IRS Form 1040 For 2025

April 15th is a dreaded date for many Americans–it’s tax day! Filing your taxes can be overwhelming, but understanding the IRS Form 1040 for 2025 can make the process a little less stressful.

The IRS Form 1040 for 2025 is the standard tax form used by individuals to report their income, deductions, and credits for the year. It’s important to fill it out accurately to avoid any potential issues with the IRS.

IRS Form 1040 For 2025

Demystifying IRS Form 1040 For 2025

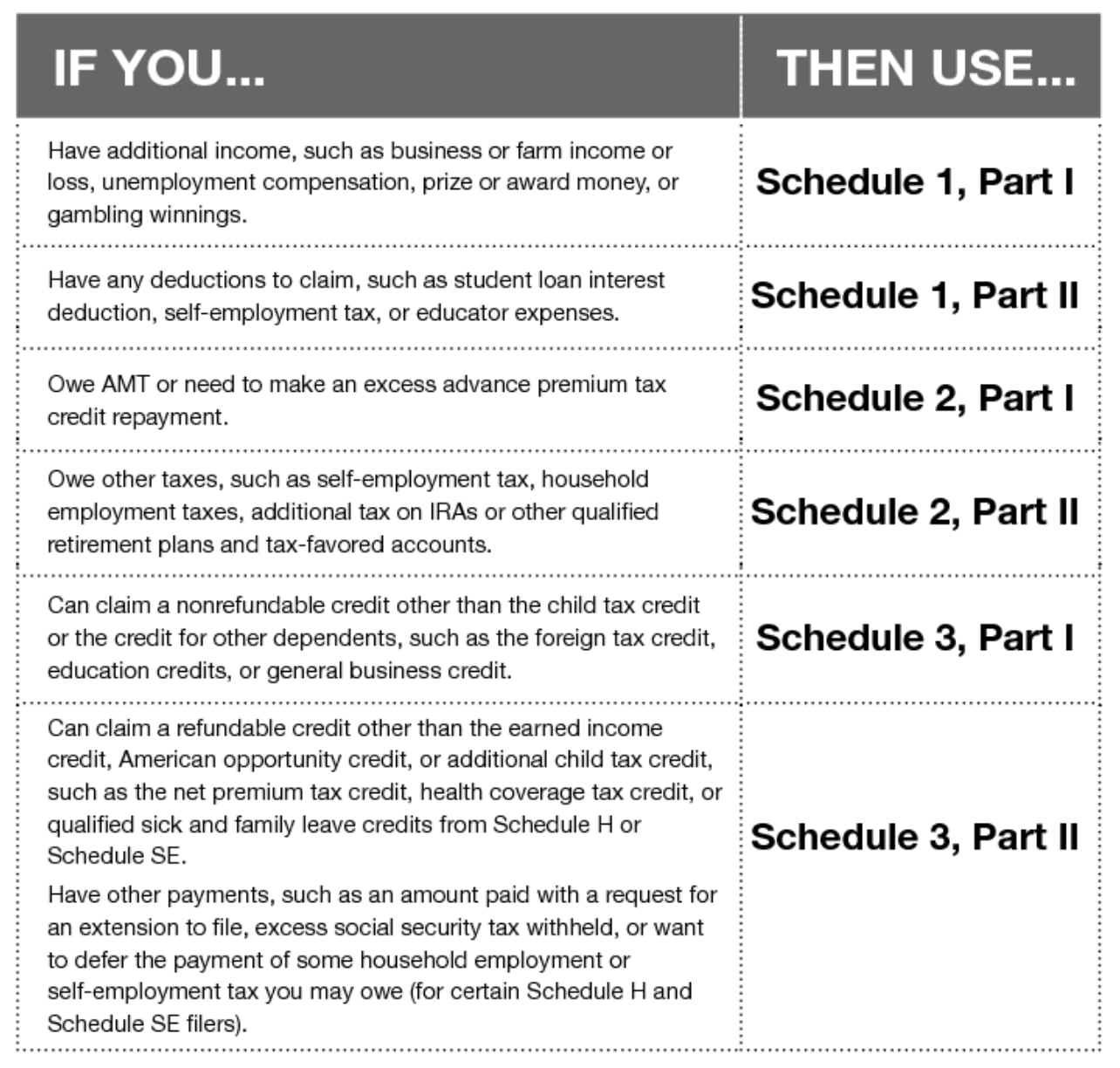

When filling out the IRS Form 1040 for 2025, you’ll need to provide information about your income, such as wages, salaries, and tips. You’ll also need to report any other sources of income, like investments or rental properties.

Don’t forget to take advantage of deductions and credits that you qualify for. These can help lower your taxable income and potentially increase your refund. Common deductions include student loan interest, mortgage interest, and charitable contributions.

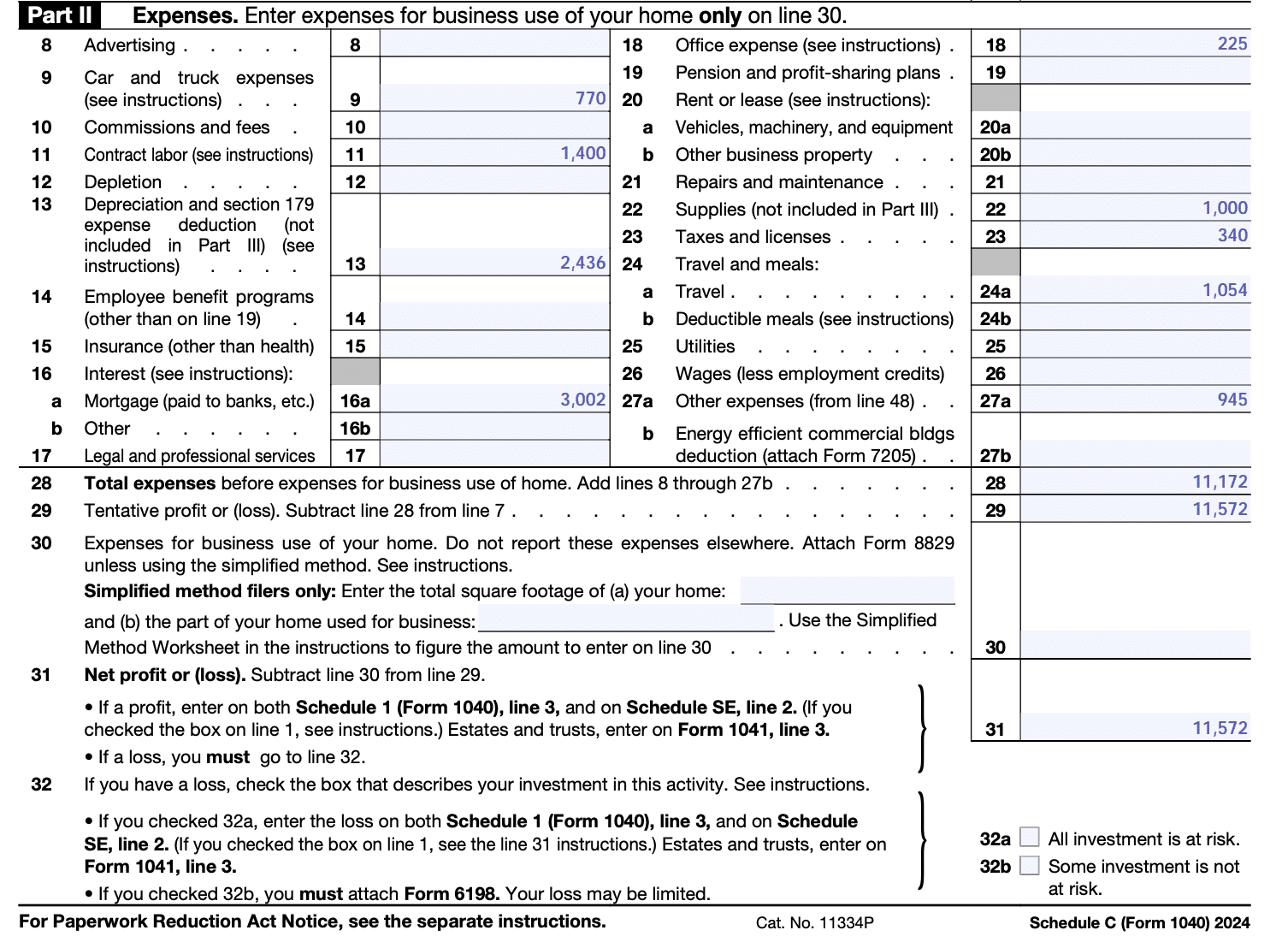

If you’re self-employed, you’ll need to report your business income and expenses on Schedule C. This form allows you to deduct business expenses like office supplies, travel costs, and advertising. Keeping accurate records throughout the year can make this process much smoother.

Once you’ve completed your IRS Form 1040 for 2025, double-check everything for accuracy before submitting it. Mistakes can delay your refund or even trigger an audit. If you’re unsure about anything, consider consulting a tax professional for guidance.

Understanding the IRS Form 1040 for 2025 can help make tax season less stressful. By staying organized and informed, you can ensure that your taxes are filed accurately and on time. Remember, it’s always better to be proactive than reactive when it comes to taxes!

What Is An Extension To File Taxes In 2025 And How Do You Request It

IRS Formular 1040 Ausf llen Infos Zum IRS Formular 1040 ES

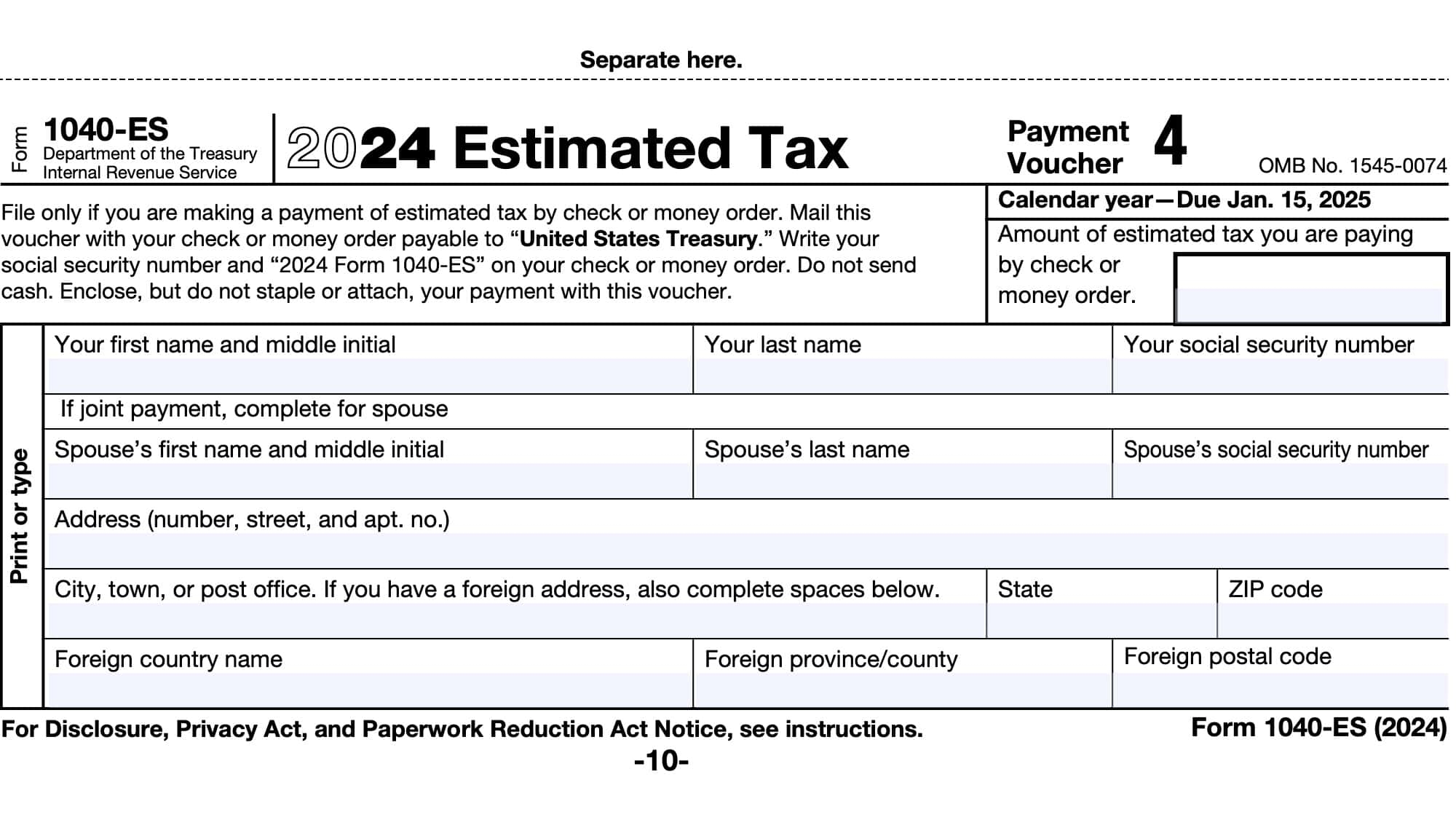

IRS Form 1040 ES Instructions Estimated Tax Payments

How To Fill Out Schedule C In 2025 With Example

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor