IRS 2025 Form 1040-ES

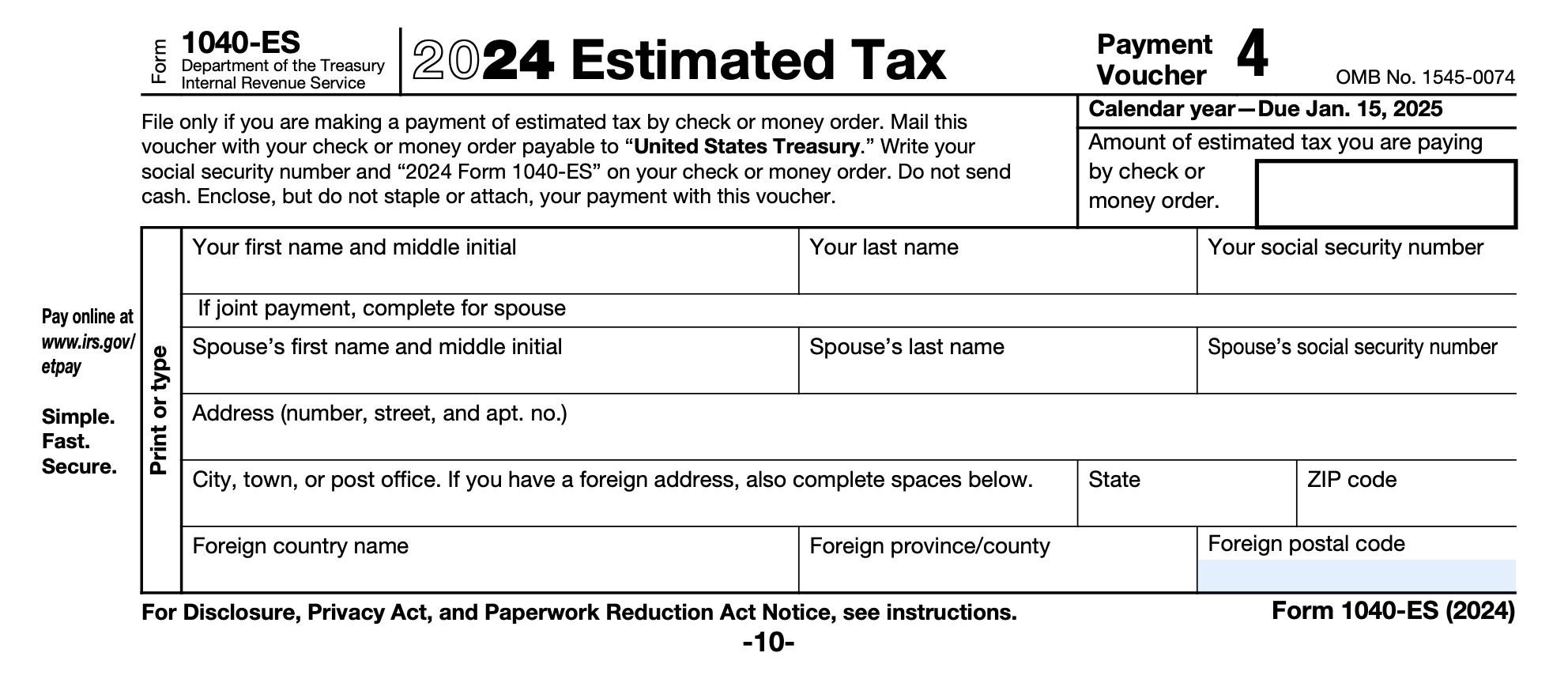

Are you looking for information on the IRS 2025 Form 1040-ES? Filing taxes can be a confusing process, but understanding the necessary forms can make it easier for you. The Form 1040-ES is used to pay estimated taxes throughout the year.

It is important to remember that the IRS requires taxpayers to pay taxes as they earn income, rather than waiting until the end of the year. The Form 1040-ES helps individuals calculate and pay their estimated taxes on a quarterly basis.

