IRS Form 1040 2025

Are you ready for tax season in 2025? It’s that time of year again when you need to start thinking about filing your taxes. One of the most common forms you’ll encounter is the IRS Form 1040, which is used by individuals to report their income and calculate their tax liability.

With the IRS Form 1040 2025, there may be some changes to the form and instructions, so it’s important to stay updated on any updates from the Internal Revenue Service. This form is crucial for accurately reporting your income, deductions, and credits to determine how much you owe or are owed in taxes.

IRS Form 1040 2025

Understanding IRS Form 1040 2025

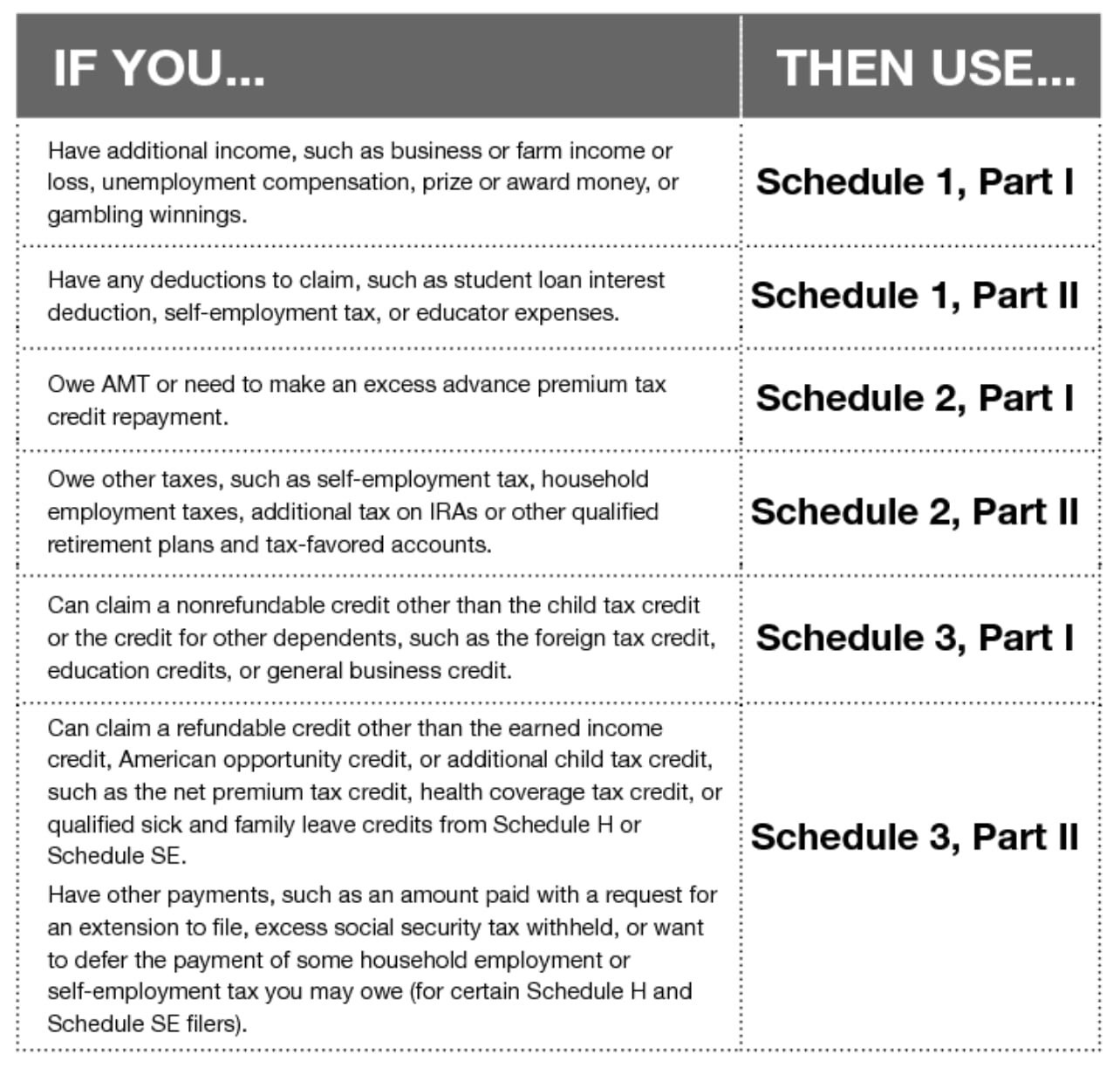

The IRS Form 1040 2025 will likely require you to provide information about your income, such as wages, dividends, and capital gains. You’ll also need to report any deductions you’re eligible for, like student loan interest or mortgage interest.

Additionally, the form may ask for details on any tax credits you qualify for, such as the Earned Income Tax Credit or Child Tax Credit. It’s essential to fill out this form accurately and completely to avoid any potential issues with the IRS.

As you gather your documents and prepare to file your taxes, make sure to review the IRS Form 1040 2025 instructions carefully. If you have any questions or need assistance, don’t hesitate to reach out to a tax professional for guidance. Remember, filing your taxes accurately and on time is essential to avoid penalties and fees.

Stay organized, keep track of deadlines, and don’t procrastinate when it comes to filing your taxes. By understanding the IRS Form 1040 2025 and following the instructions closely, you can navigate the tax-filing process with confidence and ease.

IRS Income Tax Refund Schedule For 2025 CPA Practice Advisor

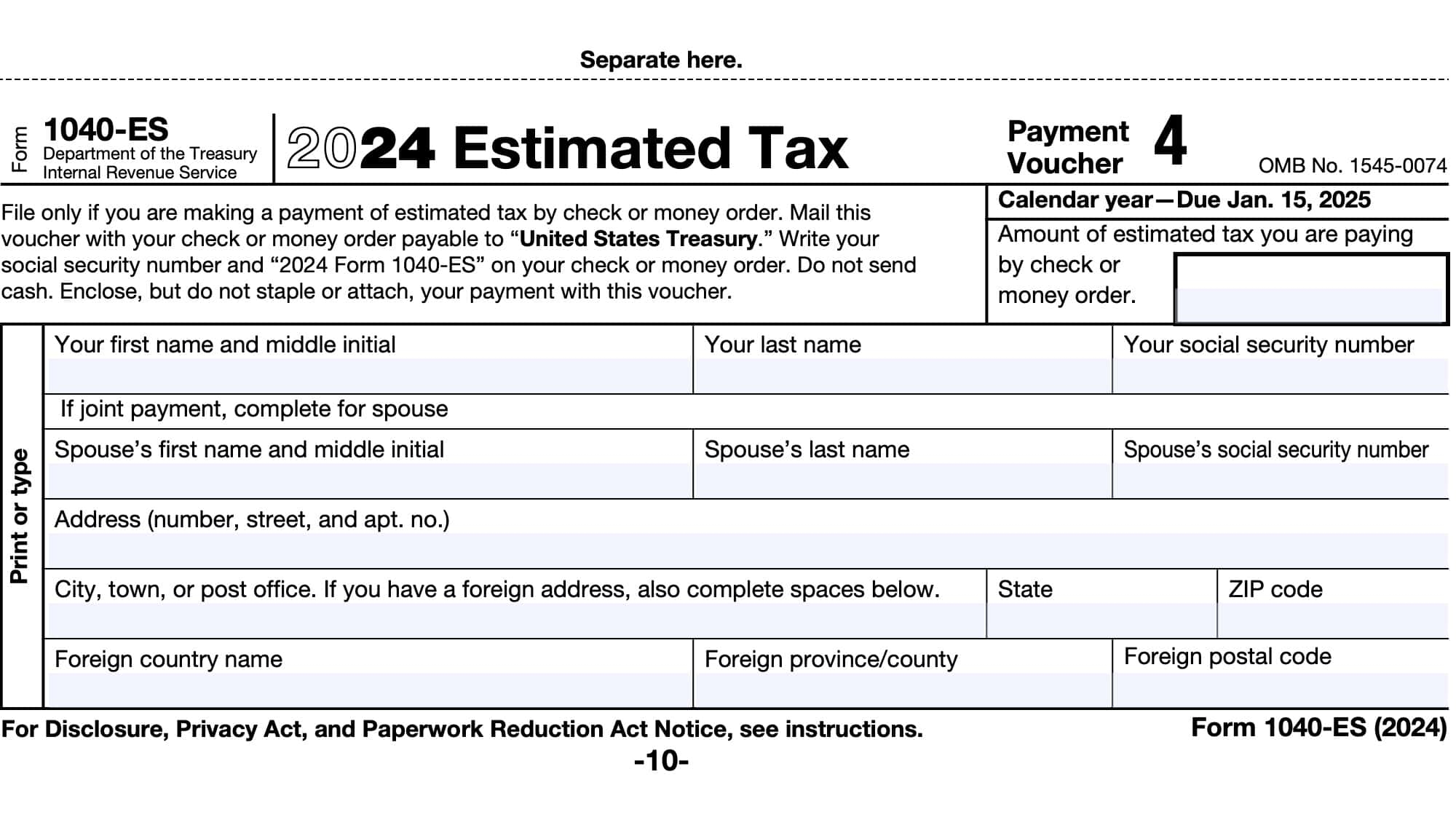

IRS Form 1040 ES Instructions Estimated Tax Payments

IRS Formular 1040 Ausf llen Infos Zum IRS Formular 1040 ES

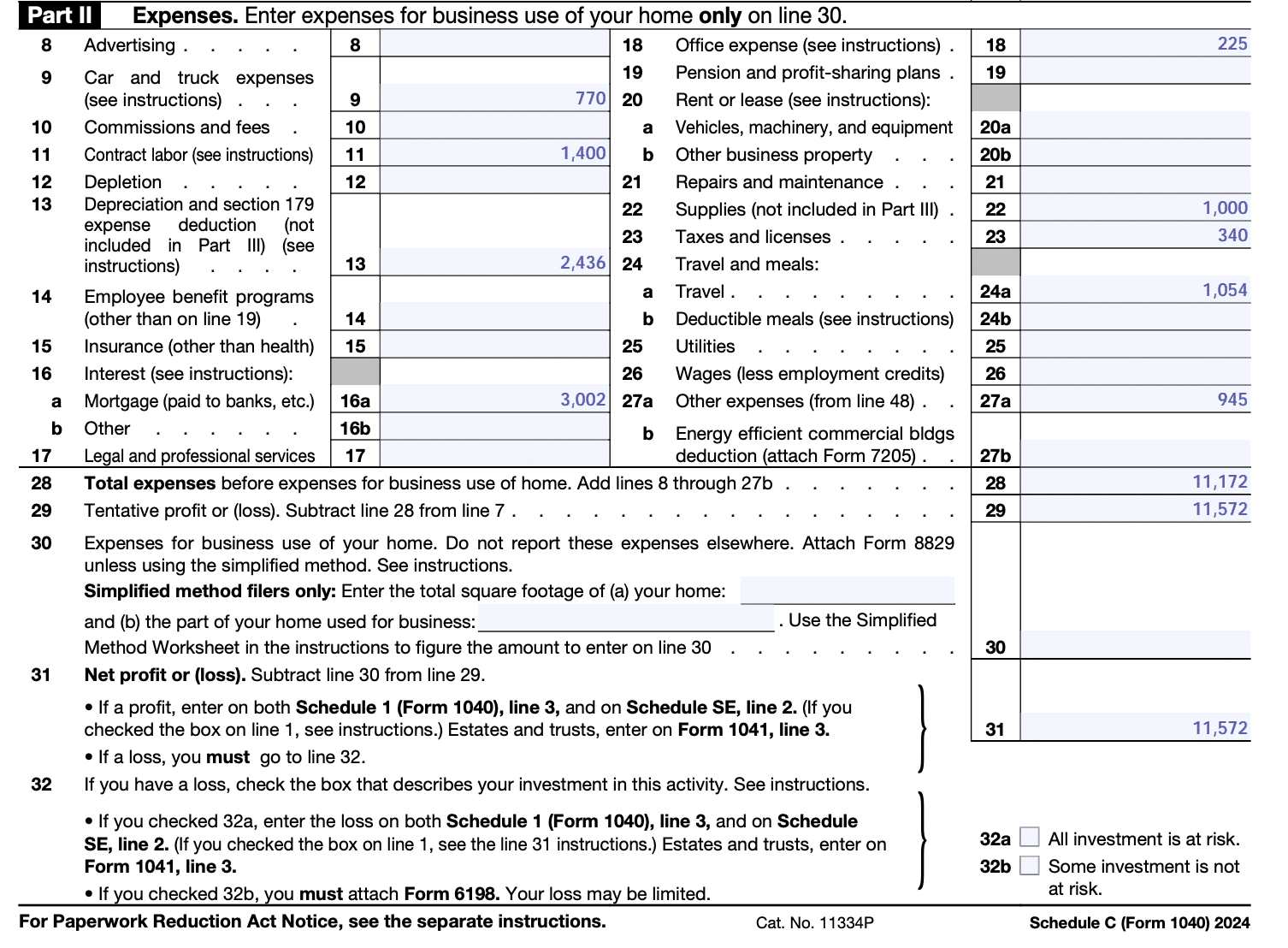

How To Fill Out Schedule C In 2025 With Example

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor