Tax Form 1040 For 2025

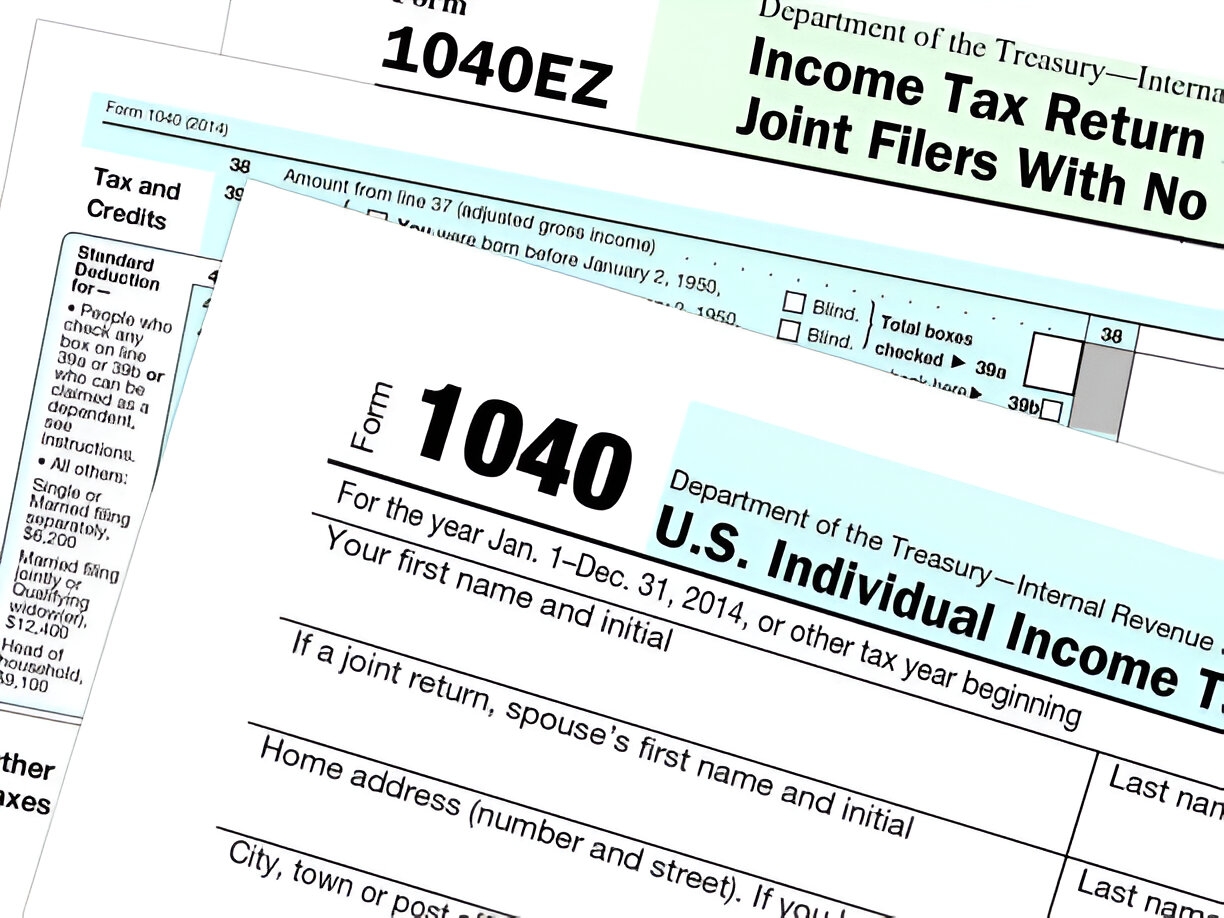

Planning ahead for your taxes is always a smart move. One form that you’ll likely encounter is the Tax Form 1040, which is used for filing individual income tax returns with the IRS.

As we look ahead to 2025, it’s essential to understand the changes that may come with the Tax Form 1040. Staying informed about any updates or modifications can help you prepare and file your taxes accurately and on time.

Tax Form 1040 For 2025

Tax Form 1040 For 2025

For the tax year 2025, the IRS may introduce new requirements or adjustments to the Tax Form 1040. It’s crucial to stay updated on any changes to avoid any potential mistakes or delays in the filing process.

One key aspect to keep in mind is the deadline for filing your Tax Form 1040 for the 2025 tax year. Make sure to mark your calendar and set reminders to avoid missing the deadline and facing penalties or late fees.

Additionally, familiarize yourself with any new tax credits, deductions, or income thresholds that may apply to your situation for the 2025 tax year. Being aware of these updates can help you maximize your tax savings and ensure compliance with the IRS regulations.

Ultimately, staying informed and proactive when it comes to your tax obligations can make the filing process smoother and less stressful. By understanding the Tax Form 1040 for 2025 and any changes that may arise, you can navigate the tax season with confidence and peace of mind.

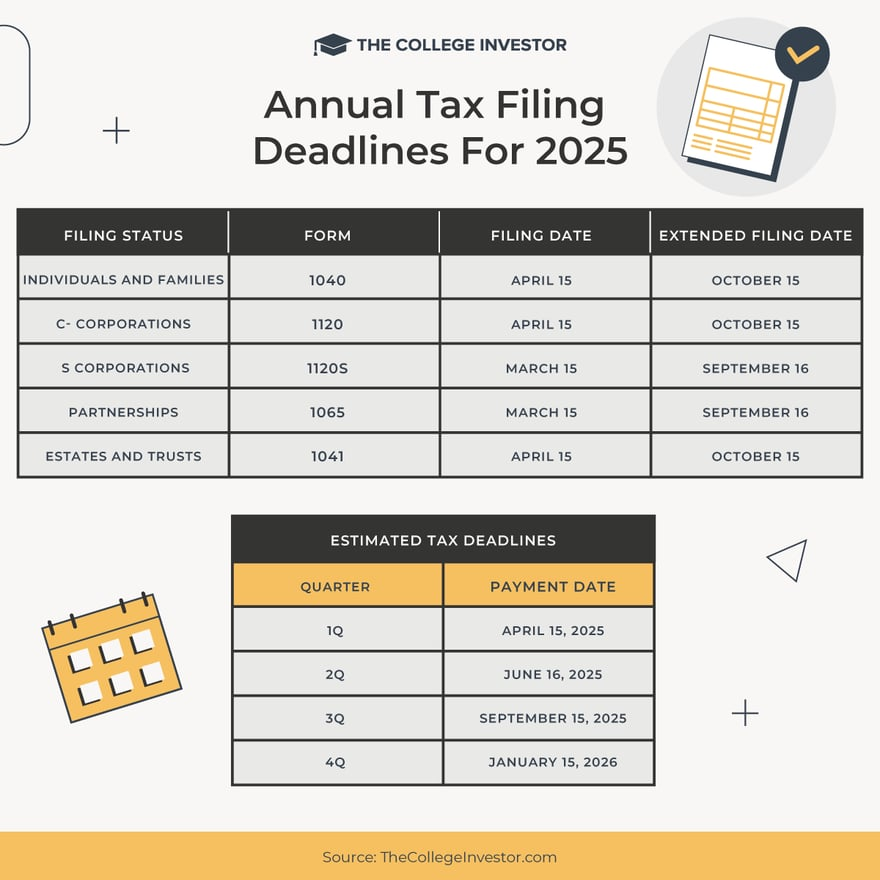

When Are Taxes Due In 2025 Including Estimated Taxes

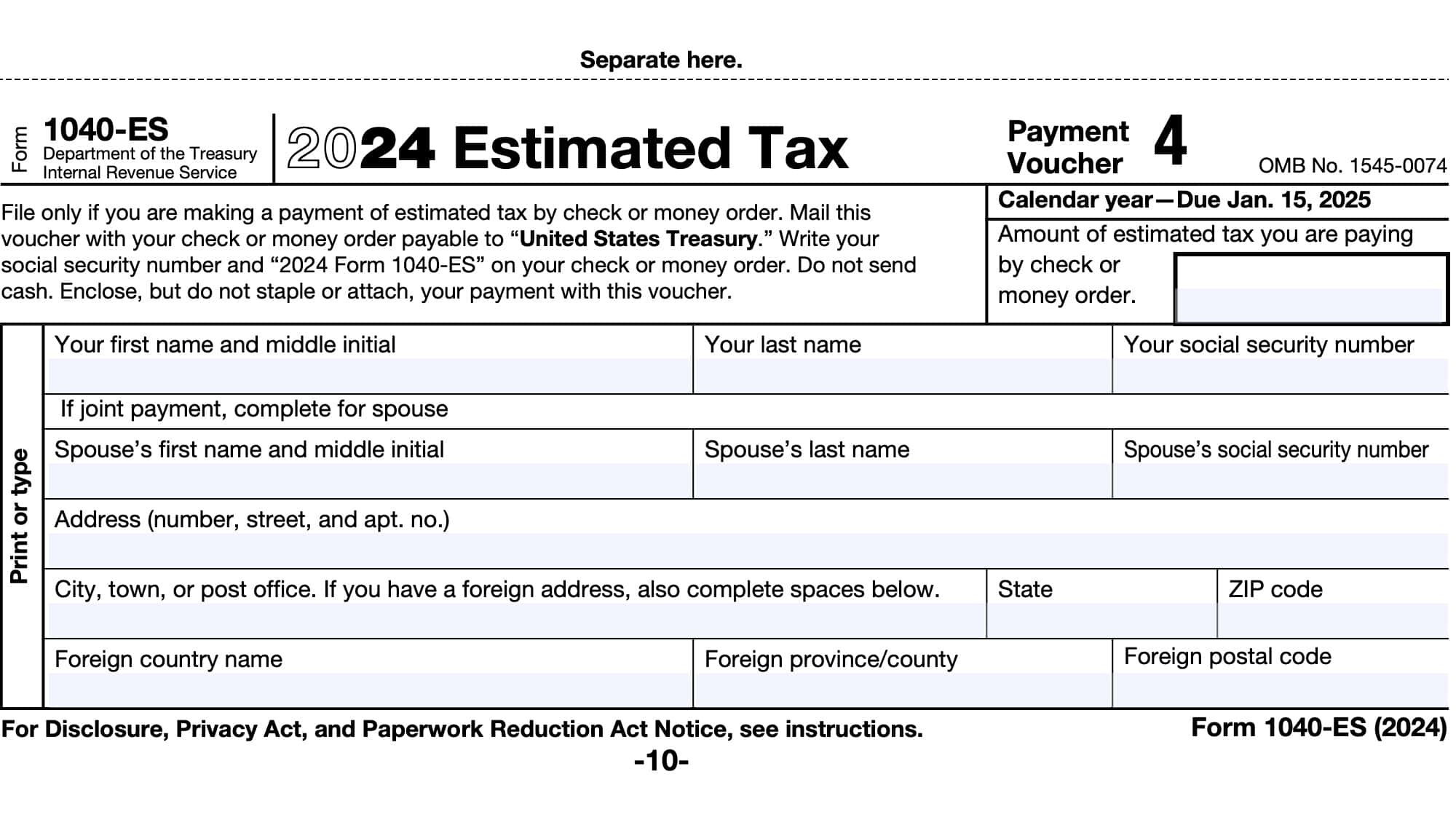

IRS Form 1040 ES Instructions Estimated Tax Payments

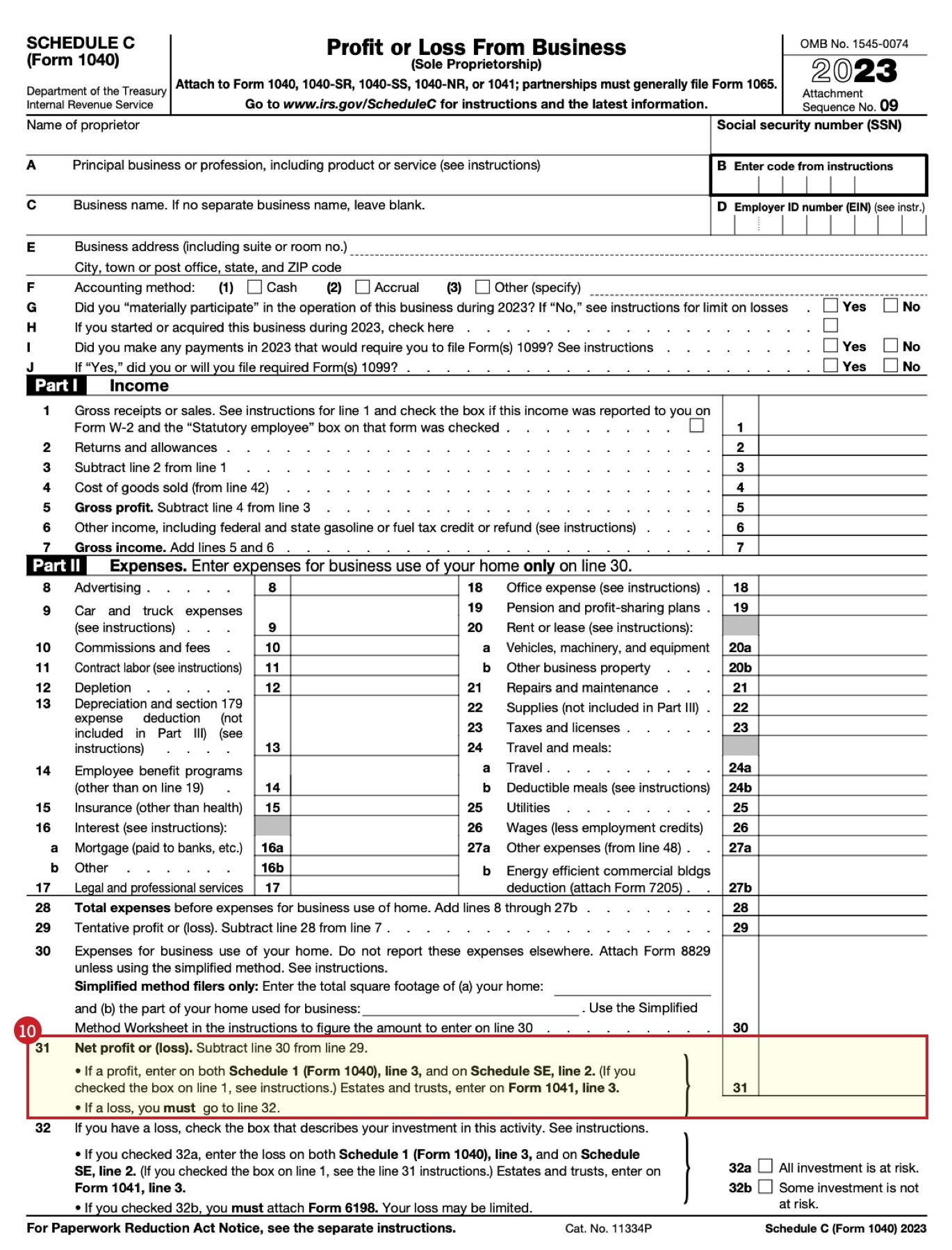

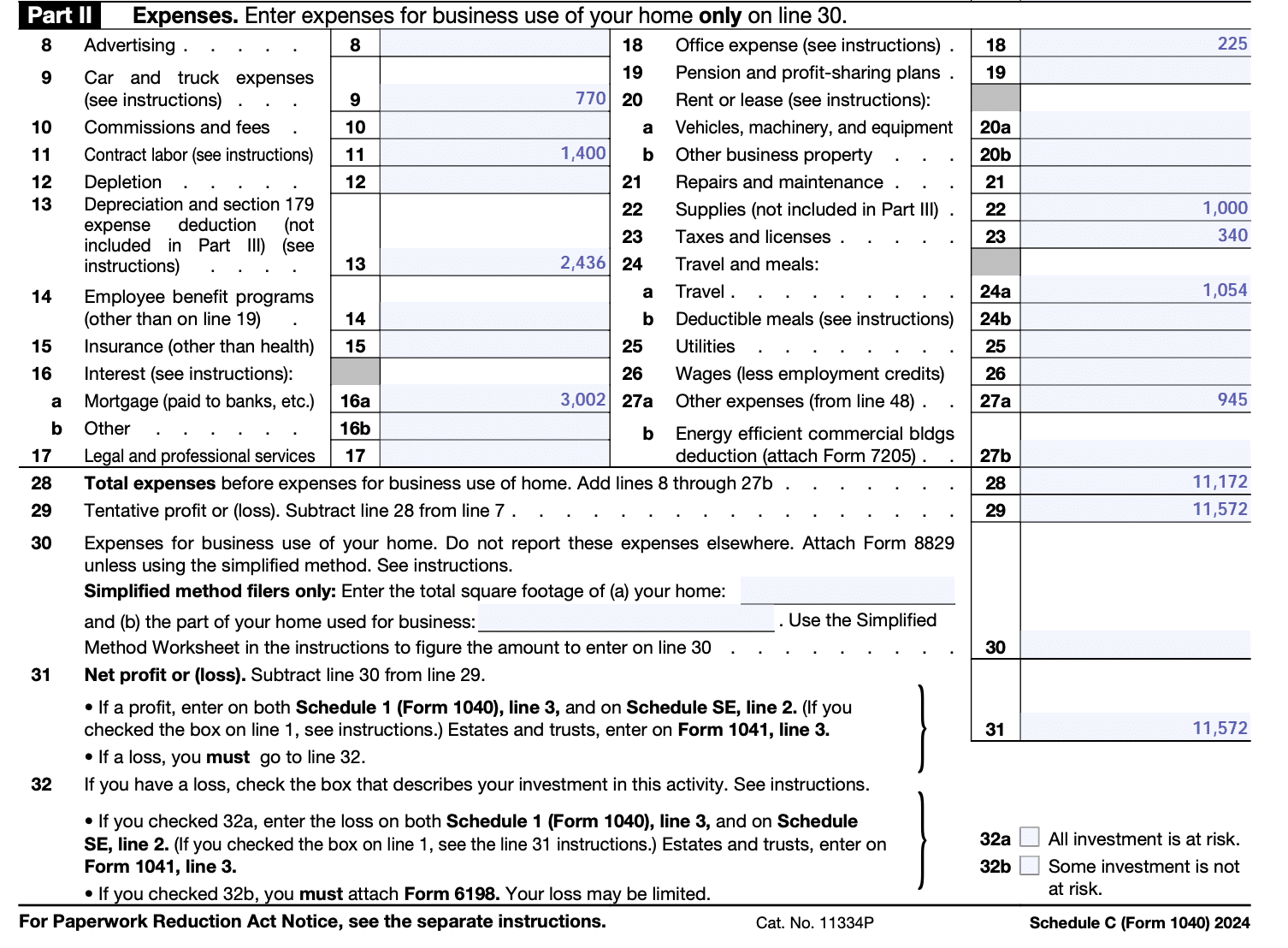

How To Fill Out Schedule C In 2025 With Example

Form 1040 U S Individual Tax Return Definition Types And Use

IRS Updates Tax Brackets Standard Deductions For 2025 CPA Practice Advisor