IRS 1099-NEC Form 2025

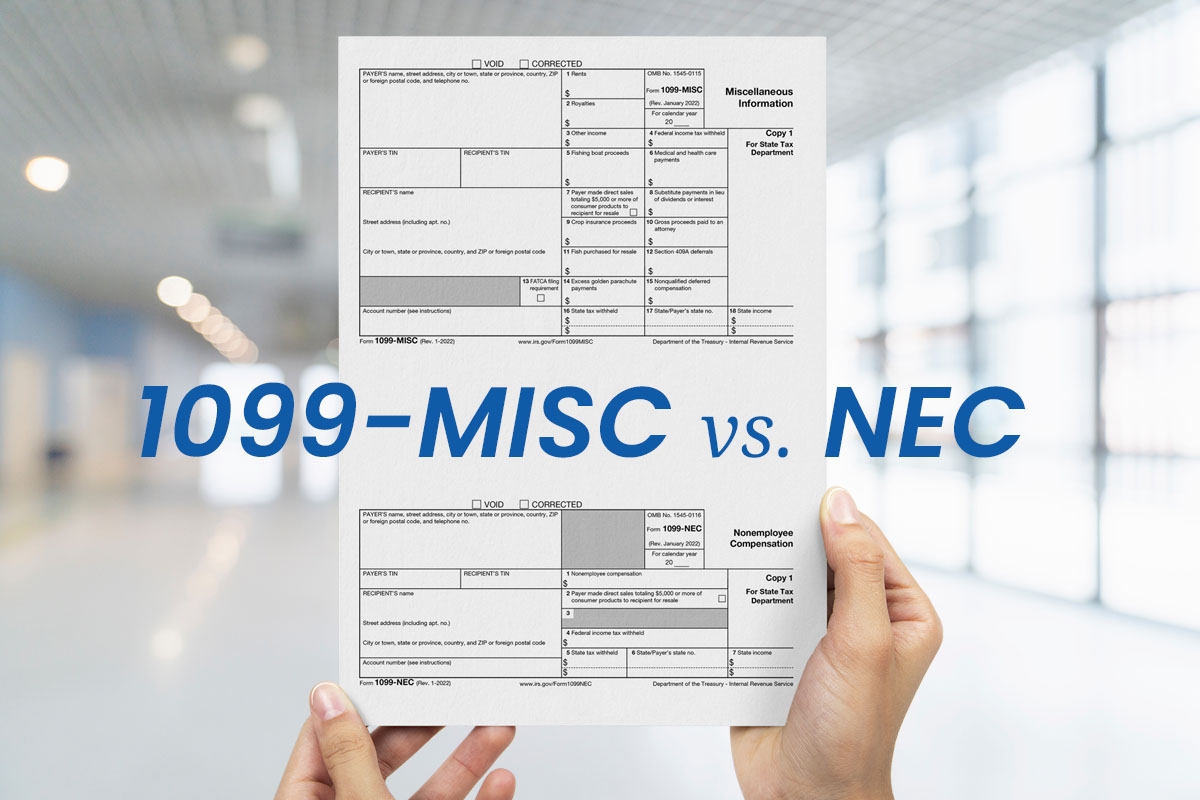

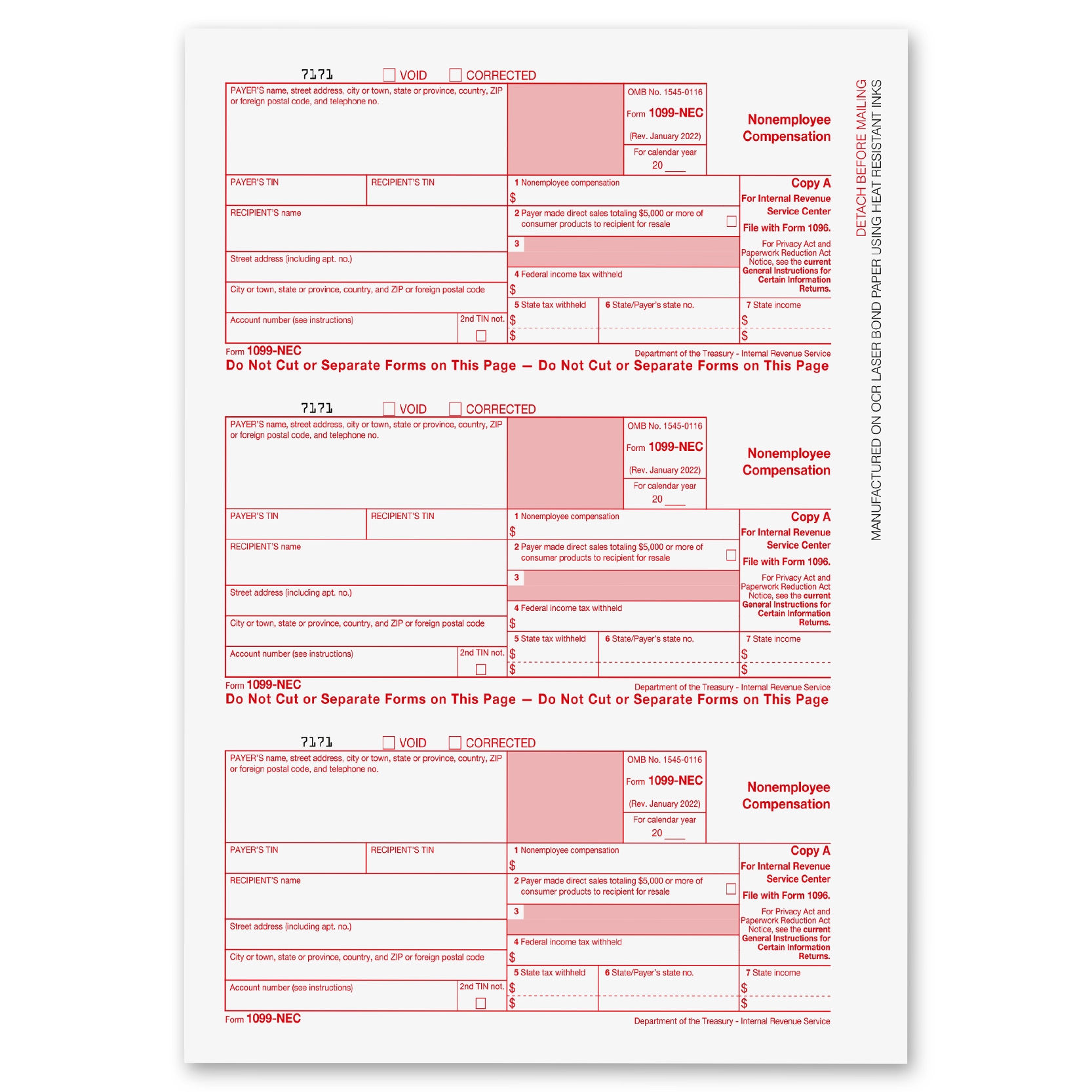

Are you familiar with the IRS 1099-NEC Form 2025? This form is used to report nonemployee compensation to the IRS. It’s important to understand the ins and outs of this form to ensure compliance with tax regulations.

When it comes to filing taxes, accuracy is key. The IRS 1099-NEC Form 2025 is no exception. Make sure you have all the necessary information and documentation before submitting your form to avoid any potential issues.

IRS 1099-NEC Form 2025

Understanding the IRS 1099-NEC Form 2025

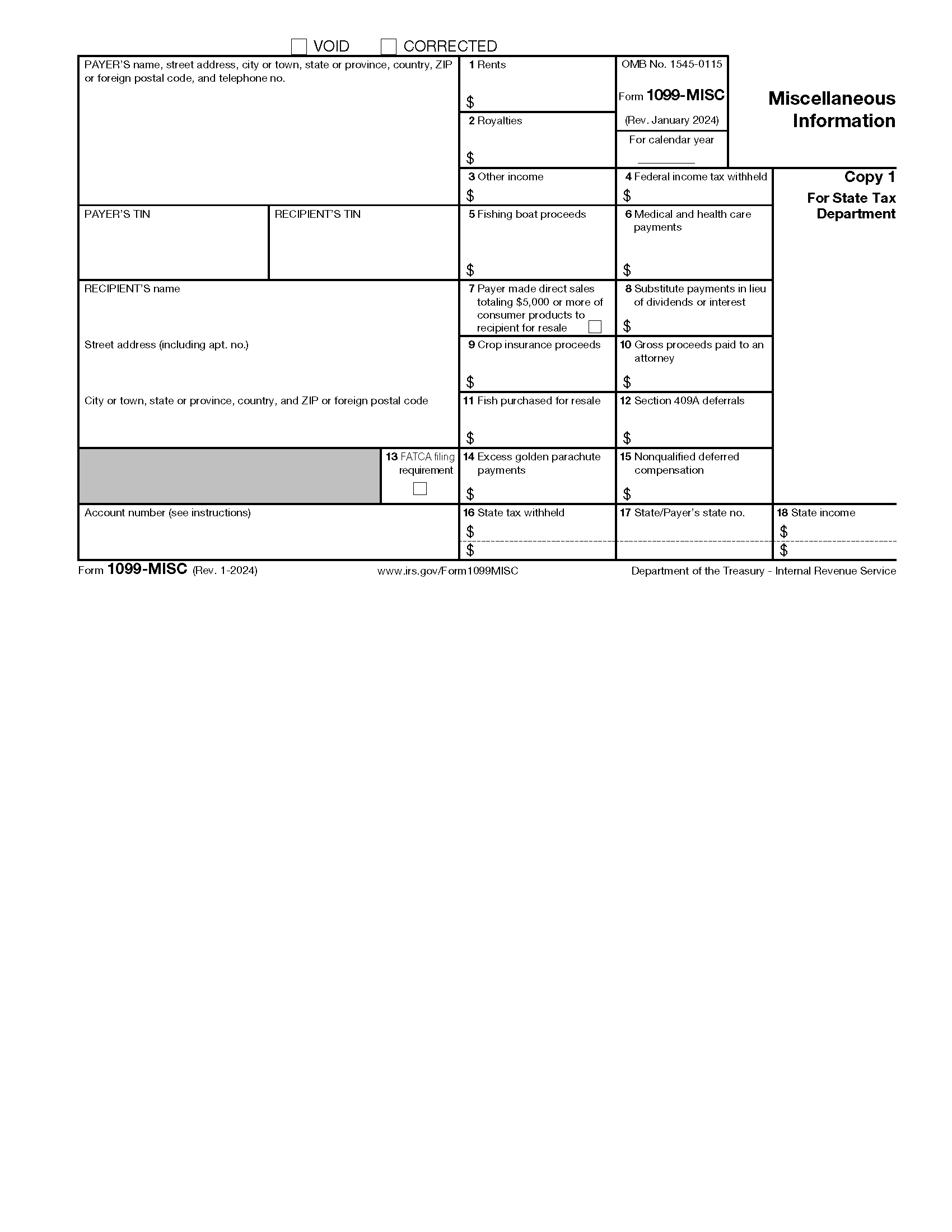

The IRS 1099-NEC Form 2025 is typically used to report payments made to independent contractors, freelancers, and other nonemployees. This form helps the IRS track income that may not be reported on traditional W-2 forms.

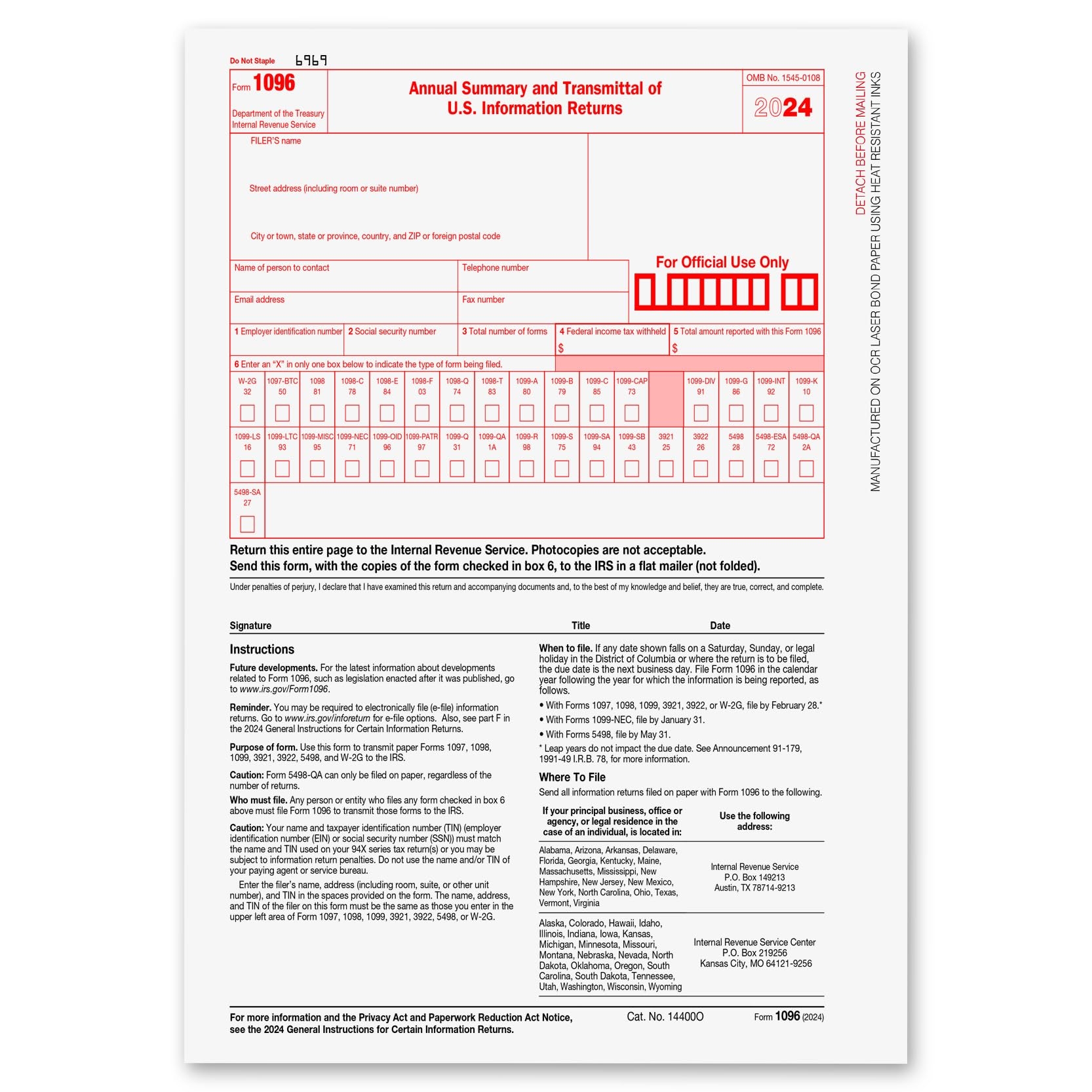

It’s important to note that failure to file the IRS 1099-NEC Form 2025 or inaccuracies in reporting can result in penalties from the IRS. Be sure to carefully review all information before submitting your form to avoid any potential issues.

Keep detailed records of all payments made to nonemployees throughout the year to make the process of filling out the IRS 1099-NEC Form 2025 easier. This will help ensure that you have all the necessary information at your fingertips when it comes time to file your taxes.

In conclusion, understanding the IRS 1099-NEC Form 2025 is essential for anyone who pays nonemployees for services. By staying informed and accurate in your reporting, you can avoid potential penalties and ensure compliance with IRS regulations.

Itemize Deductions Or Take The Standard Deduction Which Is Right For You

Amazon 1099 NEC Forms 2024 1099 NEC Laser Forms IRS Approved Designed For Quickbooks And Accounting Software 2024 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms Office Products

Free IRS Form 1099 MISC PDF EForms

1099 Requirements For Business Owners In 2025 Mark J Kohler

1099 NEC Forms 2023 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms ONGULS