IRS 2025 Form 1040-ES

Understanding the IRS 2025 Form 1040-ES

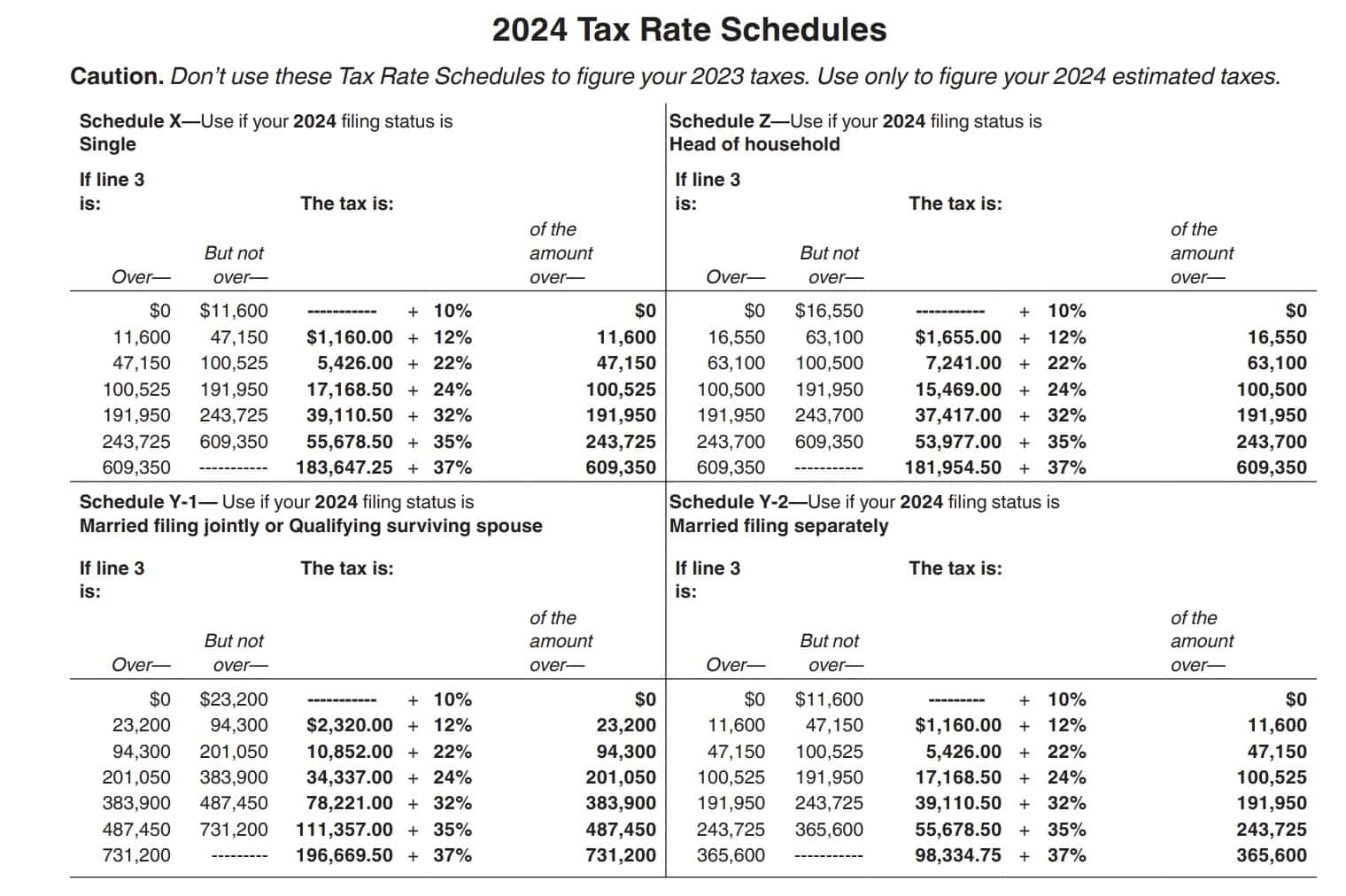

When filling out the Form 1040-ES, taxpayers will need to estimate their total income for the year and calculate their expected deductions and credits. Based on these figures, they will determine how much they owe in taxes for each quarter.

It is essential to submit the Form 1040-ES and make the appropriate payments on time to avoid penalties and interest charges from the IRS. By staying organized and keeping accurate records, taxpayers can ensure they meet their tax obligations throughout the year.

Ultimately, the IRS 2025 Form 1040-ES is a valuable tool for individuals who need to pay estimated taxes on a quarterly basis. By understanding how to complete this form correctly, taxpayers can avoid potential issues with the IRS and stay on top of their tax responsibilities.

In conclusion, if you are required to pay estimated taxes, it is essential to familiarize yourself with the IRS 2025 Form 1040-ES. By following the guidelines and submitting the form accurately and on time, you can ensure that you meet your tax obligations and avoid any unnecessary penalties or fees.

Man Writing Check To Internal Revenue Service IRS Form 1040 ES For Payment Of Estimated Taxes In 2015 Stock Photo Alamy

When Does The 2025 Tax Filing Season Start Here s The Exact Date Announced By The IRS Marca

A Guide To Household Employers Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting