1099 K Form 2025

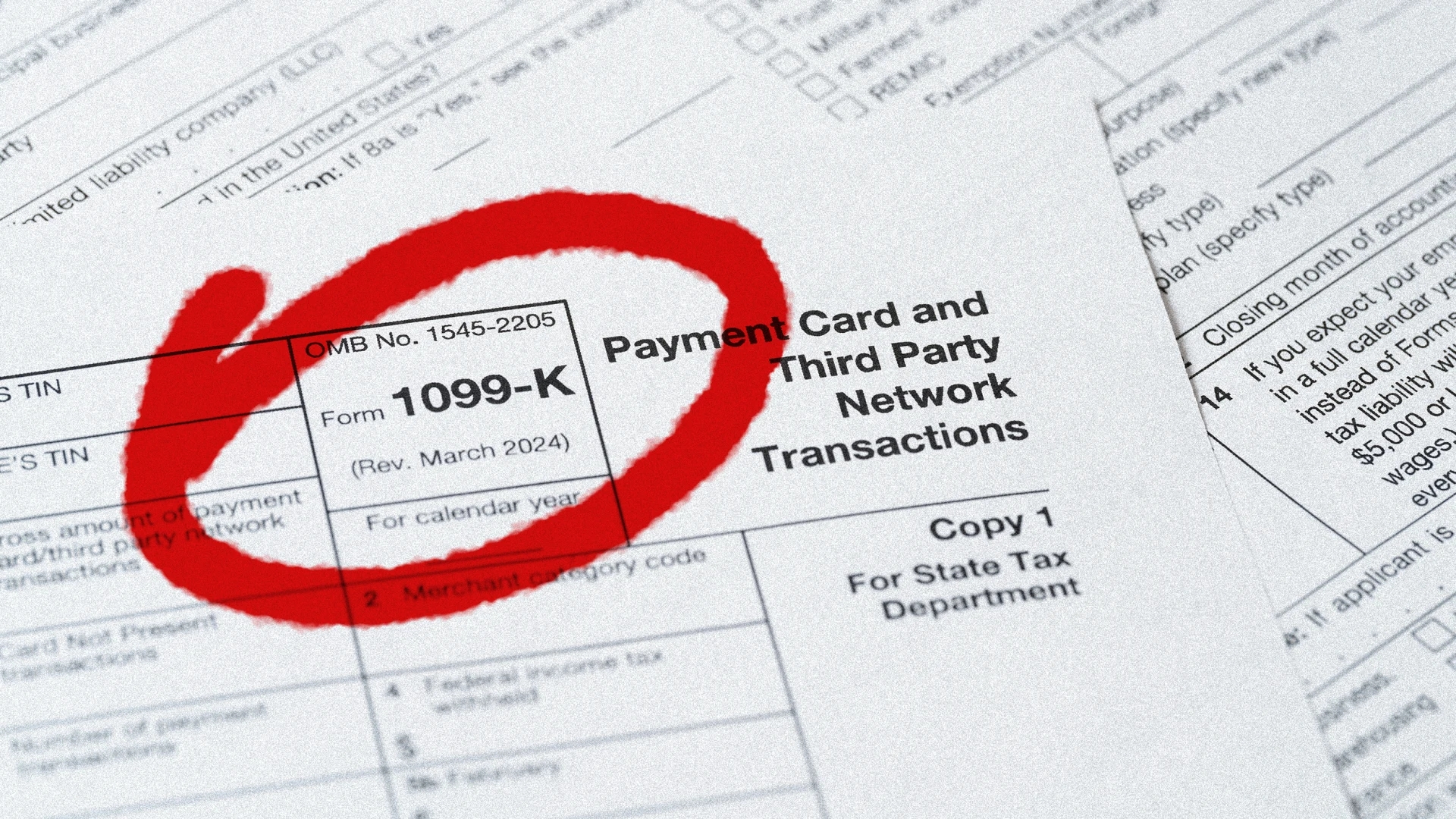

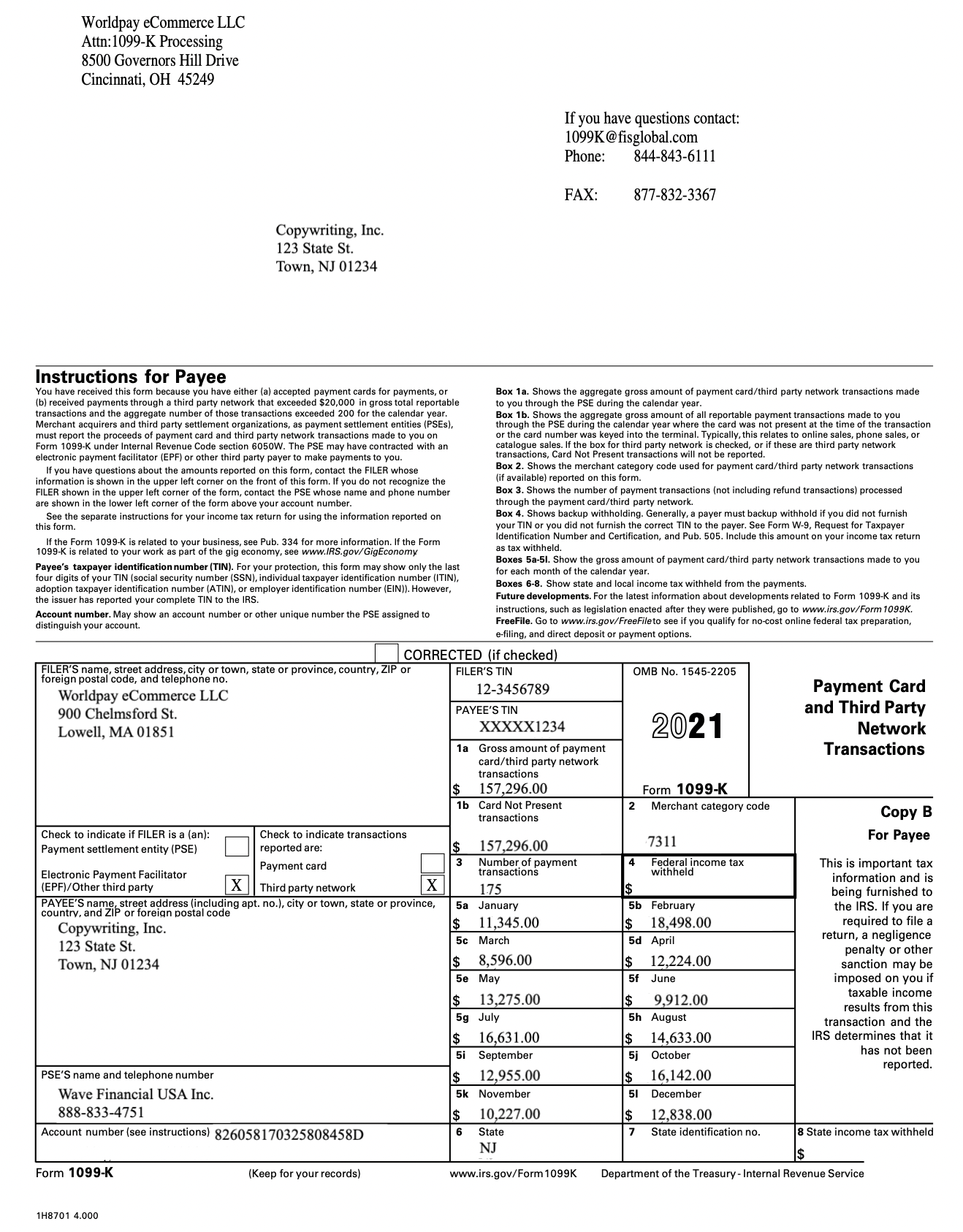

Are you ready for tax season 2025? If you’re a freelancer or independent contractor, you’ll want to be familiar with the 1099 K form. This form is used to report income from payment card transactions and third-party network transactions.

It’s essential to keep track of your earnings throughout the year so that when tax time rolls around, you’ll have all the necessary information to fill out your 1099 K form accurately. This form ensures that you report all your income to the IRS and avoid any potential penalties.

1099 K Form 2025

1099 K Form 2025: What You Need to Know

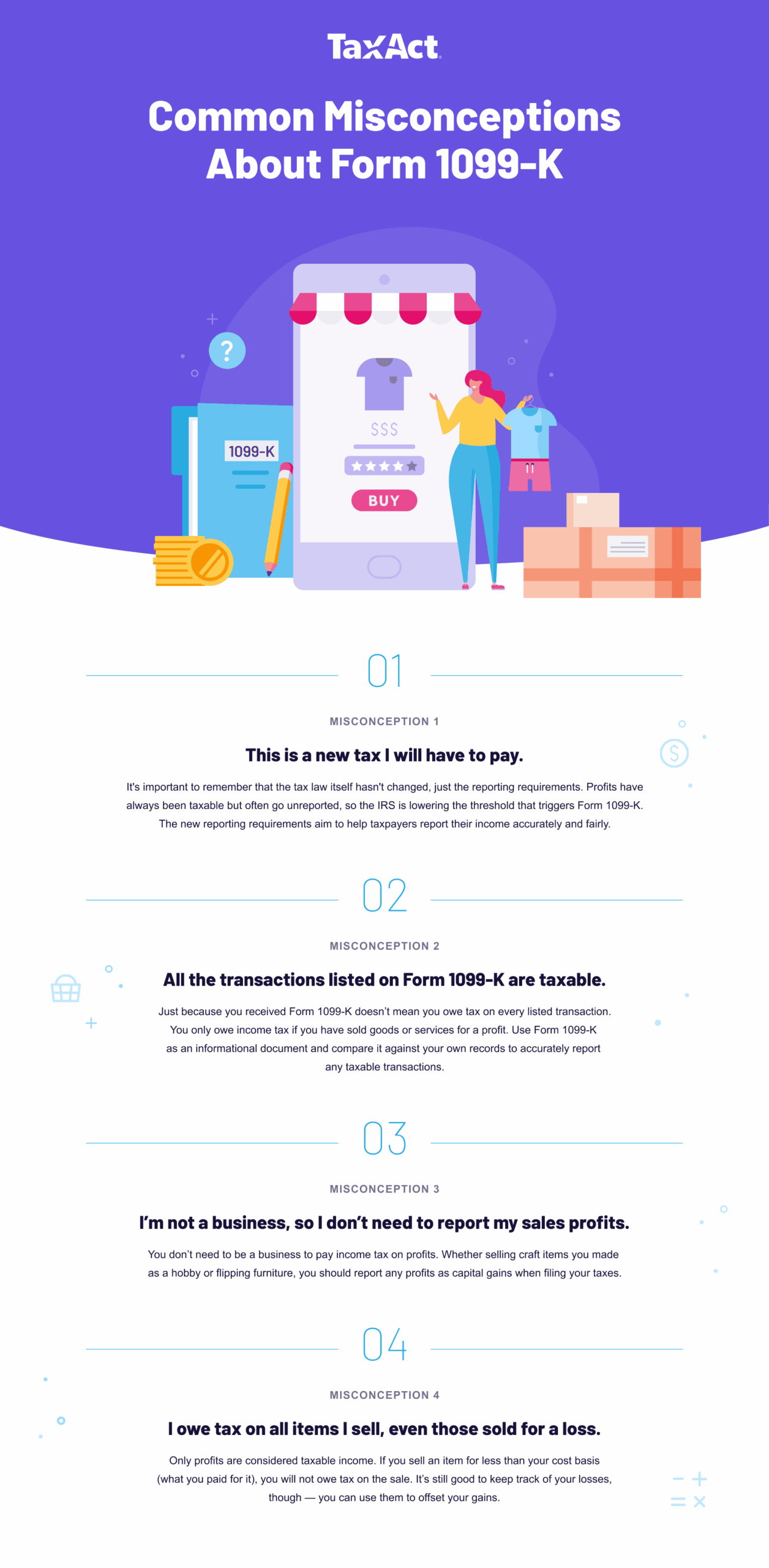

When you receive a 1099 K form, make sure to review it carefully to ensure the information is correct. If there are any discrepancies, reach out to the issuer to make corrections. It’s crucial to report all your income accurately to avoid any issues with the IRS.

Keep all your receipts and records organized throughout the year to make the tax-filing process smoother. Utilize accounting software or apps to track your income and expenses efficiently. This will save you time and stress when it comes time to file your taxes.

If you’re unsure about how to fill out your 1099 K form, consider seeking help from a tax professional. They can provide guidance and ensure that you’re reporting your income correctly. Remember, it’s better to ask for help than to make mistakes that could lead to penalties.

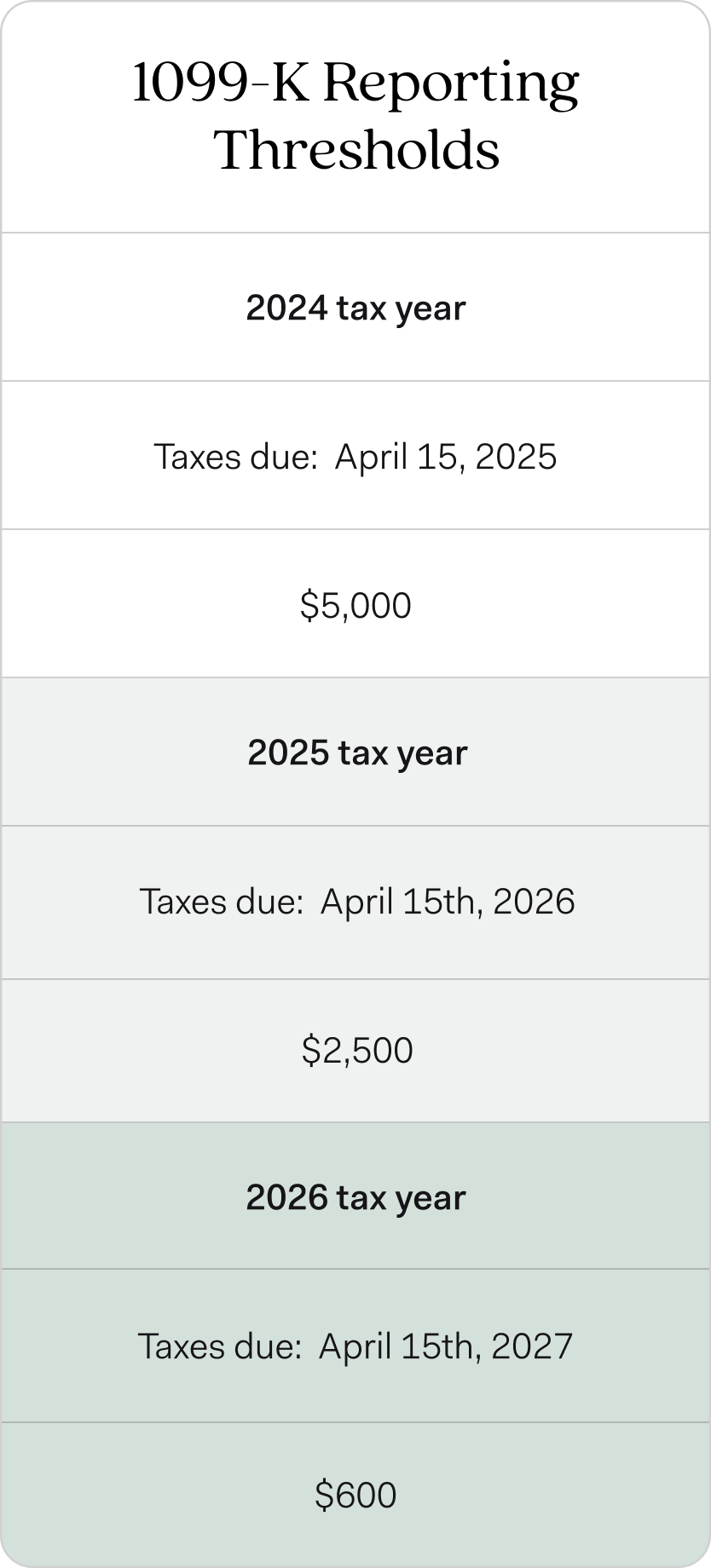

As tax season approaches, take the time to familiarize yourself with the 1099 K form and gather all the necessary documents. By staying organized and proactive, you can ensure a smooth and stress-free tax-filing experience in 2025.

What To Know About The New 1099 K Reporting Threshold TaxAct

I Received A Form 1099 K Taxpayer Advocate Service

Form 1099 K A Guide For The Self Employed

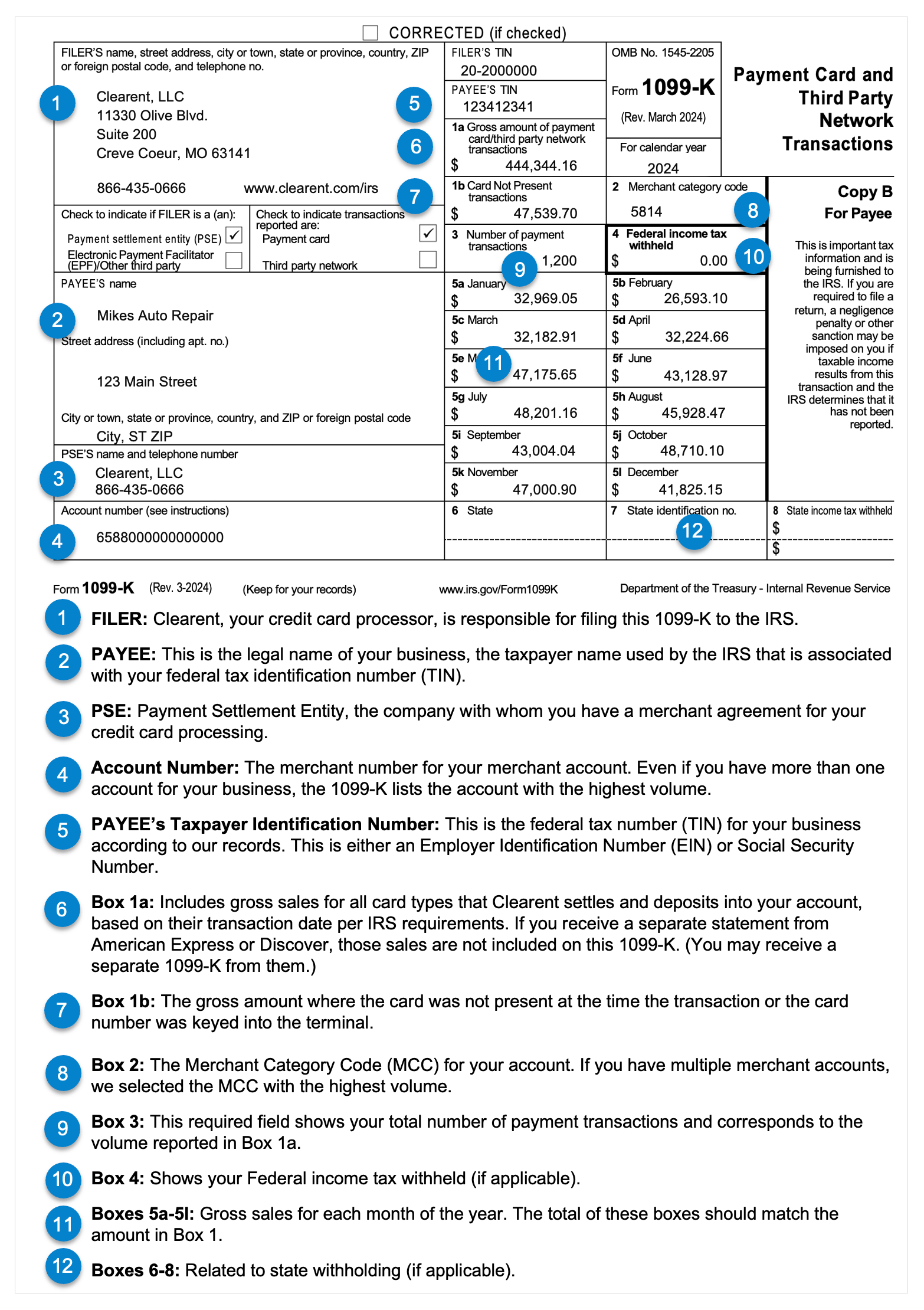

Understanding Your Form 1099 K Clearent By Xplor