IRS 2025 Form 1040

Are you ready to tackle tax season like a pro? Understanding the IRS 2025 Form 1040 is key to staying organized and maximizing your deductions. Don’t let the thought of taxes stress you out – we’ve got you covered!

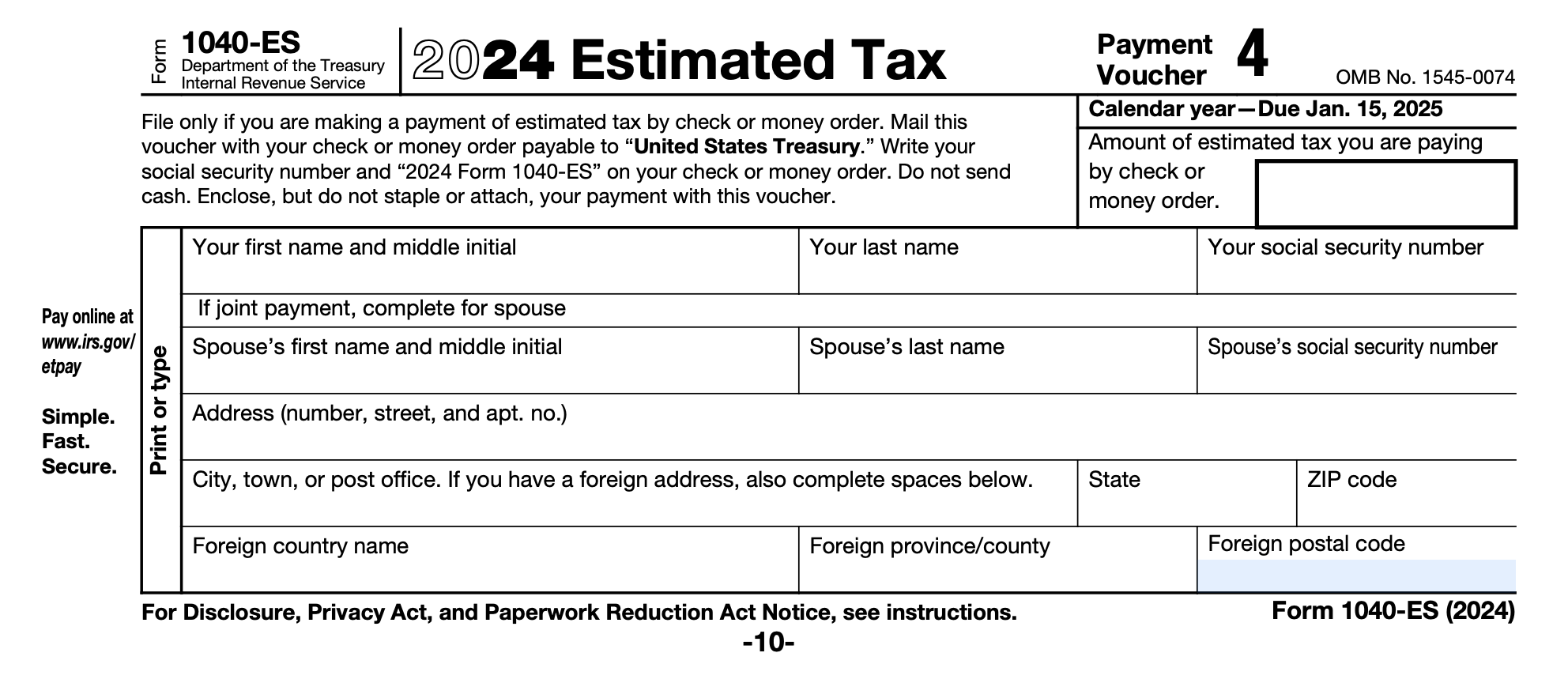

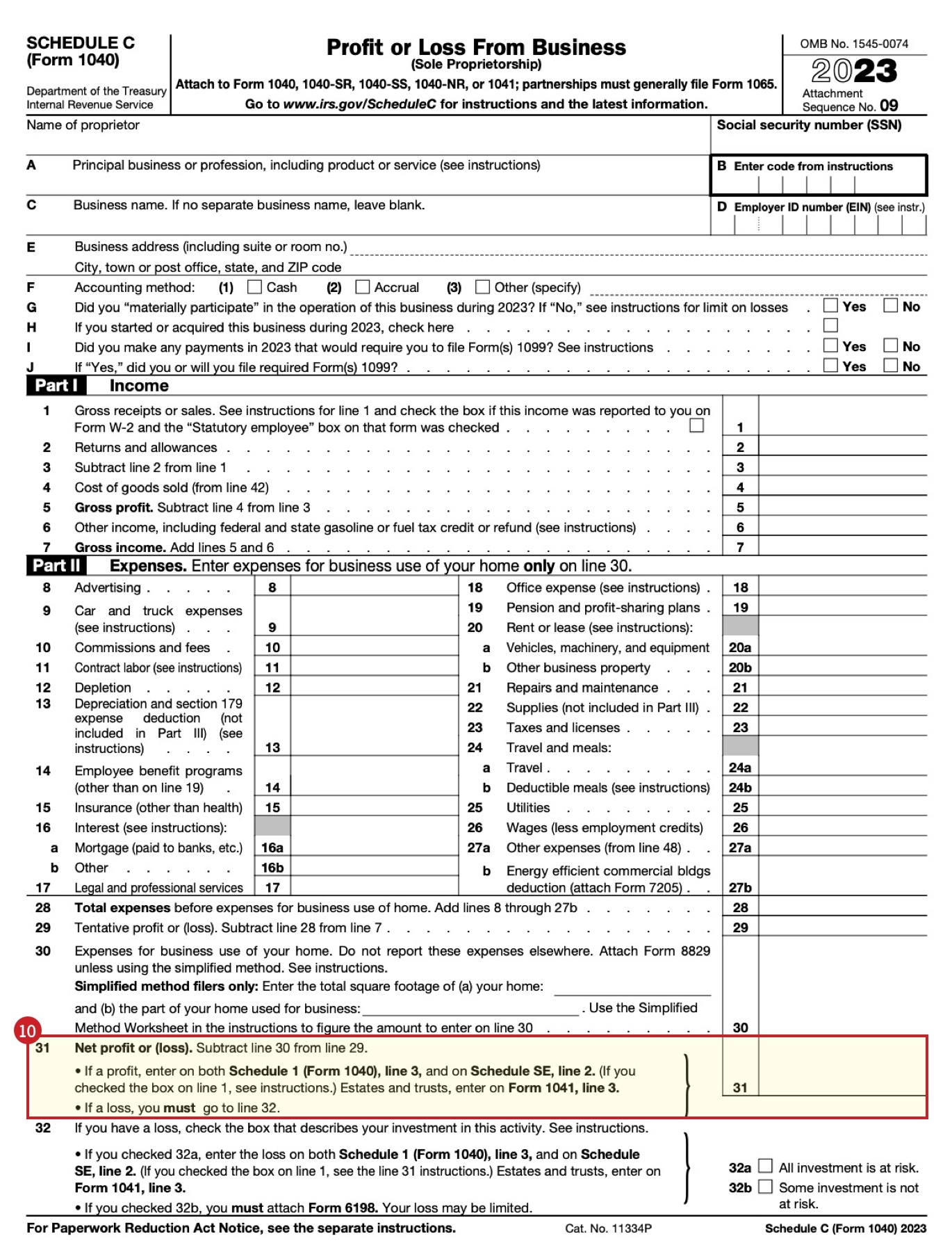

With the IRS 2025 Form 1040, you’ll report your income, deductions, and credits for the year. It’s the main form used by individuals to file their federal income tax returns. Knowing how to fill it out correctly can save you time and money.

IRS 2025 Form 1040

Demystifying the IRS 2025 Form 1040

When filling out the IRS 2025 Form 1040, make sure to double-check all your information for accuracy. Any mistakes could delay your refund or even trigger an audit. Take your time, review each section carefully, and don’t hesitate to seek help if needed.

