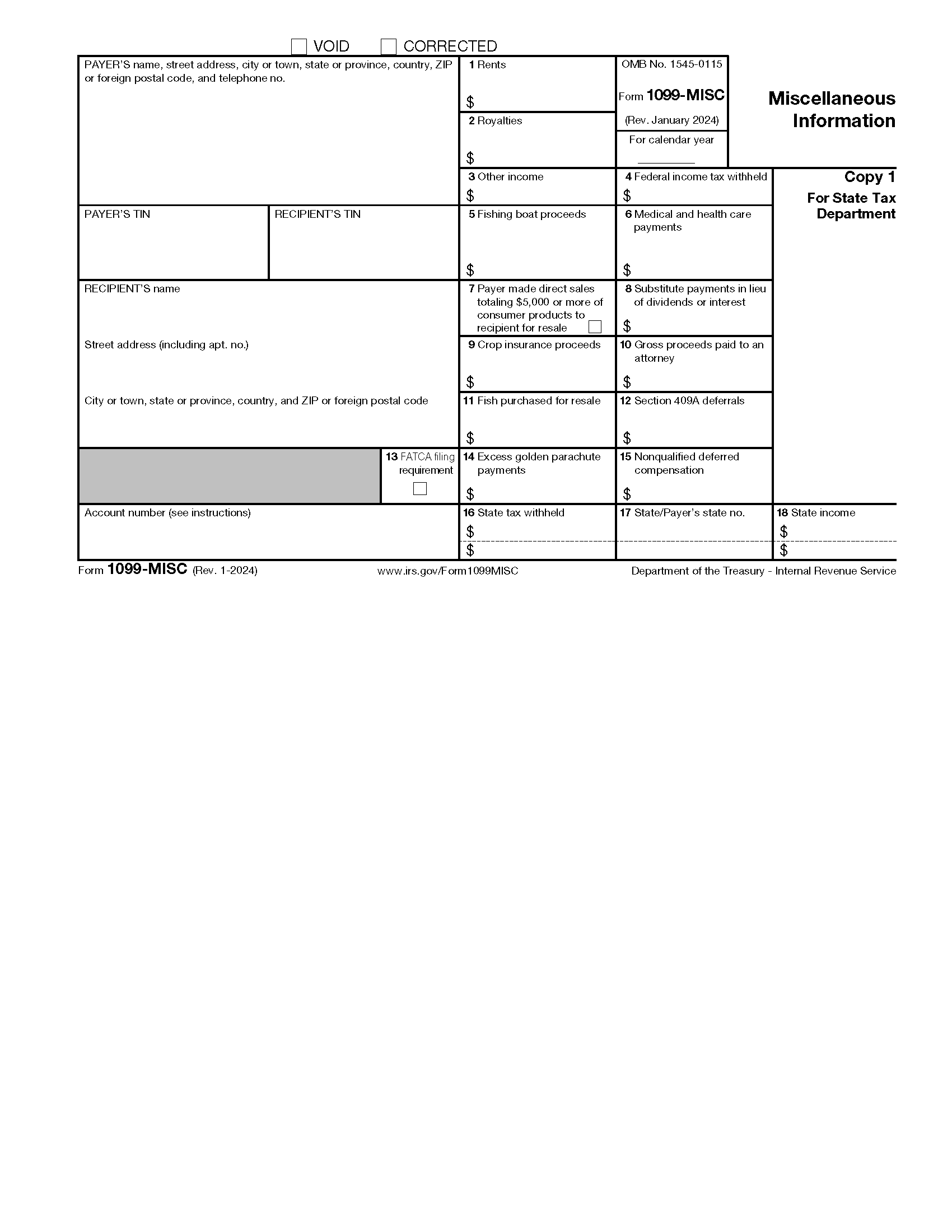

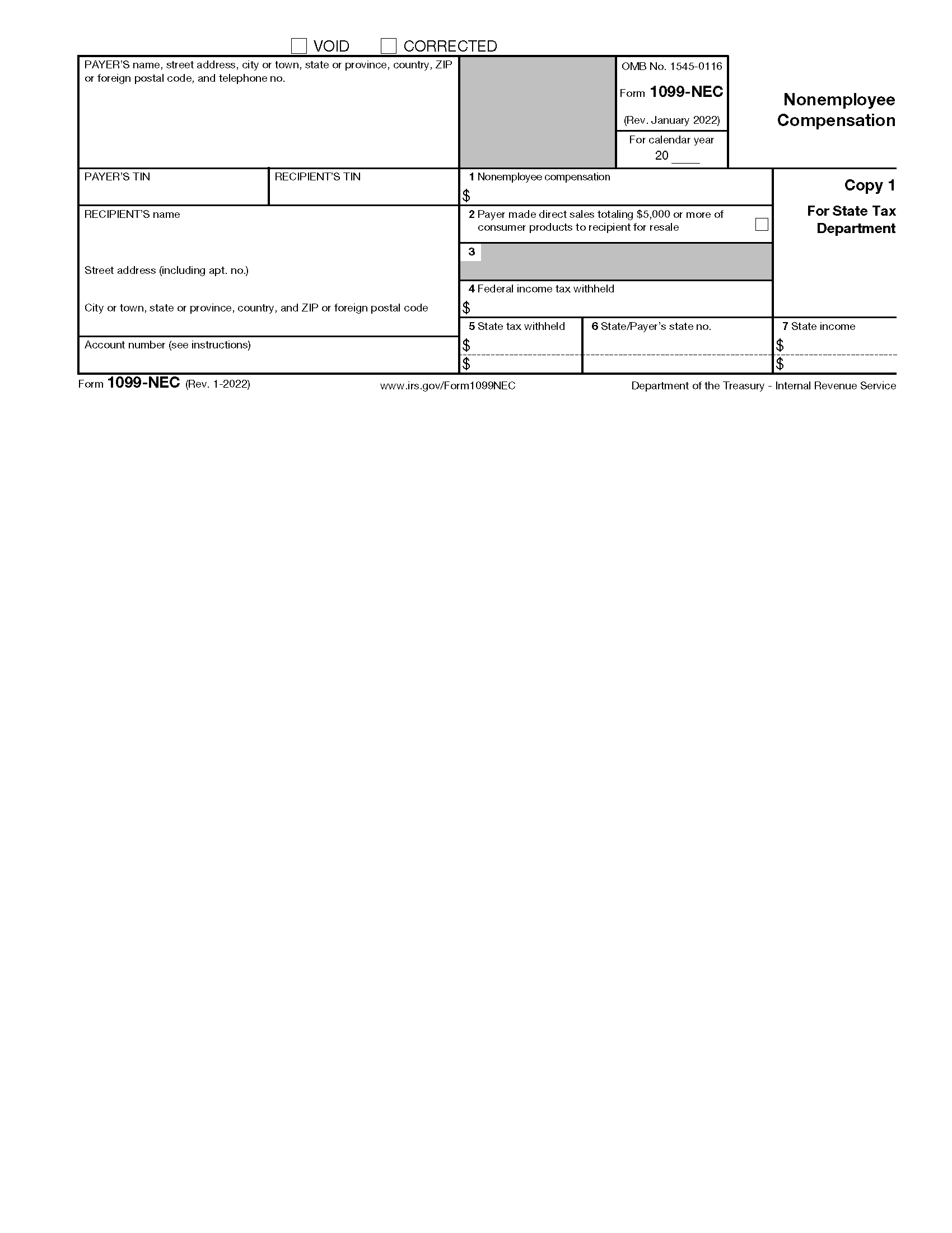

IRS 1099 Form 2025

Are you ready for tax season? As we approach the end of the year, it’s essential to start thinking about the IRS 1099 Form 2025. This form is crucial for reporting various types of income, so it’s essential to understand how it works.

Whether you’re a freelancer, contractor, or small business owner, the IRS 1099 Form 2025 plays a significant role in your tax filing process. It’s used to report income like freelance earnings, rental income, and more. Filing this form accurately and on time is vital to avoid penalties.

IRS 1099 Form 2025

Understanding the IRS 1099 Form 2025

When you receive income that needs to be reported on a 1099 Form, the payer will send you a copy of the form detailing the income you earned. You’ll use this information to report your earnings on your tax return accurately.

It’s crucial to keep track of all income you receive throughout the year to ensure you don’t miss any reporting requirements. Failing to report income can lead to penalties and additional taxes owed, so it’s best to stay organized and keep accurate records.

As tax season approaches, make sure you have all the necessary information and forms in place to file your taxes accurately and on time. If you have any questions about the IRS 1099 Form 2025 or need assistance with your tax preparation, don’t hesitate to reach out to a tax professional for help.

Remember, staying informed and organized can make the tax filing process much smoother. So, don’t wait until the last minute. Start preparing for tax season now and ensure you’re ready to tackle your taxes with confidence!

1099 Requirements For Business Owners In 2025 Mark J Kohler

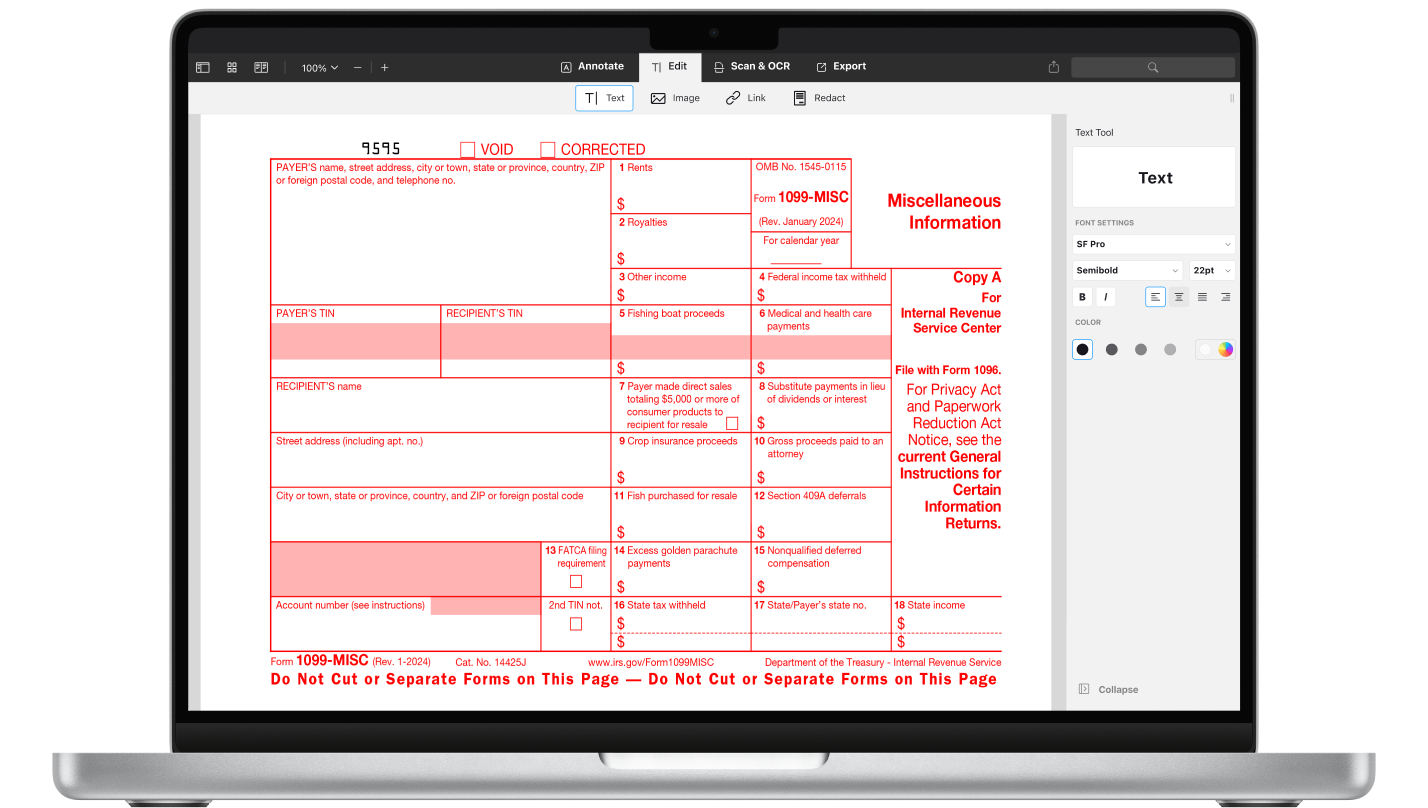

How To Fill Out IRS 1099 MISC Form PDF 2025 PDF Expert

Form 1099 Reporting Non Employment Income

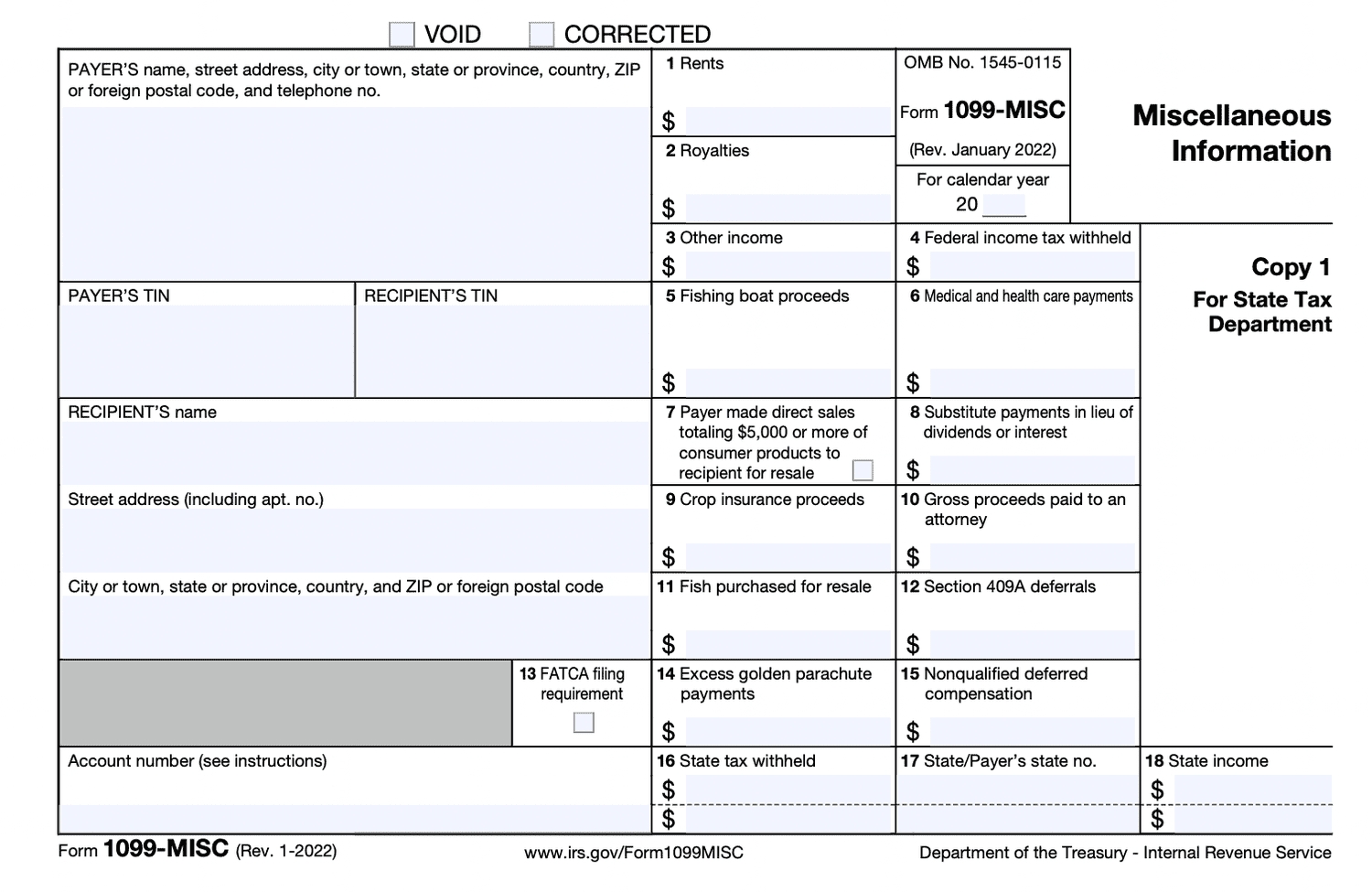

Free IRS Form 1099 MISC PDF EForms

Free IRS 1099 Form PDF EForms