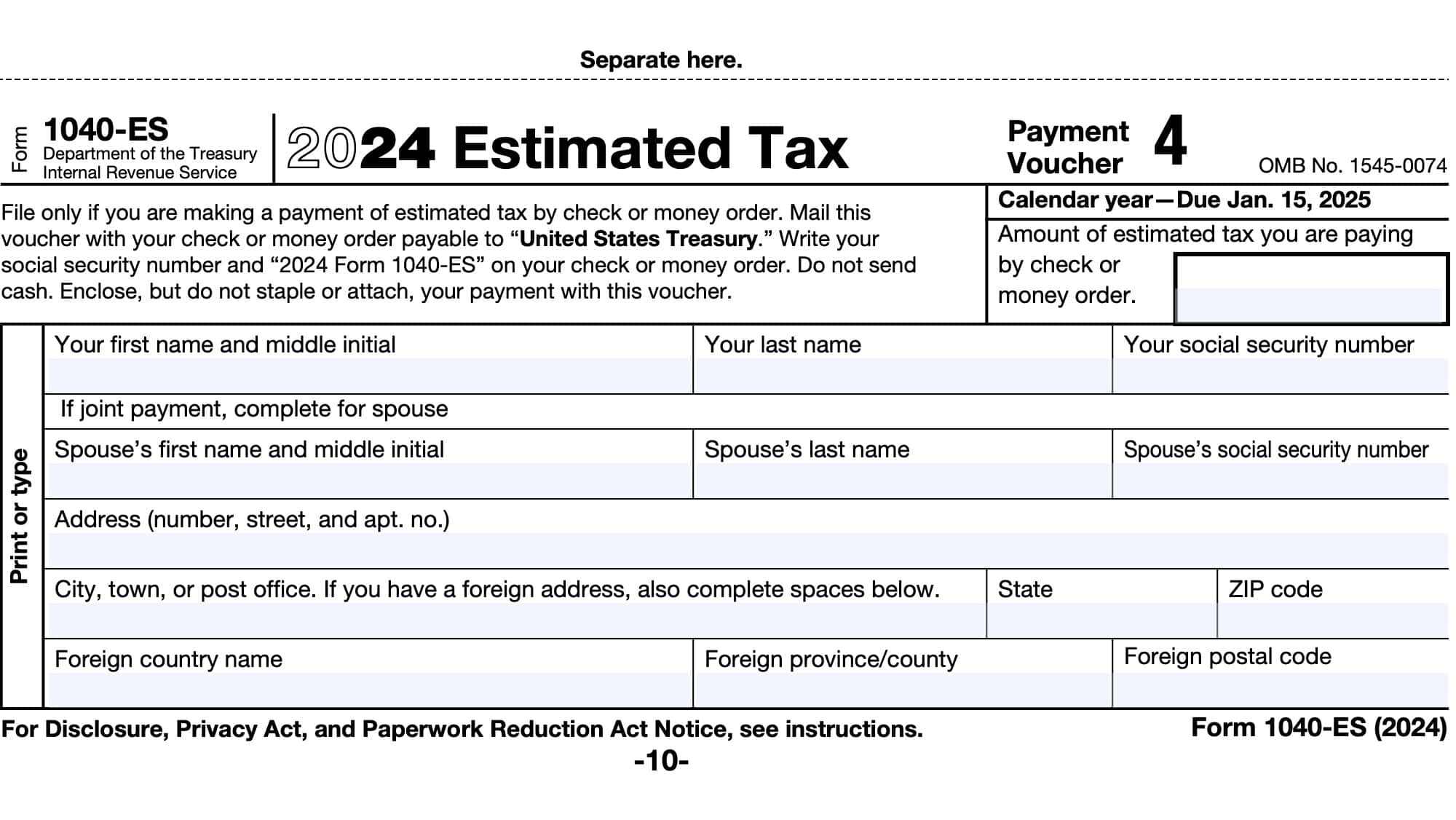

IRS Form 1040 ES Instructions Estimated Tax Payments

Where To Find My 2023 Tax Information 2025 26 Federal Student Aid

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor