Tax Form 1040 2025

Are you ready for tax season? It’s time to start thinking about the Tax Form 1040 for 2025. Filing your taxes can be overwhelming, but with the right information, you can breeze through the process.

When it comes to Tax Form 1040 for 2025, there are a few changes to be aware of. Make sure you have all your necessary documents, such as W-2s, 1099s, and receipts, to accurately report your income and deductions.

Tax Form 1040 2025

Understanding the Changes in Tax Form 1040 2025

One significant change in the Tax Form 1040 for 2025 is the increased standard deduction. This means you may be able to reduce your taxable income even if you don’t itemize deductions. It’s essential to take advantage of all available deductions to maximize your refund.

Additionally, keep an eye out for any tax credits you may qualify for, such as the Earned Income Tax Credit or Child Tax Credit. These credits can significantly reduce the amount of tax you owe or increase your refund, so it’s worth exploring your eligibility.

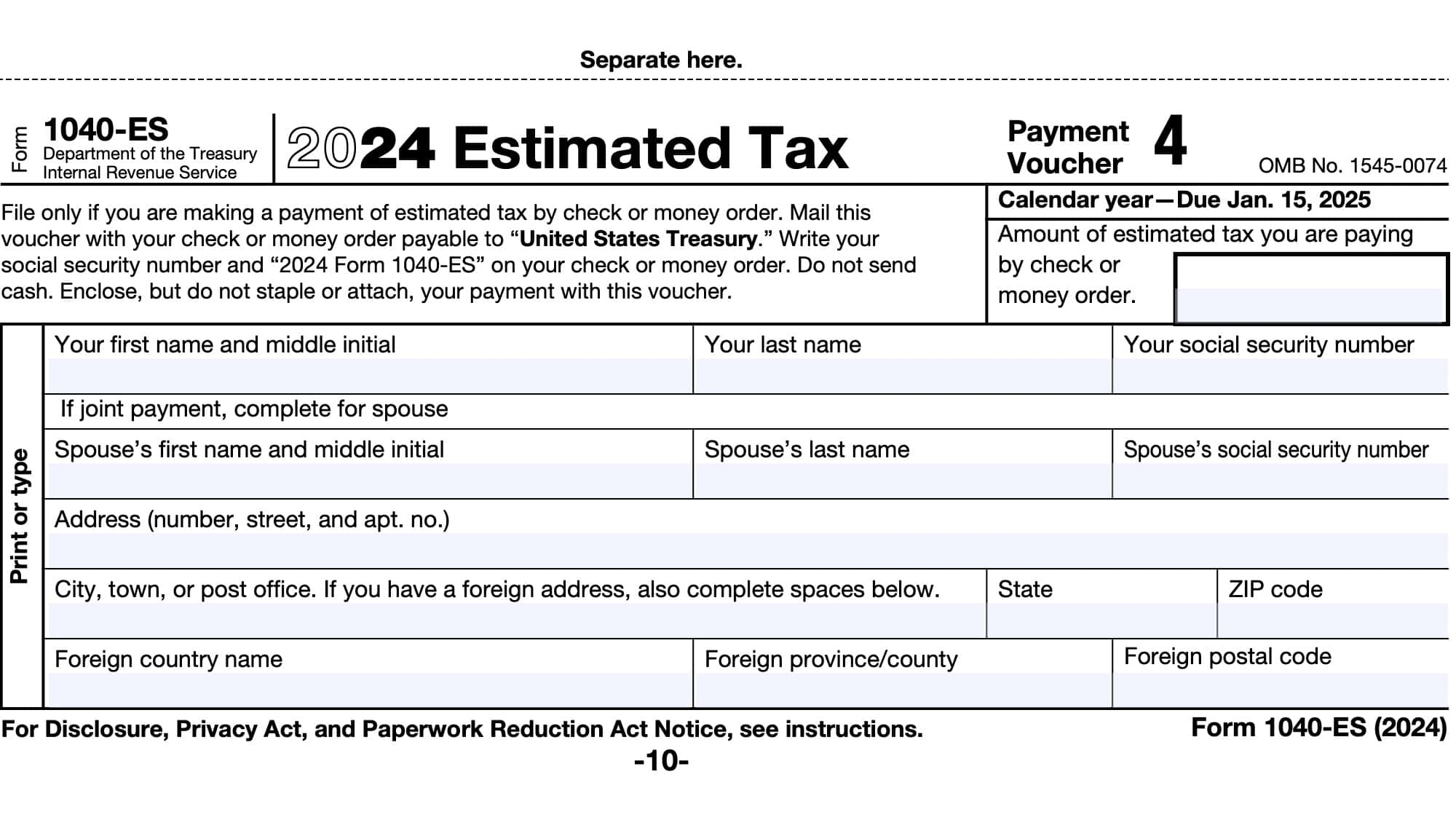

Lastly, don’t forget to file your taxes on time. The deadline for Tax Form 1040 for 2025 is typically April 15th, but it’s always a good idea to check for any deadline extensions. Filing late can result in penalties and interest, so make sure you submit your return promptly.

As you navigate through the Tax Form 1040 for 2025, remember to stay organized, keep accurate records, and seek help from a tax professional if needed. With a little preparation and knowledge, you can tackle your taxes with confidence and ease.

IRS Form 1040 ES Instructions Estimated Tax Payments

Where To Find My 2023 Tax Information 2025 26 Federal Student Aid

Form 1040 U S Individual Tax Return Definition Types And Use

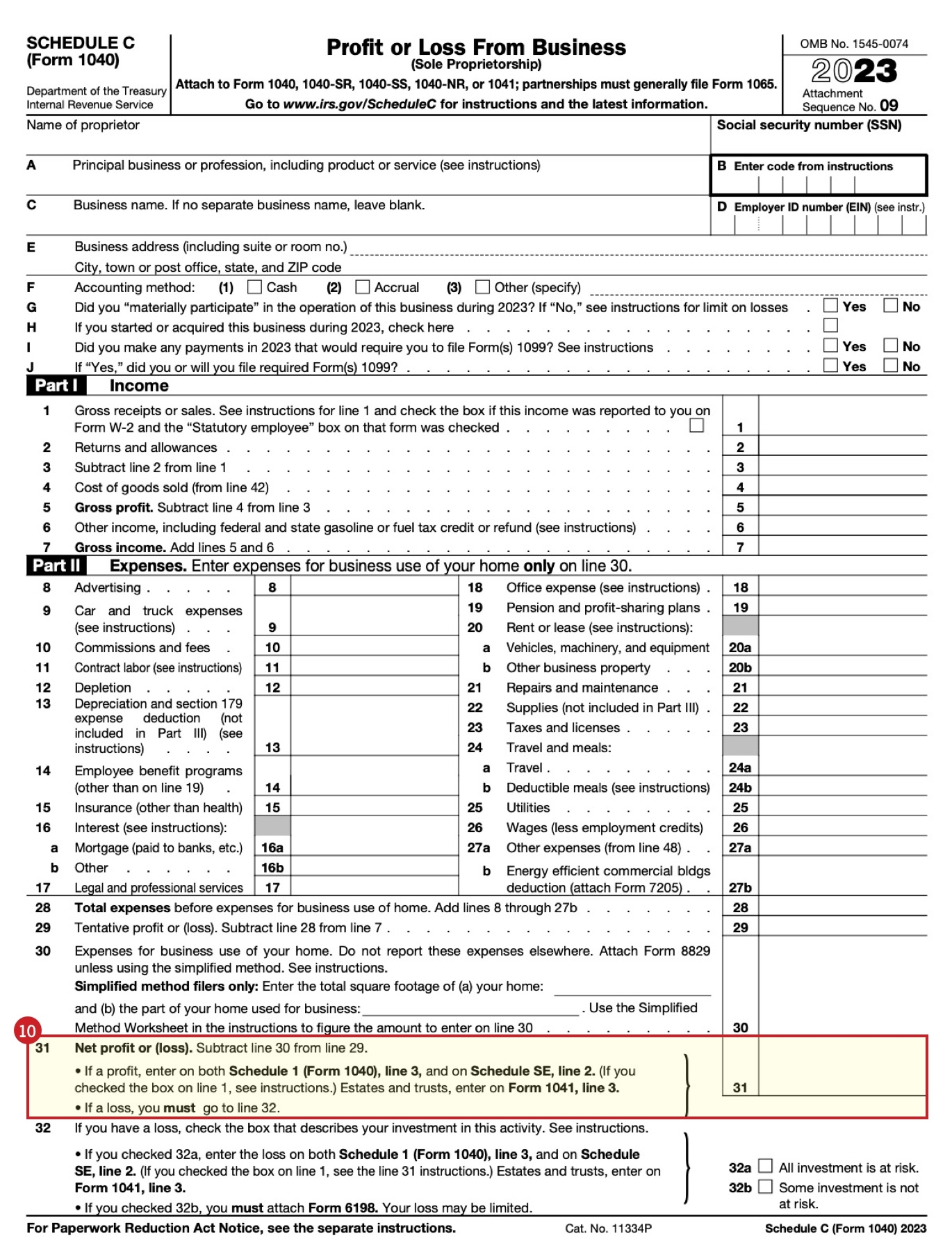

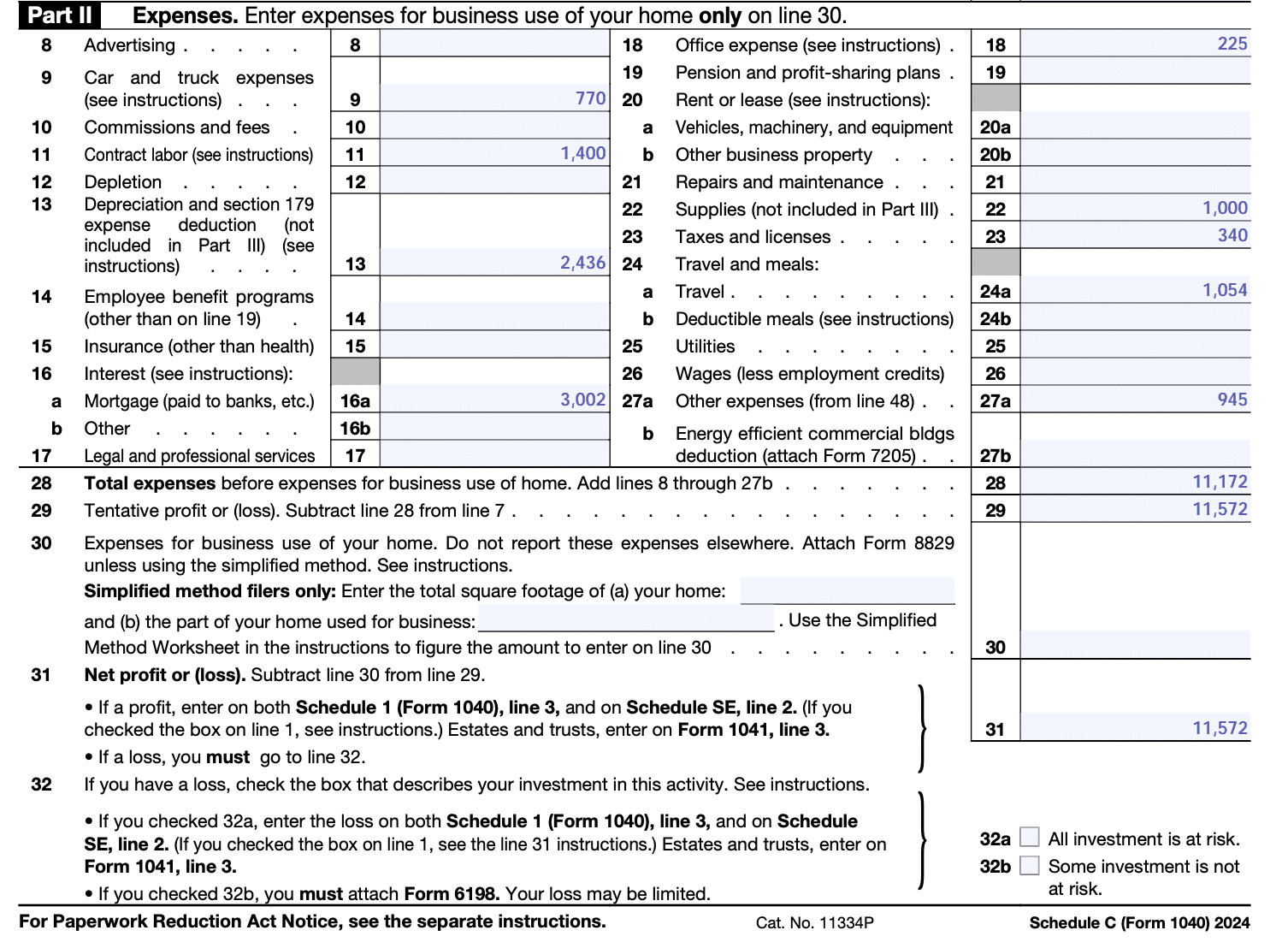

How To Fill Out Schedule C In 2025 With Example

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor