IRS Form 1040-ES For 2025

Planning ahead for your taxes can save you a lot of stress and headaches come tax season. One important form to consider is the IRS Form 1040-ES, which helps taxpayers estimate and pay their taxes throughout the year.

As we look ahead to the year 2025, it’s never too early to start thinking about your tax obligations. By familiarizing yourself with the IRS Form 1040-ES, you can avoid any surprises and ensure that you are on track with your tax payments.

IRS Form 1040-ES For 2025

IRS Form 1040-ES For 2025

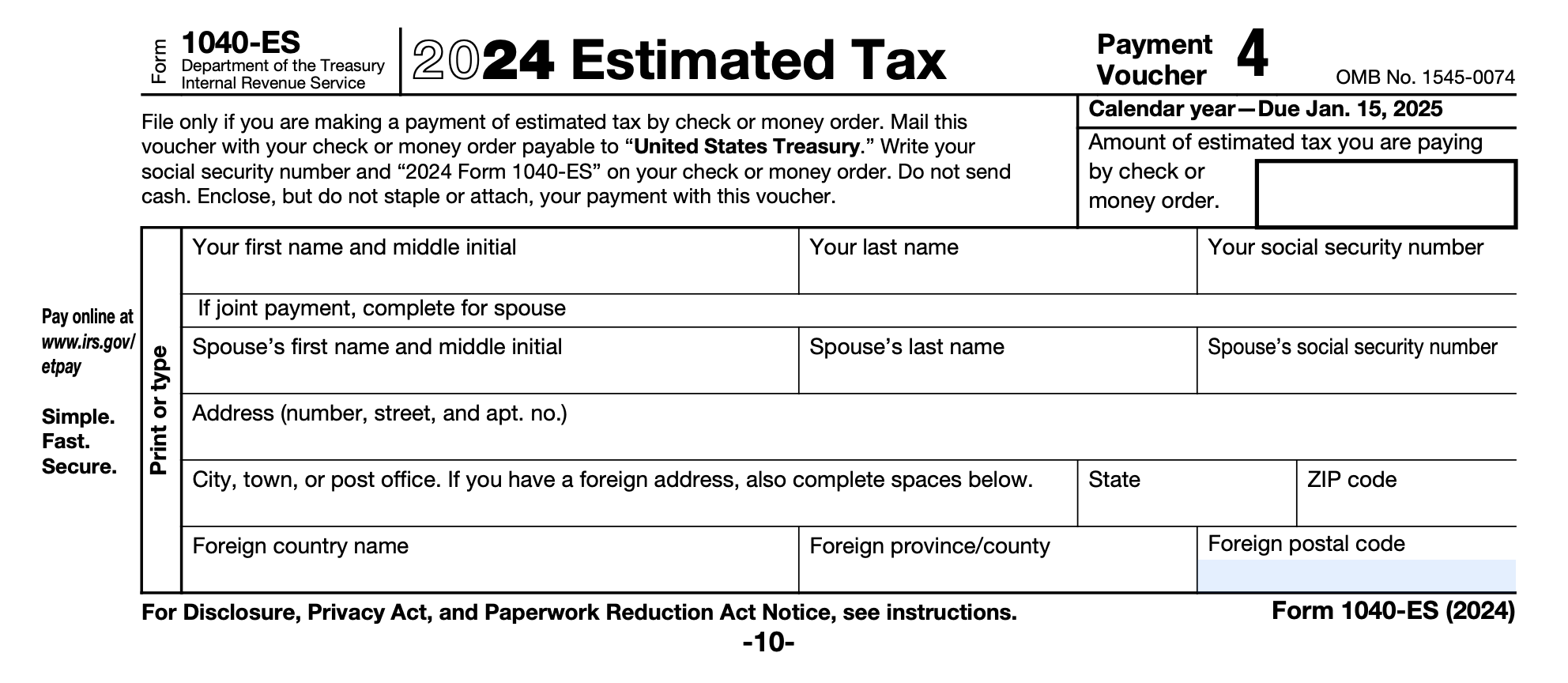

IRS Form 1040-ES is used to calculate and pay estimated taxes for individuals who are self-employed or have other sources of income that require them to make quarterly tax payments. It helps you avoid underpayment penalties and stay compliant with the IRS.

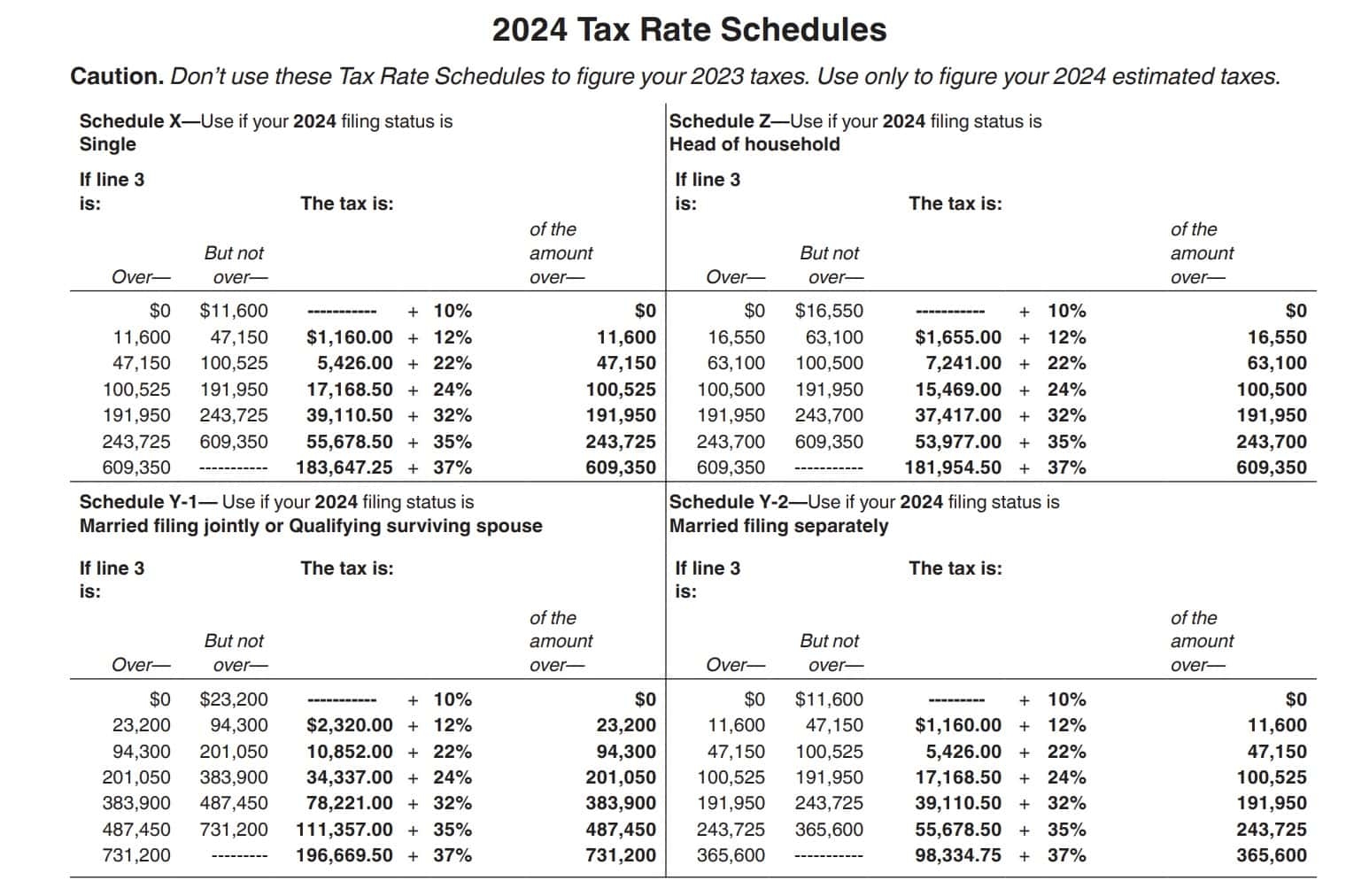

When completing Form 1040-ES, you will need to estimate your total income, deductions, and credits for the year. Based on these estimates, you will calculate your expected tax liability and determine how much you need to pay each quarter to avoid penalties.

By staying organized and proactive with your tax planning, you can avoid the stress of scrambling to pay a large tax bill at the end of the year. Using IRS Form 1040-ES allows you to spread out your tax payments evenly throughout the year, making it easier to manage your finances.

As 2025 approaches, take the time to review your financial situation and consider using IRS Form 1040-ES to stay ahead of your tax obligations. By planning ahead and staying informed, you can ensure a smoother tax season and avoid any surprises when it comes time to file your taxes.

September 15 Third Quarter Estimated Tax Deadline Franek Tax Services Tax Services

2025 Tax Guide Key Documents And Steps To File Your 2024 Taxes Marca

A Guide To Household Employers Estimated Tax Payments

IRS Form 1040 ES Instructions Estimated Tax Payments

What Is IRS Form 1040 ES Guide To Estimated Income Tax Bench Accounting