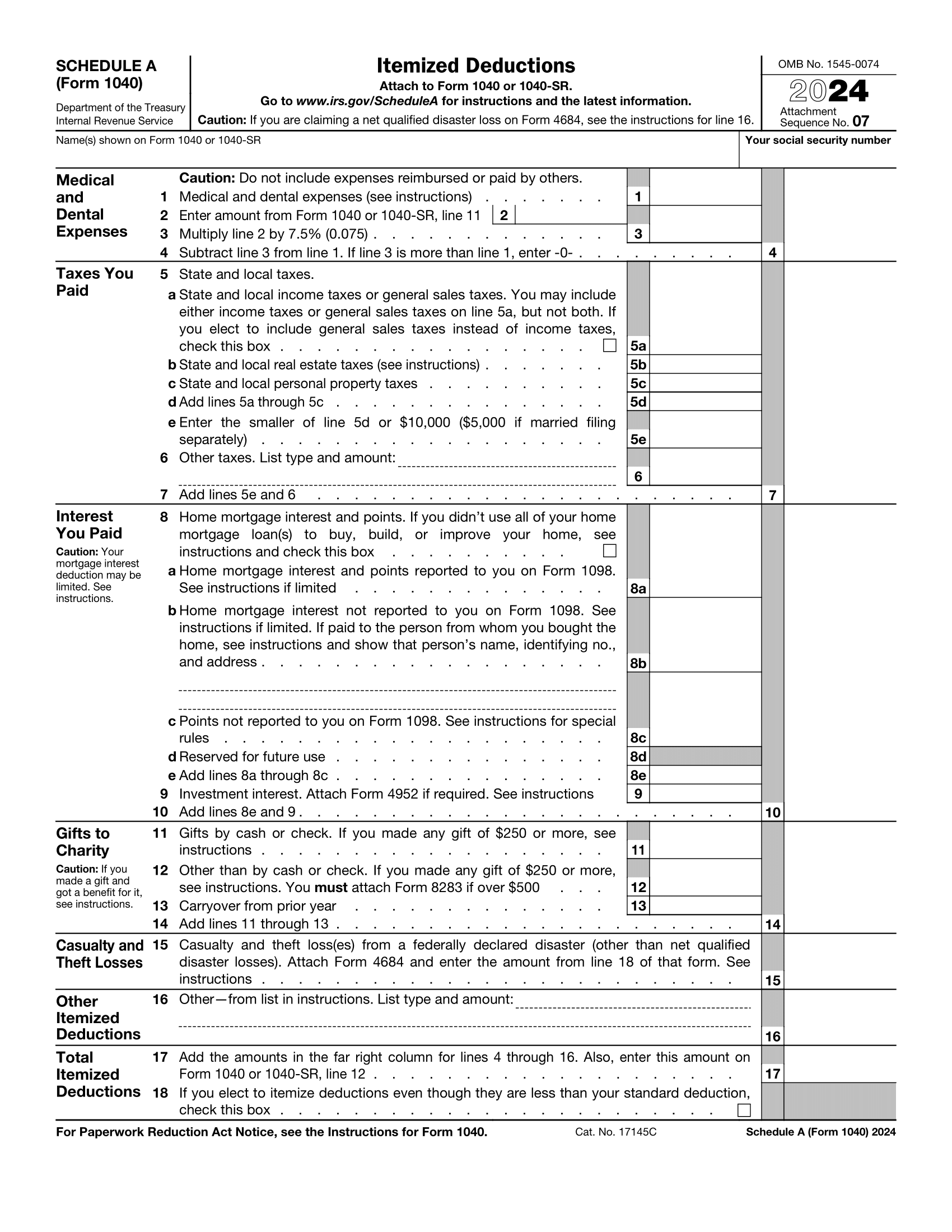

One of the most important parts of the IRS 2025 Form 1040 is the deductions section. This is where you can reduce your taxable income by claiming expenses like mortgage interest, medical costs, and charitable donations. Be sure to gather all necessary documentation to support your claims.

Remember to keep copies of all your tax documents for at least three years in case you need to reference them later. By staying organized and informed, you can navigate tax season with confidence and ease. Don’t let the IRS 2025 Form 1040 intimidate you – you’ve got this!

So, whether you’re a seasoned tax pro or a first-time filer, understanding the ins and outs of the IRS 2025 Form 1040 is crucial. By familiarizing yourself with the form and following our tips, you’ll be well on your way to a smooth and stress-free tax season. Happy filing!

What Is An Extension To File Taxes In 2025 And How Do You Request It

These Are The New IRS Tax Brackets For 2025

Schedule A Form 1040 A Guide To The Itemized Deduction Bench Accounting

Where To Find My 2023 Tax Information 2025 26 Federal Student Aid

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor