IRS Form 1099-NEC 2025

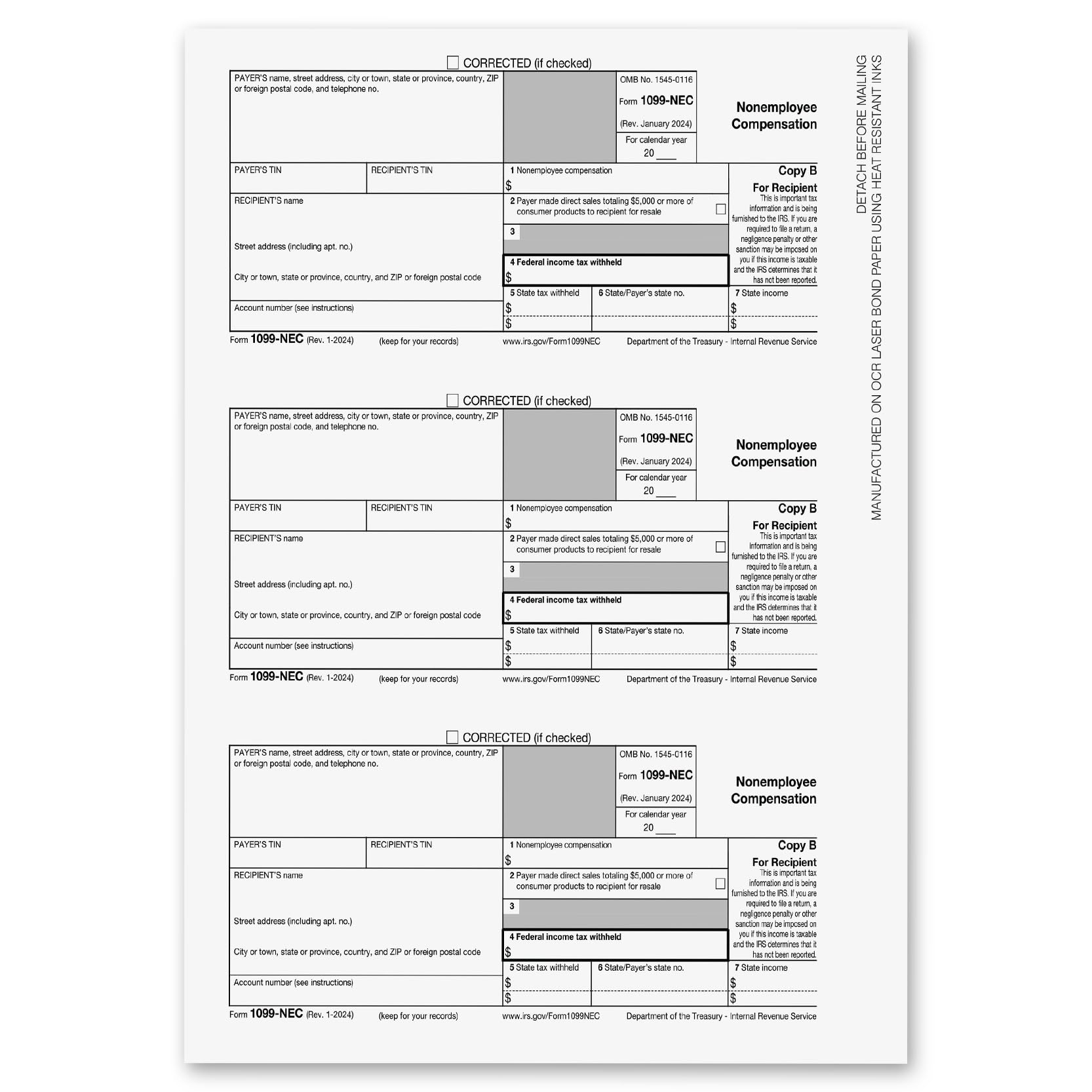

Are you a freelancer or independent contractor who received income in 2025? If so, you may be familiar with IRS Form 1099-NEC. This form is used to report nonemployee compensation to the IRS.

Filing your taxes correctly is crucial to avoid any penalties or audits. Understanding how to properly fill out IRS Form 1099-NEC 2025 is essential to ensure compliance with tax laws and regulations.

IRS Form 1099-NEC 2025

Everything You Need to Know About IRS Form 1099-NEC 2025

First and foremost, it’s important to accurately report the income you received as a freelancer or independent contractor. This includes any fees, commissions, prizes, or awards you earned throughout the year.

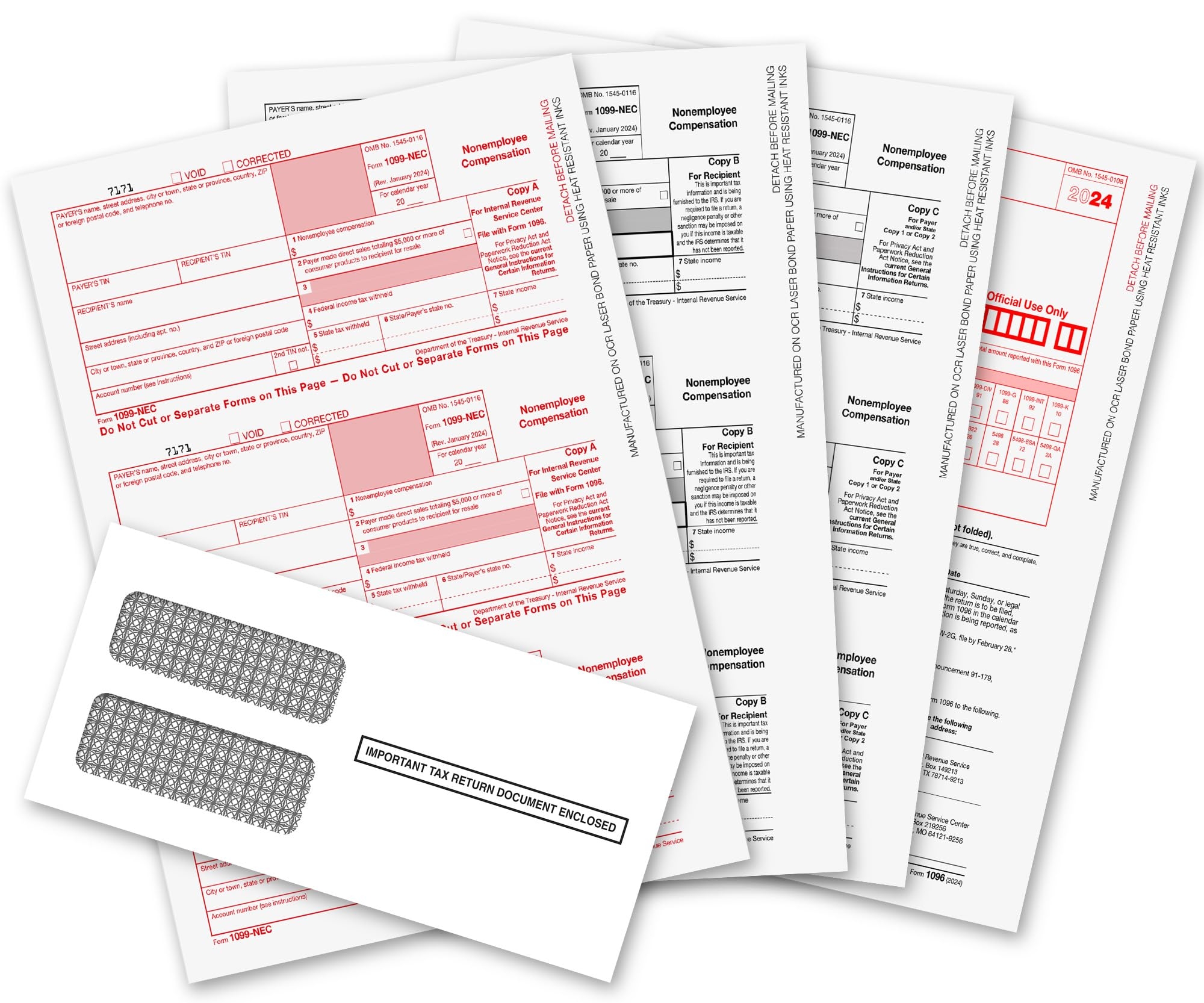

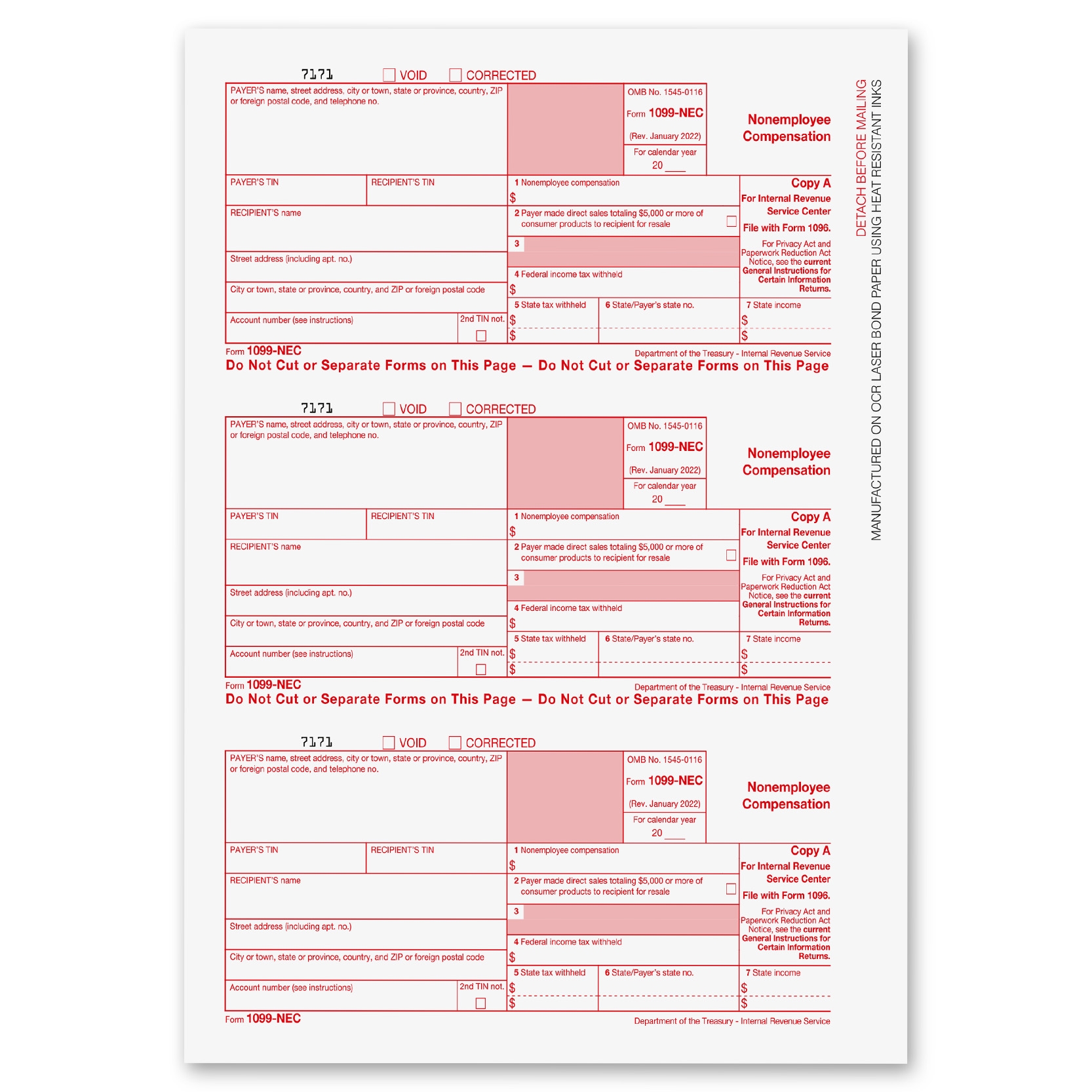

When filling out IRS Form 1099-NEC 2025, make sure to provide your personal information, including your name, address, and taxpayer identification number. Additionally, you’ll need to include the payer’s information and the total amount of nonemployee compensation you received.

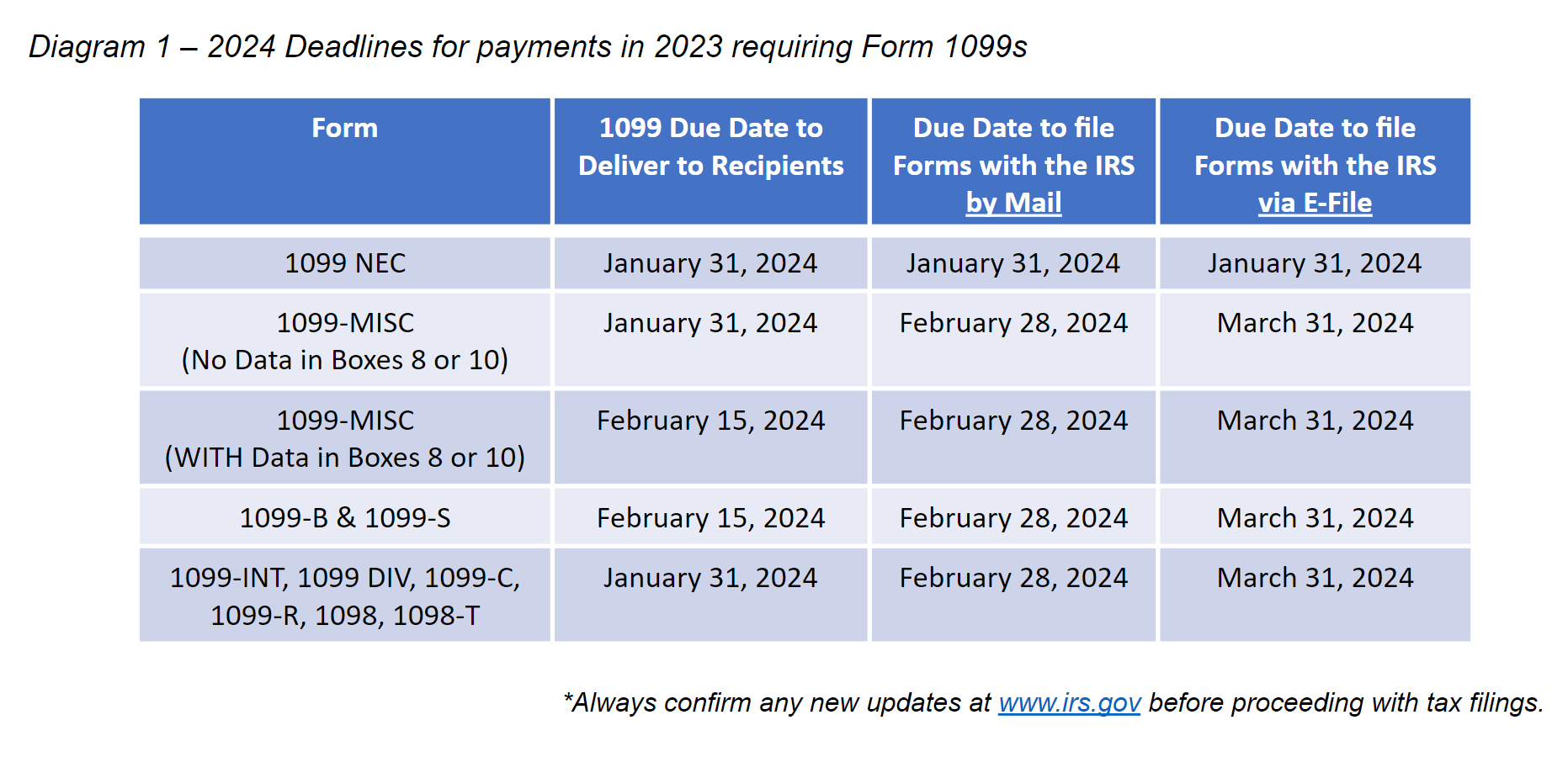

It’s crucial to submit IRS Form 1099-NEC 2025 by the specified deadline to avoid any late filing penalties. Keep thorough records of your income and expenses throughout the year to streamline the tax filing process and ensure accuracy.

In conclusion, understanding the ins and outs of IRS Form 1099-NEC 2025 is essential for freelancers and independent contractors. By following the guidelines and accurately reporting your income, you can navigate the tax filing process with ease and peace of mind.

1099 Requirements For Business Owners In 2025 Mark J Kohler

Amazon 1099 NEC Forms 2024 1099 NEC Laser Forms IRS Approved Designed For Quickbooks And Accounting Software 2024 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms Office Products

Free IRS 1099 NEC Form 2021 2024 PDF EForms

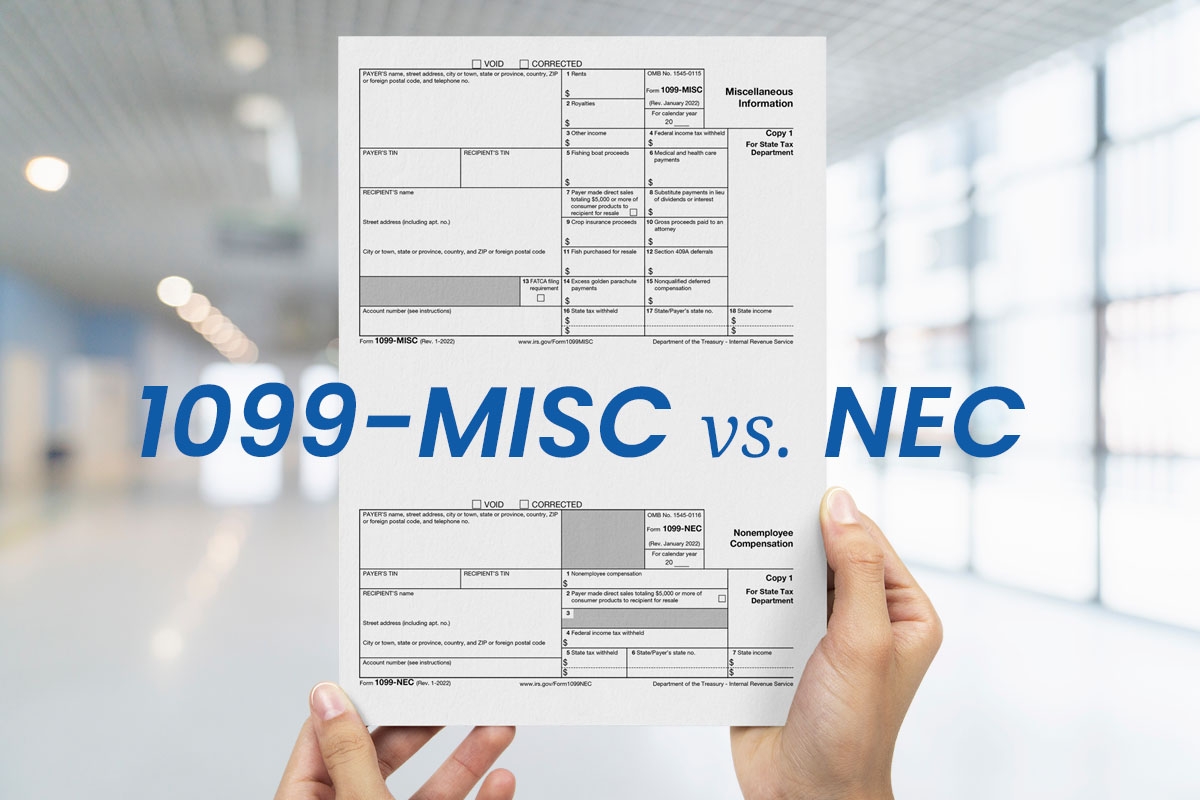

Form 1099 MISC Vs 1099 NEC What You Need To Know Form Pros

1099 NEC Forms 2023 4 Part Tax Forms Kit 25 Envelopes Self Seal 25 Vendor Kit Total 38 108 Forms ONGULS